Question: pls dont do a! thank you! b n c pls! thank you! I DO NOT NEED A PLS AND THANK YOU pls help! will leave

pls dont do a! thank you!

b n c pls! thank you!

I DO NOT NEED A PLS AND THANK YOU

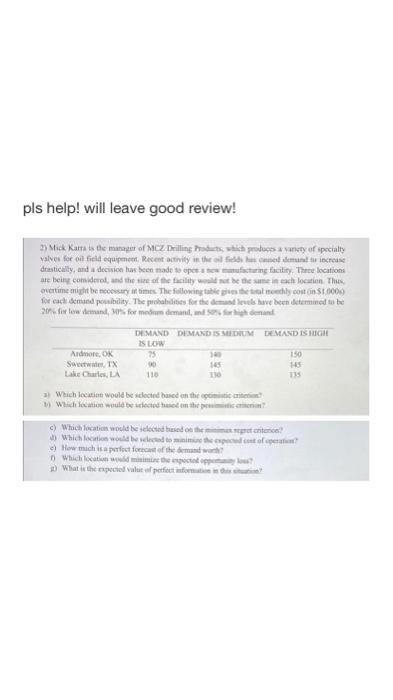

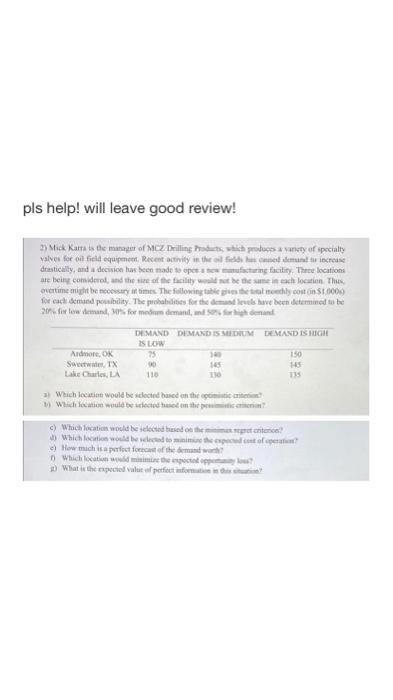

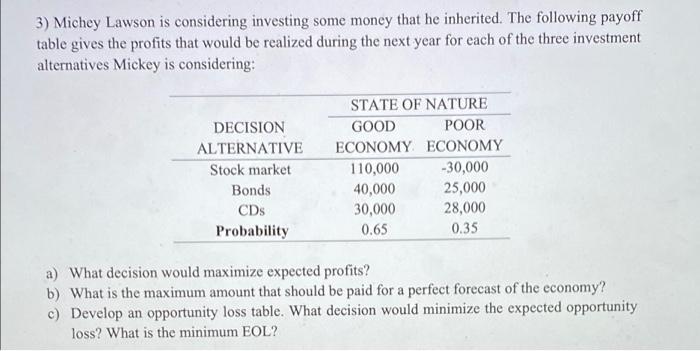

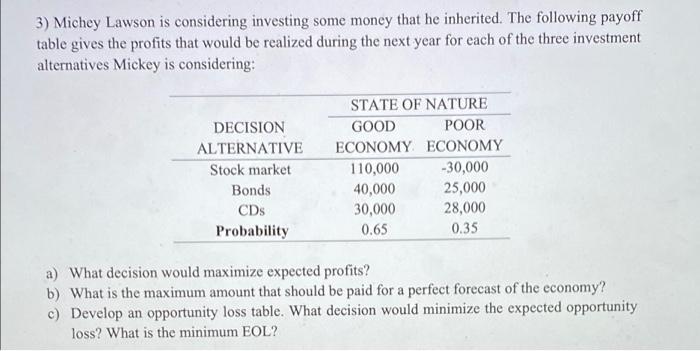

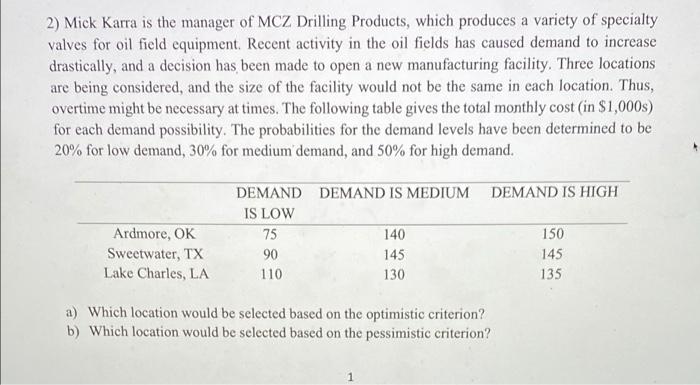

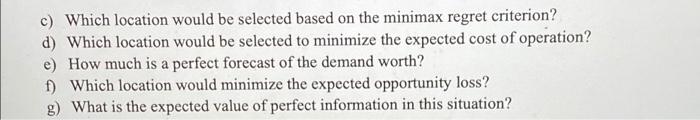

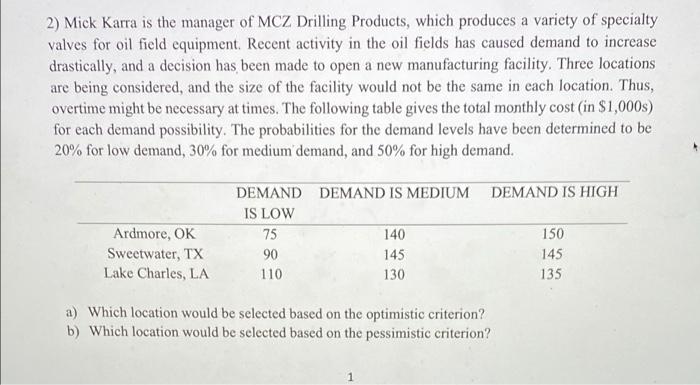

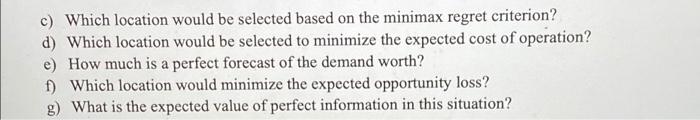

pls help! will leave good review! 2) Mick Karta is the manager of MCZ Drilling which sety of specialty valves for oid quipment Recent activity in the music drastically, and decision las been made to operating facility. The locations te being comidered the time of the facilitate the same location. The overtime might be cry time. The following tabletely cost in 10000 for each demand posibility. The probabilities for the seves have been determined to be 20. flow and formem demand and 150 DEMAND DEMAND IS SEDIUM DEMAND IS HUGH SLOW Ardmore, OK 75 Swew, TX 90 145 145 Lake Charles LA 130 135 Which location would be based on the tante c) Which location would be clected based on the hich action would be the of e) How mich is a perfect forecast of the demand Which one What is the expected value perfecto 3) Michey Lawson is considering investing some money that he inherited. The following payoff table gives the profits that would be realized during the next year for each of the three investment alternatives Mickey is considering: DECISION ALTERNATIVE Stock market Bonds CDs Probability STATE OF NATURE GOOD POOR ECONOMY ECONOMY 110,000 -30,000 40,000 25,000 30,000 28,000 0.65 0.35 a) What decision would maximize expected profits? b) What is the maximum amount that should be paid for a perfect forecast of the economy? c) Develop an opportunity loss table. What decision would minimize the expected opportunity loss? What is the minimum EOL? 2) Mick Karra is the manager of MCZ Drilling Products, which produces a variety of specialty valves for oil field equipment. Recent activity in the oil fields has caused demand to increase drastically, and a decision has been made to open a new manufacturing facility. Three locations are being considered, and the size of the facility would not be the same in each location. Thus, overtime might be necessary at times. The following table gives the total monthly cost (in $1,000s) for each demand possibility. The probabilities for the demand levels have been determined to be 20% for low demand, 30% for medium demand, and 50% for high demand. DEMAND IS HIGH Ardmore, OK Sweetwater, TX Lake Charles, LA DEMAND DEMAND IS MEDIUM IS LOW 75 140 90 145 110 130 150 145 135 a) Which location would be selected based on the optimistic criterion? b) Which location would be selected based on the pessimistic criterion? c) Which location would be selected based on the minimax regret criterion? d) Which location would be selected to minimize the expected cost of operation? e) How much is a perfect forecast of the demand worth? f) Which location would minimize the expected opportunity loss? g) What is the expected value of perfect information in this situation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock