Question: pls answer Problem 2-8 Discontinued operations components held for sale (LO2-5, LO2-6, LO2-8) For 20X1. Silvertip Construction, Inc, reported income from continuing operations (after tax)

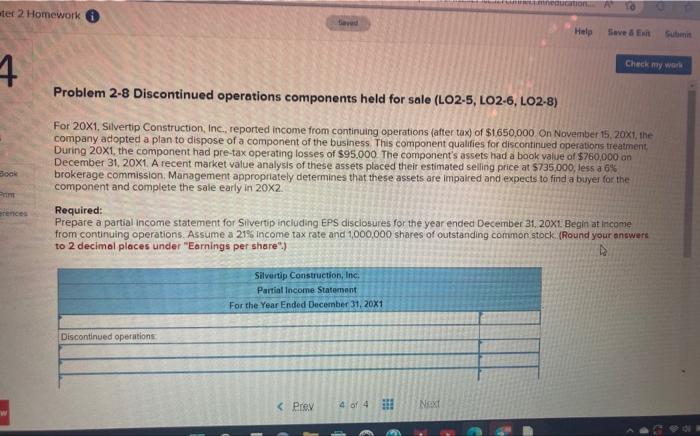

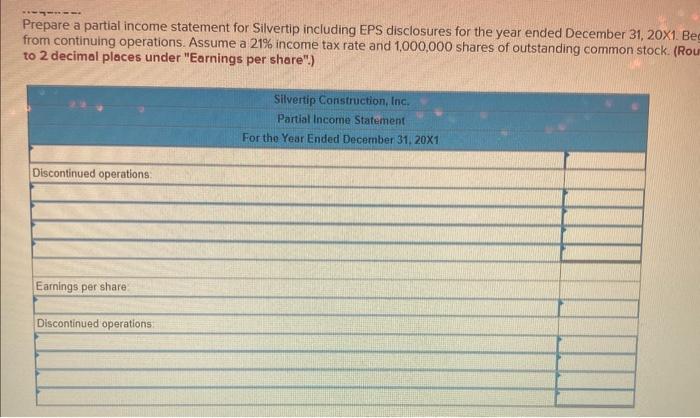

Problem 2-8 Discontinued operations components held for sale (LO2-5, LO2-6, LO2-8) For 20X1. Silvertip Construction, Inc, reported income from continuing operations (after tax) of $1,650,000.On November 15,201, the company adopted a plan to dispose of a component of the business. This component qualifies for discontinued operations treatment, During 20X1, the component had pre-tax operating losses of $95.000 The component's assets had a book value of $760,000 an December 31, 20X1. A recent market value analysis of these assets placed their estimated selling price at $735,000, less a 6% brokerage commission. Management approprlately determines that these assets are impaired and expects to find a buyer for the component and complete the sale early in 202 Required: Prepare a partial income statement for Silvertip including. EPS disciosures for the year ended December 31, 20X1. Begin at income from continuing operations. Assume a 21% income tax rate and 1,000,000 shares of outstanding corrimon stock. (Round your answers to 2 decimal places under "Earnings per share".) Prepare a partial income statement for Silvertip including EPS disclosures for the year ended December 31,201. B from continuing operations. Assume a 21% income tax rate and 1,000,000 shares of outstanding common stock. (Ro to 2 decimal places under "Earnings per share".)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts