Question: pls answer this question step by step with clear explanation Helium Mist has just graduated from college and is looking to become an entrepreneur. He

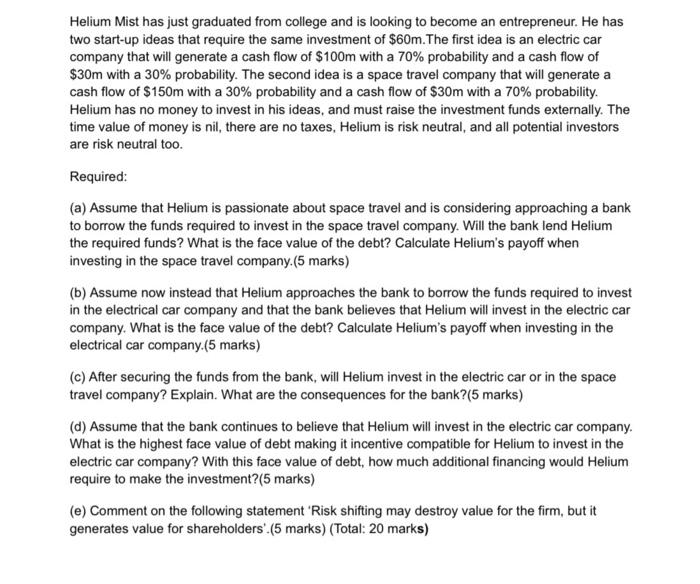

Helium Mist has just graduated from college and is looking to become an entrepreneur. He has two start-up ideas that require the same investment of $60m. The first idea is an electric car company that will generate a cash flow of $100m with a 70% probability and a cash flow of $30m with a 30% probability. The second idea is a space travel company that will generate a cash flow of $150m with a 30% probability and a cash flow of $30m with a 70% probability. Helium has no money to invest in his ideas, and must raise the investment funds externally. The time value of money is nil, there are no taxes. Helium is risk neutral, and all potential investors are risk neutral too. Required: (a) Assume that Helium is passionate about space travel and is considering approaching a bank to borrow the funds required to invest in the space travel company. Will the bank lend Helium the required funds? What is the face value of the debt? Calculate Helium's payoff when investing in the space travel company.(5 marks) (b) Assume now instead that Helium approaches the bank to borrow the funds required to invest in the electrical car company and that the bank believes that Helium will invest in the electric car company. What is the face value of the debt? Calculate Helium's payoff when investing in the electrical car company.(5 marks) (c) After securing the funds from the bank, will Helium invest in the electric car or in the space travel company? Explain. What are the consequences for the bank?(5 marks) (d) Assume that the bank continues to believe that Helium will invest in the electric car company. What is the highest face value of debt making it incentive compatible for Helium to invest in the electric car company? With this face value of debt, how much additional financing would Helium require to make the investment?(5 marks) (e) Comment on the following statement 'Risk shifting may destroy value for the firm, but it generates value for shareholders'. (5 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts