Question: Pls attached all the formulas, working and explanation on how to get a certain ans. Suppose a stock is currently trading at 100. An at-the-money

Pls attached all the formulas, working and explanation on how to get a certain ans.

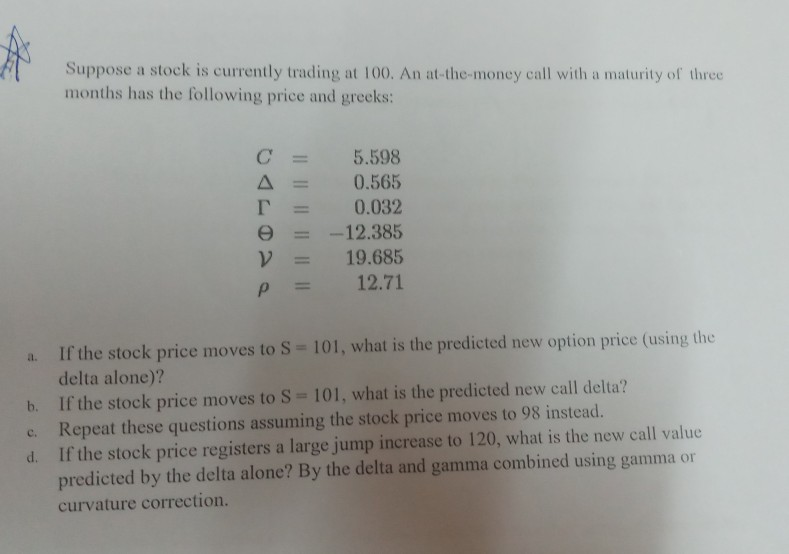

Suppose a stock is currently trading at 100. An at-the-money call with a maturity of three months has the following price and greeks: C5.598 = 0.565 -0.032 = -12.385 19.685 12.71 a. If the stock price moves to Ss- 101, what is the predicted new option price (using the delta alone)? b. If the stock price moves to S 101, what is the predicted new call delta? c. Repeat these questions assuming the stock price moves to 98 instead. d. If the stock price registers a large jump increase to 120, what is the new call value predicted by the delta alone? By the delta and gamma combined using gamma or curvature correction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts