Question: pls answer all three questions will give u thumbs up Derek plans t0 retire on his 65 th birthday. However, he plans to work part-time

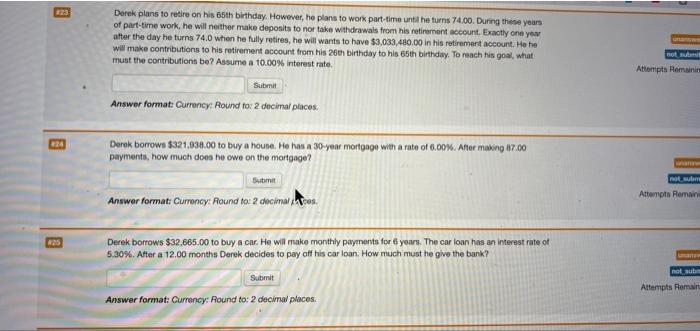

Derek plans t0 retire on his 65 th birthday. However, he plans to work part-time unt the furns 74.00. During these years of part-time work, he will neither make deposits to nor take withdrawals from his retirement account. Exactly one year after the day he turns 74.0 when he fully retires, he will wants to have $3,033,480.00 in his retirement account. He he Will make contributions to his retirement account trom his 26 th birthdoy to his 65 th birthday. To raach his goal, what must the contributions be? Assume a 10.00% interest rate. Answer format: Currency: Round fo: 2 decimai places: Derek borrows 5321,038.00 to buy a house. He has a 30-year mortgage with a rate of 6.00%. Afler making liz. .00 payments, how much does he owe on the mortgage? Answer format: Cumency: Round to: 2 decimal istres. Derek borrows $32,665.00 to buy a car. He will make monthly payments for 6 yoars. The car loan has an interest rate of 5.30\%. After a 12.00 months Derek decides to pay off his car loan. How much must he give the bank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts