Question: pls answer this two questions Question 19 5 points Save Answer Silicon Corp. recently issued 10-year, 12 percent coupon bonds at par value. Silicon's beta

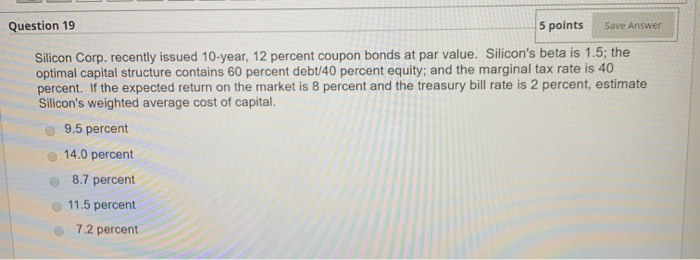

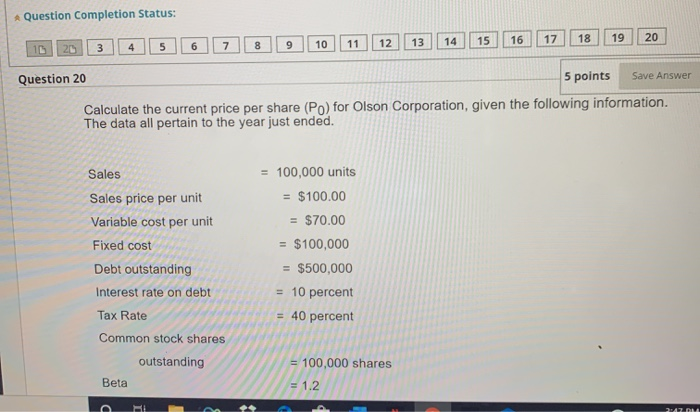

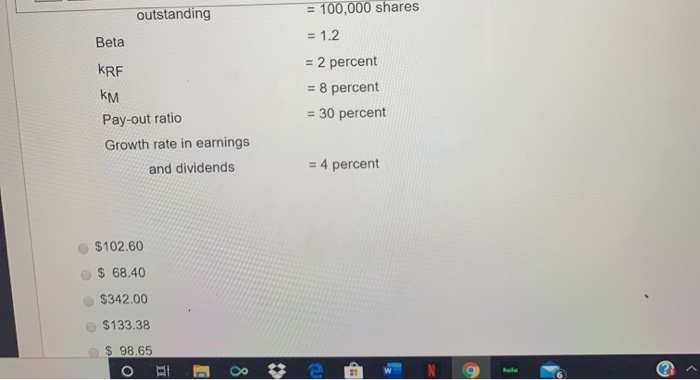

Question 19 5 points Save Answer Silicon Corp. recently issued 10-year, 12 percent coupon bonds at par value. Silicon's beta is 1.5; the optimal capital structure contains 60 percent debt/40 percent equity; and the marginal tax rate is 40 percent. If the expected return on the market is 8 percent and the treasury bill rate is 2 percent, estimate Silicon's weighted average cost of capital. 9.5 percent 14.0 percent 8.7 percent 11.5 percent 7.2 percent Question Completion Status: 0 20 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Question 20 5 points Save Answer Calculate the current price per share (Po) for Olson Corporation, given the following information. The data all pertain to the year just ended. Sales Sales price per unit Variable cost per unit Fixed cost Debt outstanding Interest rate on debt Tax Rate Common stock shares outstanding Beta = 100,000 units = $100.00 = $70.00 = $100,000 = $500,000 = 10 percent = 40 percent = 100,000 shares OBILA outstanding Beta KRF KM Pay-out ratio Growth rate in earnings and dividends = 100,000 shares = 1.2 = 2 percent = 8 percent = 30 percent = 4 percent $102.60 $ 68.40 $342.00 $133.38 $ 98.65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts