Question: pls explain clearly, i need to know how to do it. thank you 1. Wally Wholesale has revenue of $489,000, end-of-year receivables of $113,000, account

pls explain clearly, i need to know how to do it. thank you

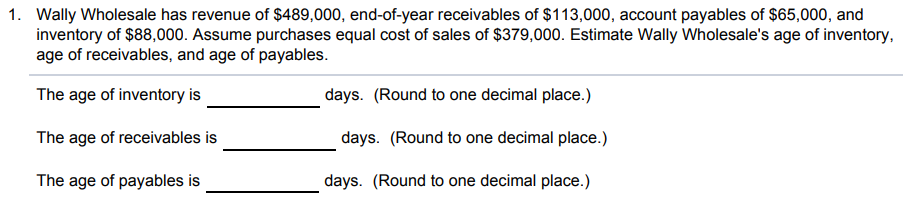

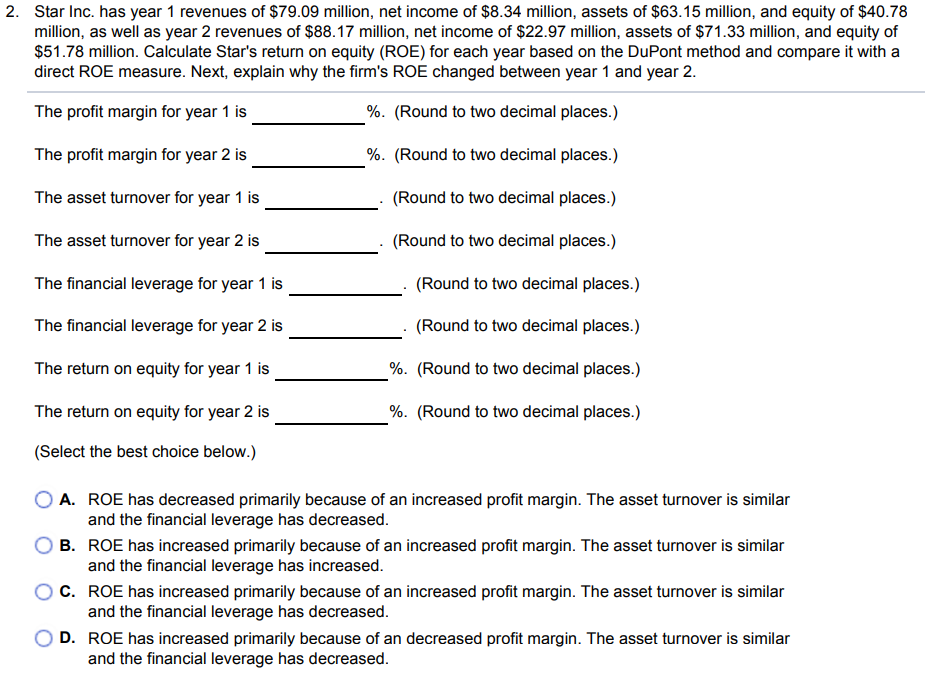

1. Wally Wholesale has revenue of $489,000, end-of-year receivables of $113,000, account payables of $65,000, and inventory of $88,000. Assume purchases equal cost of sales of $379,000. Estimate Wally Wholesale's age of inventory, age of receivables, and age of payables. The age of inventory is days. (Round to one decimal place.) The age of receivables is days. (Round to one decimal place.) The age of payables is days. (Round to one decimal place.) Star Inc. has year 1 revenues of $79.09 million, net income of $8.34 million, assets of $63.15 million, and equity of $40.78 million, as well as year 2 revenues of $88.17 million, net income of $22.97 million, assets of $71.33 million, and equity of $51.78 million. Calculate Star's return on equity (ROE) for each year based on the DuPont method and compare it with a direct ROE measure. Next, explain why the firm's ROE changed between year 1 and year 2 . The profit margin for year 1 is \%. (Round to two decimal places.) The profit margin for year 2 is \%. (Round to two decimal places.) The asset turnover for year 1 is . (Round to two decimal places.) The asset turnover for year 2 is . (Round to two decimal places.) The financial leverage for year 1 is (Round to two decimal places.) The financial leverage for year 2 is (Round to two decimal places.) The return on equity for year 1 is \%. (Round to two decimal places.) The return on equity for year 2 is \%. (Round to two decimal places.) (Select the best choice below.) A. ROE has decreased primarily because of an increased profit margin. The asset turnover is similar and the financial leverage has decreased. B. ROE has increased primarily because of an increased profit margin. The asset turnover is similar and the financial leverage has increased. C. ROE has increased primarily because of an increased profit margin. The asset turnover is similar and the financial leverage has decreased. D. ROE has increased primarily because of an decreased profit margin. The asset turnover is similar and the financial leverage has decreased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts