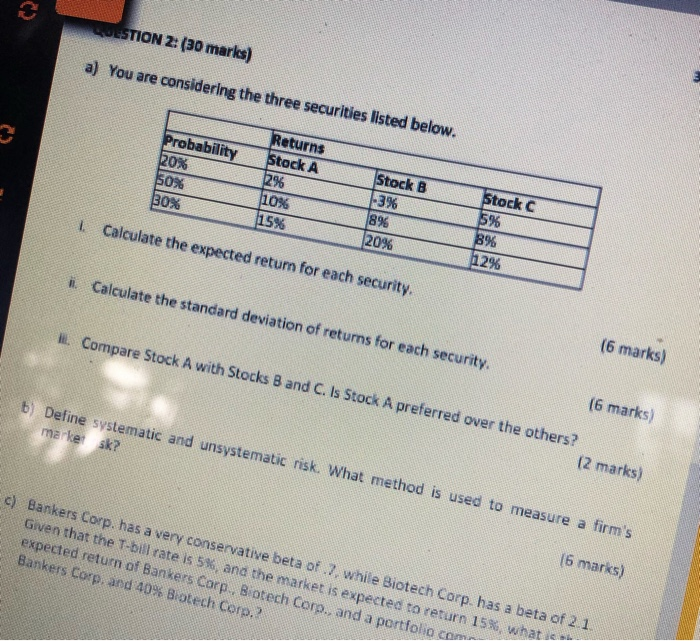

Question: pls do question b and c asap 3 QUESTION 2: (30 marks) a) You are considering the three securities listed below. Probability 20% 50% 30%

3 QUESTION 2: (30 marks) a) You are considering the three securities listed below. Probability 20% 50% 30% Returns Stock A 12% 10% 15% Stock B -3% 8% 20% Calculate the expected return for each security. Stock C 5% B% 12% 1. Calculate the standard deviation of returns for each security. . Compare Stock A with Stocks B and C. Is Stock A preferred over the others? (2 marks) (6 marks) (6 marks) 6) Define systematic and unsystematic risk. What method is used to measure a firm's market sk? 16 marks) c) Bankers Corp. has a very conservative beta of.7. while Biotech Corp has a beta of 2.1 Given that the T-bill rate is 5%, and the market is expected to return 15%, what expected return of Bankers Corp. Biotech Corp. and a portfolio.com Bankers Corp. and 40% Biotech Corp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts