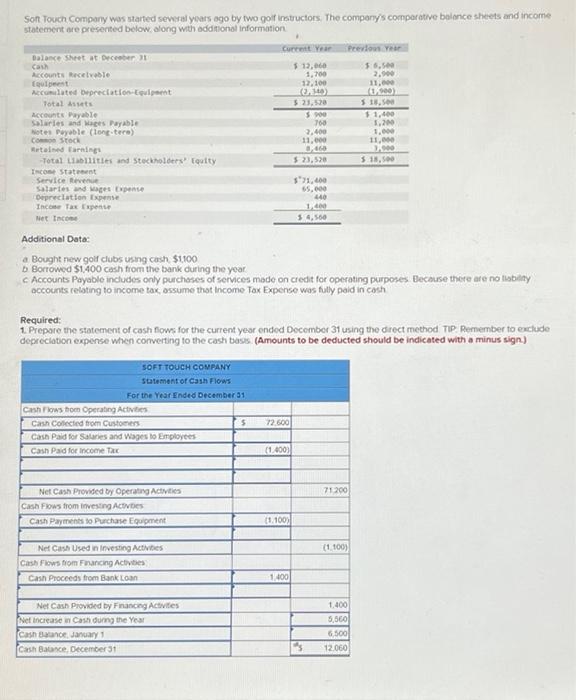

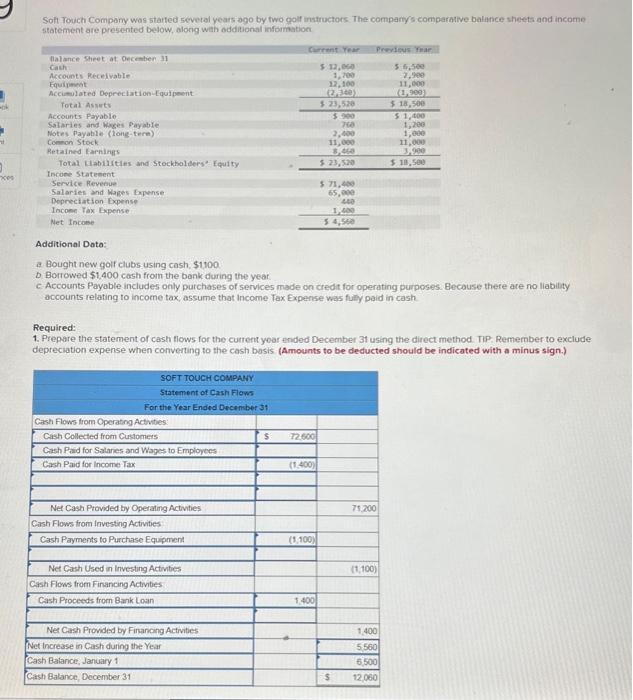

Question: PLS do asap Son Touch Compeny was started sevyral yoars ago by two goit instuctors. The compony's comporative bolonce sheets and income statement are gresented

Son Touch Compeny was started sevyral yoars ago by two goit instuctors. The compony's comporative bolonce sheets and income statement are gresented below, along with odditional information Additional Data: a Bought new goif clubs using cash $1100 b Bortowed $1,400 cosh from the bank during the year c Accounts Payable includes only purchoses of services made on credit for operating purposes Decouse there are no thabilty accounts reloting to income tax, ossume thot Income Tax Expense was fully paid in cash Required: 1. Prepare the statement of cash fows for the current year ended Docember 31 using the drect method TiP: Remember to erclude depreclaton expense when corverting to the cash bass. (Amounts to be deducted should be indicated with a minus sign.) Soft Touch Compory wos starfed sevetal years ago by fwo golf inttractors The compartys comparative bathice sheetiand income statement are presented below, along with odditional infodmation Additional Date: a. Bought new golf clubs using cash, $1100 b Borrowed $1.400 cash fromn the benk during the year c. Accounts Payable includes only purchases of services made oncredit for operating purposes. Because there are no liability accounts relating to income tax, assume that Income lax Experse vas fully paid in cash Required: 1. Prepare the statement of cash Hows for the curtent yoar ended December 3t using the direct method nip: Remember to exclude depreciation expense when converting to the cash basis. (Amounts to be deducted should be indicated with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts