Question: Pls do needful.. need quality work. thank you Answer all questions Question 1 (18 Marks): The directors of company ABCD Ltd is planning to invest

Pls do needful.. need quality work. thank you

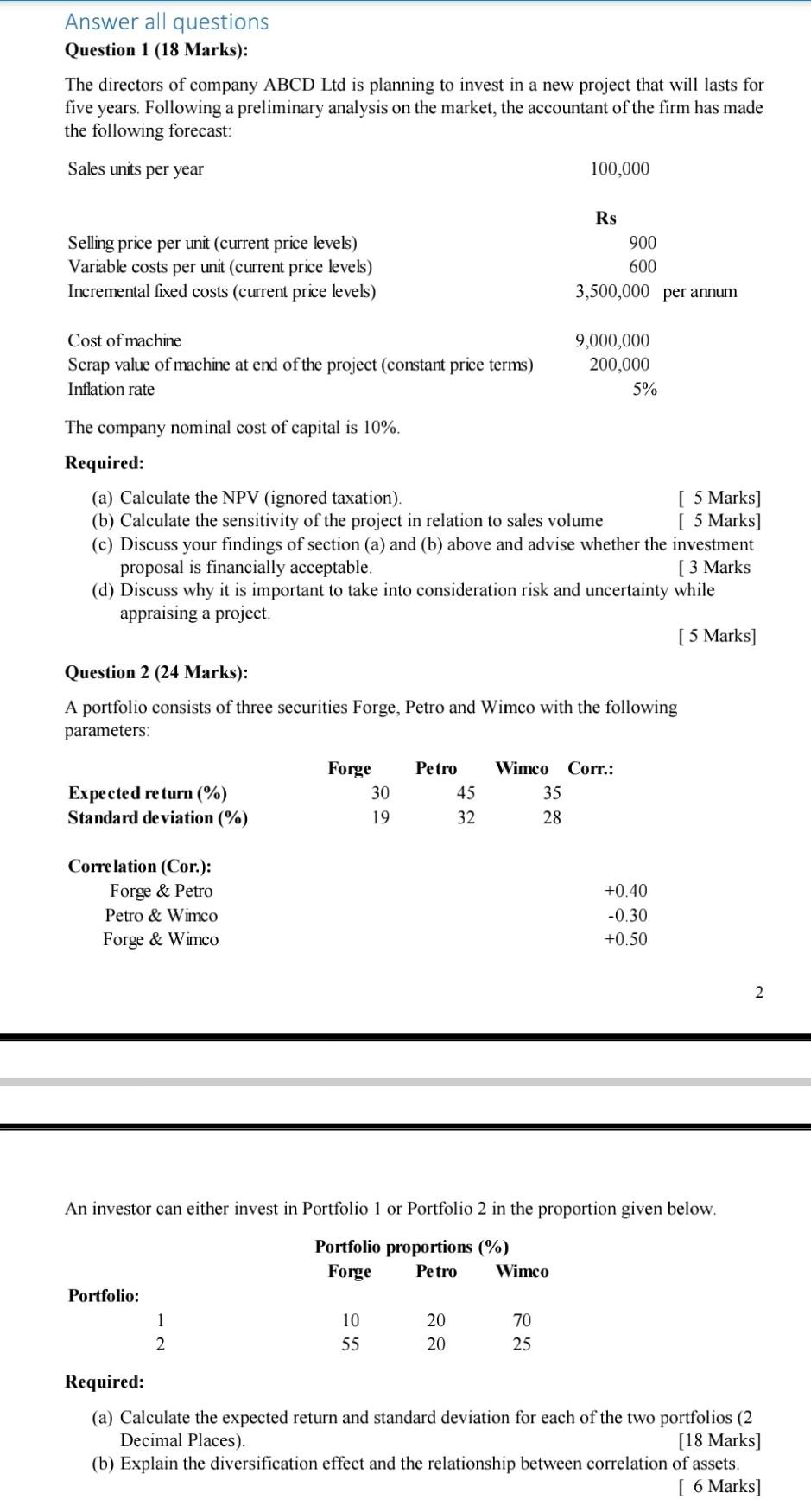

Answer all questions Question 1 (18 Marks): The directors of company ABCD Ltd is planning to invest in a new project that will lasts for five years. Following a preliminary analysis on the market, the accountant of the firm has made the following forecast: Sales units per year 100,000 Rs Selling price per unit (current price levels) Variable costs per unit (current price levels) Incremental fixed costs (current price levels) 900 600 3,500,000 per annum Cost of machine Scrap value of machine at end of the project (constant price terms) Inflation rate 9,000,000 200,000 5% The company nominal cost of capital is 10%. Required: (a) Calculate the NPV (ignored taxation) [ 5 Marks] (b) Calculate the sensitivity of the project in relation to sales volume [ 5 Marks] (c) Discuss your findings of section (a) and (b) above and advise whether the investment proposal is financially acceptable. [ 3 Marks (d) Discuss why it is important to take into consideration risk and uncertainty while appraising a project. [ 5 Marks] Question 2 (24 Marks): A portfolio consists of three securities Forge, Petro and Wimco with the following parameters: Expected return (%) Standard deviation (%) Forge 30 19 Petro 45 32 Wimco Corr.: 35 28 Correlation (Cor.): Forge & Petro Petro & Wimco Forge & Wimco +0.40 -0.30 +0.50 2 An investor can either invest in Portfolio 1 or Portfolio 2 in the proportion given below. Portfolio proportions (%) Forge Petro Wimco Portfolio: 1 2 10 55 20 20 70 25 Required: (a) Calculate the expected return and standard deviation for each of the two portfolios (2 Decimal Places). [18 Marks] (b) Explain the diversification effect and the relationship between correlation of assets. [ 6 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts