Question: pls answer the following: 1) Make journal entry to record purchase 2) Calculate amortization for 2017. Make journal entry to record amortization expense. 3) Find

pls answer the following:

pls answer the following:

1) Make journal entry to record purchase

2) Calculate amortization for 2017. Make journal entry to record amortization expense.

3) Find the ending balance of each of the intangibles

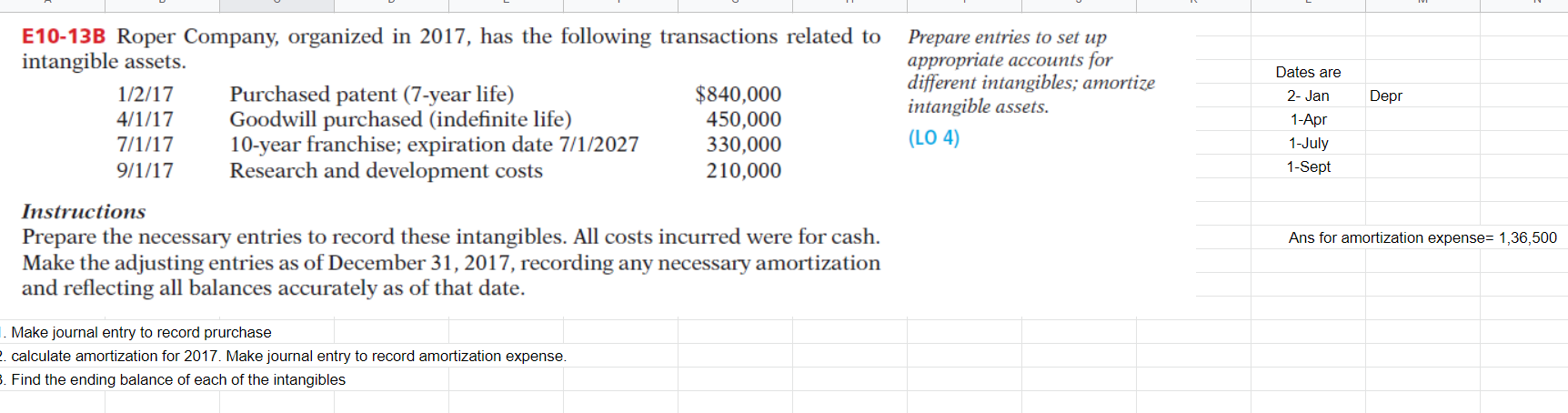

E10-13B Roper Company, organized in 2017, has the following transactions related to intangible assets. 1/2/17 4/1/17 7/1/17 9/1/17 Purchased patent (7-year life) Goodwill purchased (indefinite life) 10-year franchise; expiration date 7/1/2027 Research and development costs $840,000 450,000 330,000 210,000 Instructions Prepare the necessary entries to record these intangibles. All costs incurred were for cash. Make the adjusting entries as of December 31, 2017, recording any necessary amortization and reflecting all balances accurately as of that date. Make journal entry to record prurchase 2. calculate amortization for 2017. Make journal entry to record amortization expense. 3. Find the ending balance of each of the intangibles Prepare entries to set up appropriate accounts for different intangibles; amortize intangible assets. (LO 4) Dates are 2- Jan 1-Apr 1-July 1-Sept Depr Ans for amortization expense= 1,36,500

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

The detailed ... View full answer

Get step-by-step solutions from verified subject matter experts