Question: Pls Help! Answer if you know how to do them! If the risk premium is 2%, the nominal borrowing rate is 7% and the real

Pls Help! Answer if you know how to do them!

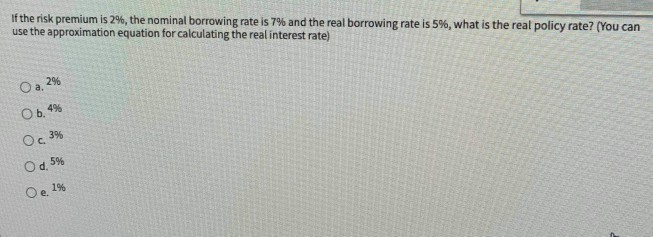

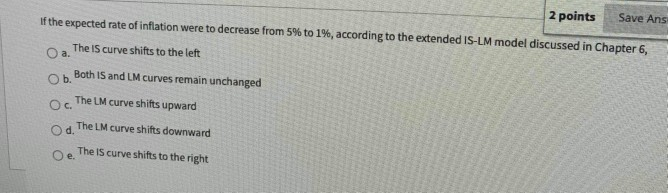

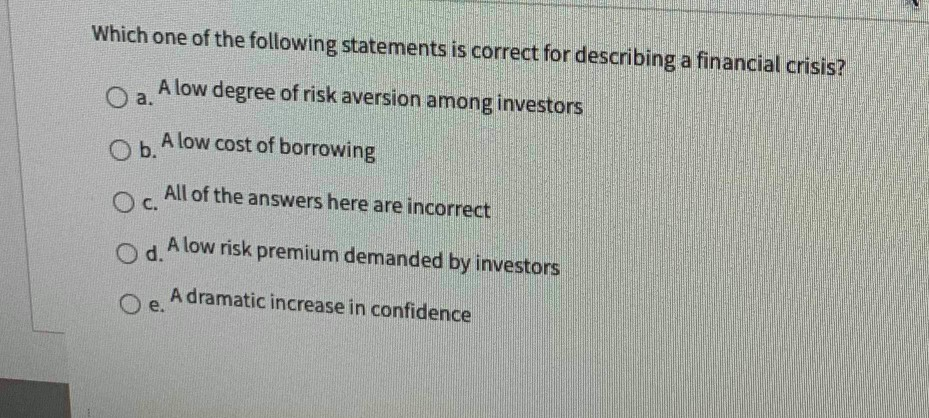

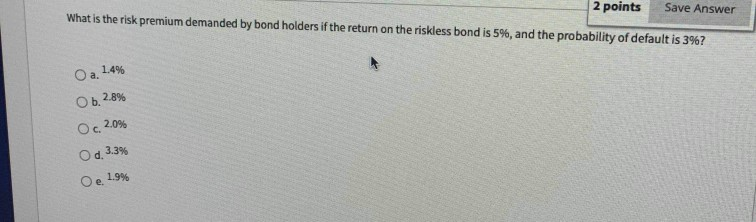

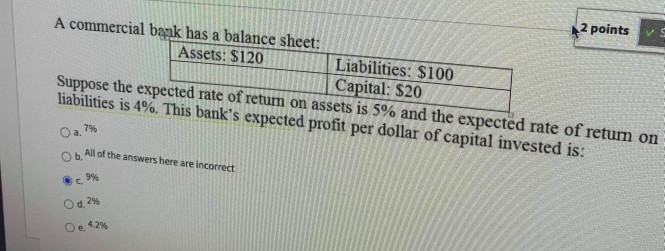

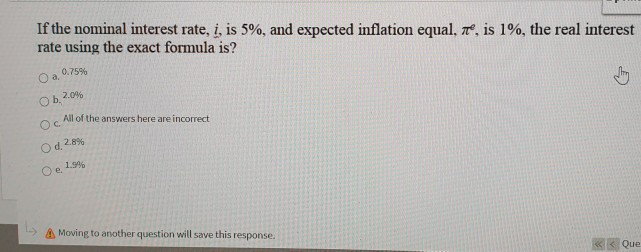

If the risk premium is 2%, the nominal borrowing rate is 7% and the real borrowing rate is 5%, what is the real policy rate? (You can use the approximation equation for calculating the real interest rate) O a. 29 Ob.4% OC 39 O d. 5% 196 Oe 2 points If the expected rate of inflation were to decrease from 5% to 1%, according to the extended IS-LM model discussed in Chapter 6, Save Ans The IS curve shifts to the left O a. ob. . Both 15 and LM curves remain unchanged Oc. The LM curve shifts upward O d. The LM curve shifts downward Oe. The IS curve shifts to the right Which one of the following statements is correct for describing a financial crisis? O a. A low degree of risk aversion among investors O b. A low cost of borrowing OC. All of the answers here are incorrect A low risk premium demanded by investors O d. A dramatic increase in confidence Oe. 2 points Save Answer What is the risk premium demanded by bond holders if the return on the riskless bond is 5%, and the probability of default is 3%? . 1.4% Ob. 2.8% Oc 2.0% O d.3.3% O e 1.9% 2 points A commercial bank has a balance sheet: Assets: $120 Liabilities: $100 Capital: $20 Suppose the expected rate of return on assets is 5% and the expected rate of retum on liabilities is 4%. This bank's expected profit per dollar of capital invested is: Oa7% b. All of the answers here are incorrect 9% C. Od: 29 O e 4.2% If the nominal interest rate, i, is 5%, and expected inflation equal, #, is 1%, the real interest rate using the exact formula is? 0.75% Oa. Ob.2.0% All of the answers here are incorrect Od 2.8% O e 1.99 Moving to another question will save this response. Que

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts