Question: Pls help me to understand the Assignment . Mr. Mangotey separated from his employers, Excellent Breweries itd on 31 December 2005 on voluntary redundancy and

Pls help me to understand the Assignment .

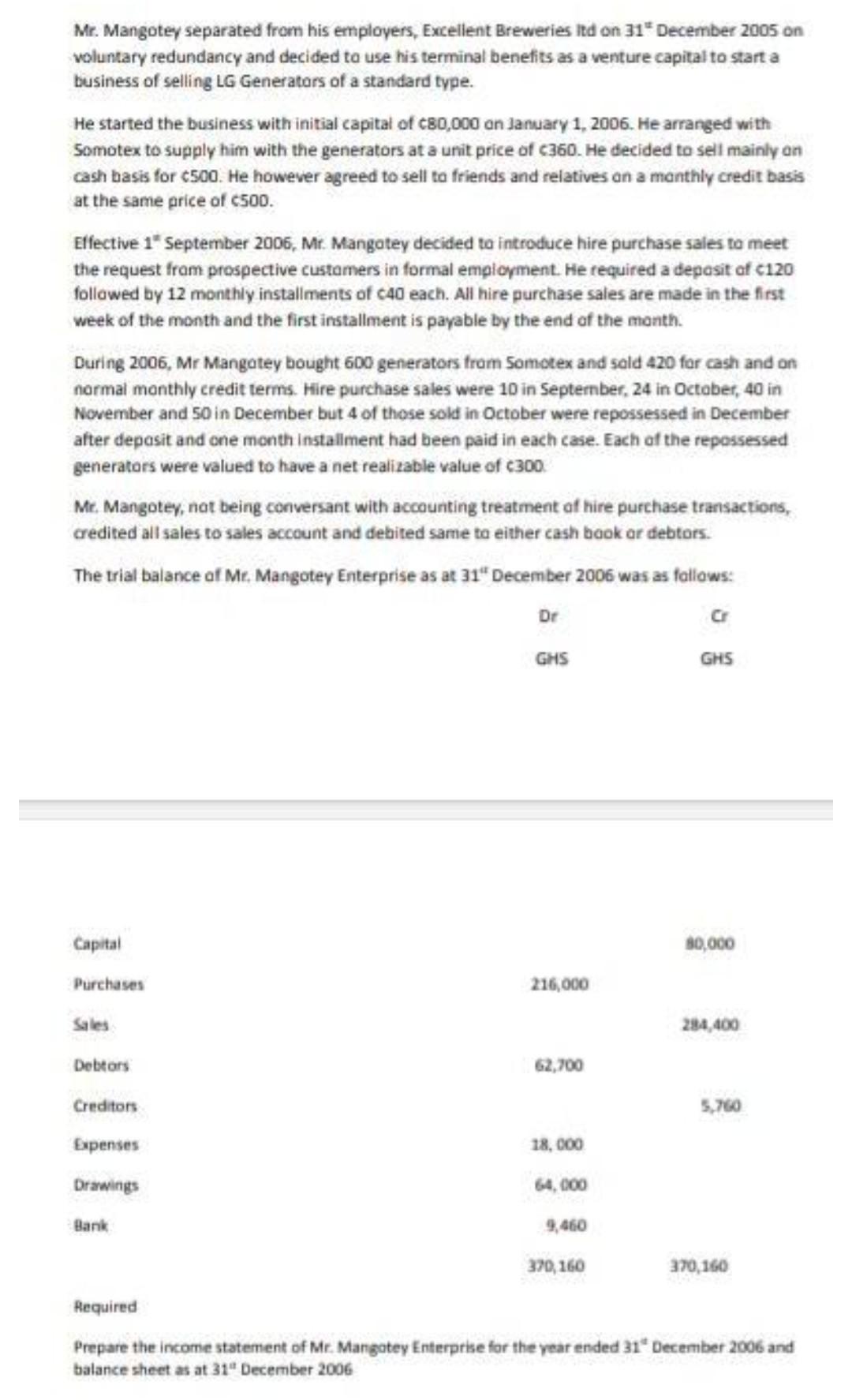

Mr. Mangotey separated from his employers, Excellent Breweries itd on 31 December 2005 on voluntary redundancy and decided to use his terminal benefits as a venture capital to start a business of selling LG Generatars of a standard type. He started the business with initial capital of c80,000 an January 1, 2006. He arranged with Somotex to supply him with the generators at a unit price of c360. He decided to sell mainly an cash basis for c500. He however agreed to sell to friends and relatives an a monthly credit basis at the same price of c500. Effective 1* September 2006, Mr. Mangotey decided to introduce hire purchase sales to meet the request fram prospective custamers in formal emplopment. He required a deposit af c120 followed by 12 monthly installments of c40 each. All hire purchase sales are made in the first week of the month and the first installment is payable by the end of the month. During 2006, Mr Mangatey bought 600 generators from Somctex and sald 420 for cash and on normal monthly credit terms. Hire purchase sales were 10 in Septernber, 24 in Octaber, 40 in November and 50 in December but 4 of those sold in October were repossessed in December after deposit and one month installment had been paid in each case. Each of the repossessed generators were valued to have a net realizable value of c300. Mc. Mangotey, nat being conversant with accounting treatment of hire purchase transactions, credited all sales to sales account and debited same to either cash book or debtors. The trial balance of Mc. Mangotey Enterprise as at 314 December 2006 was as fallows: Dr Cr GHS GHS Required Prepare the income statement of Mr. Mangotey Enterprise for the year ended 314 December 2006 and balance sheet as at 31 December 2006 Mr. Mangotey separated from his employers, Excellent Breweries itd on 31 December 2005 on voluntary redundancy and decided to use his terminal benefits as a venture capital to start a business of selling LG Generatars of a standard type. He started the business with initial capital of c80,000 an January 1, 2006. He arranged with Somotex to supply him with the generators at a unit price of c360. He decided to sell mainly an cash basis for c500. He however agreed to sell to friends and relatives an a monthly credit basis at the same price of c500. Effective 1* September 2006, Mr. Mangotey decided to introduce hire purchase sales to meet the request fram prospective custamers in formal emplopment. He required a deposit af c120 followed by 12 monthly installments of c40 each. All hire purchase sales are made in the first week of the month and the first installment is payable by the end of the month. During 2006, Mr Mangatey bought 600 generators from Somctex and sald 420 for cash and on normal monthly credit terms. Hire purchase sales were 10 in Septernber, 24 in Octaber, 40 in November and 50 in December but 4 of those sold in October were repossessed in December after deposit and one month installment had been paid in each case. Each of the repossessed generators were valued to have a net realizable value of c300. Mc. Mangotey, nat being conversant with accounting treatment of hire purchase transactions, credited all sales to sales account and debited same to either cash book or debtors. The trial balance of Mc. Mangotey Enterprise as at 314 December 2006 was as fallows: Dr Cr GHS GHS Required Prepare the income statement of Mr. Mangotey Enterprise for the year ended 314 December 2006 and balance sheet as at 31 December 2006

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts