Question: pls answer each question and explain if needed thank you! The reputation ultimately affects how bankers and investors view the decisions and proposals made by

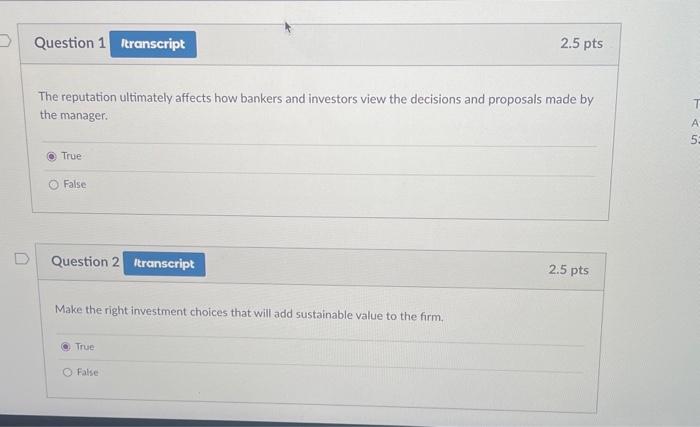

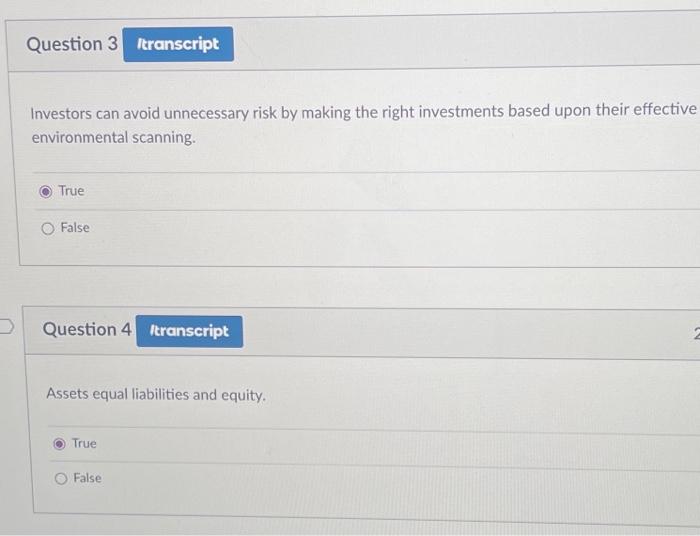

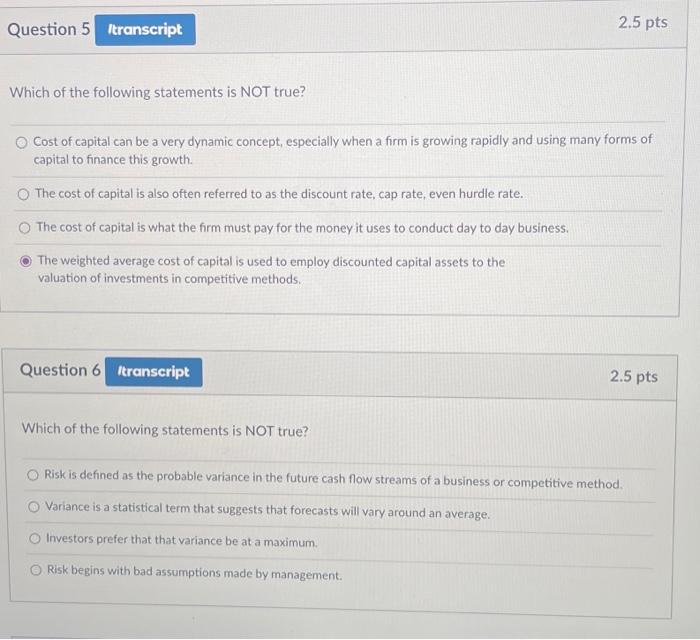

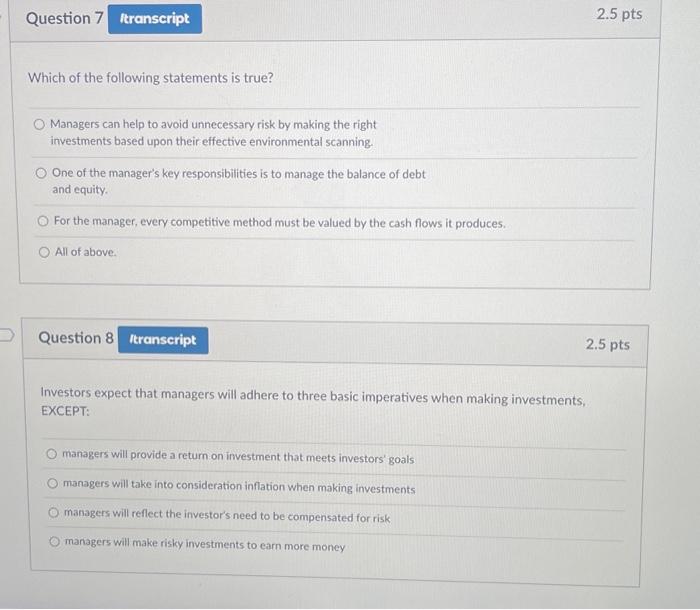

The reputation ultimately affects how bankers and investors view the decisions and proposals made by the manager. True False Question 2 2.5 pts Make the right investment choices that will add sustainable value to the furm. Investors can avoid unnecessary risk by making the right investments based upon their effective environmental scanning. True False Question 4 Assets equal liabilities and equity. True False. Which of the following statements is NOT true? Cost of capital can be a very dynamic concept, especially when a firm is growing rapidly and using many forms of capital to finance this growth. The cost of capital is also often referred to as the discount rate, cap rate, even hurdle rate. The cost of capital is what the firm must pay for the money it uses to conduct day to day business. The weighted average cost of capital is used to employ discounted capital assets to the valuation of investments in competitive methods. Question 6 2.5pts Which of the following statements is NOT true? Risk is defined as the probable variance in the future cash flow streams of a business or competitive method. Variance is a statistical term that suggests that forecasts will vary around an average. Investors prefer that that variance be at a maximum. Risk begins with bad assumptions made by management. Which of the following statements is true? Managers can help to avoid unnecessary risk by making the right investments based upon their effective environmental scanning. One of the manager's key responsibilities is to manage the balance of debt and equity. For the manager, every competitive method must be valued by the cash fows it produces. All of above. Question 8 2.5 pts Investors expect that managers will adhere to three basic imperatives when making investments, EXCEPT: managers will provide a retum on investment that meets investors' goals managers will take into consideration inflation when making investments managers will reflect the investor's need to be compensated for risk managers will make risky investments to earn more money

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts