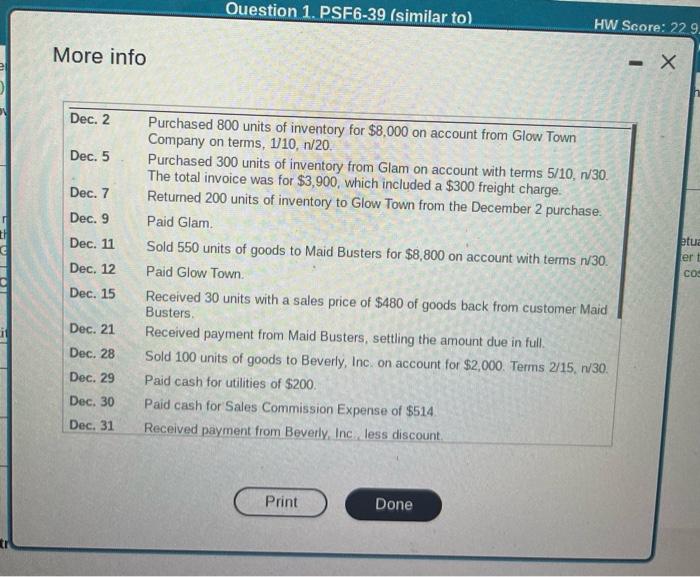

Question: pls help More info Dec. 2 Dec. 5 Dec. 7 Dec. 9 Dec. 11 Dec. 12 Dec. 15 Dec. 21 Dec. 28 Dec. 29 Dec.

More info Dec. 2 Dec. 5 Dec. 7 Dec. 9 Dec. 11 Dec. 12 Dec. 15 Dec. 21 Dec. 28 Dec. 29 Dec. 30 Dec. 31 Question 1. PSF6-39 (similar to) Purchased 800 units of inventory for $8,000 on account from Glow Town Company on terms, 1/10, n/20. Purchased 300 units of inventory from Glam on account with terms 5/10, n/30. The total invoice was for $3,900, which included a $300 freight charge. Returned 200 units of inventory to Glow Town from the December 2 purchase. Paid Glam. Sold 550 units of goods to Maid Busters for $8,800 on account with terms n/30. Paid Glow Town. Received 30 units with a sales price of $480 of goods back from customer Maid Busters. Received payment from Maid Busters, settling the amount due in full. Sold 100 units of goods to Beverly, Inc. on account for $2,000. Terms 2/15, n/30. Paid cash for utilities of $200. Paid cash for Sales Commission Expense of $514. Received payment from Beverly, Inc, less discount. Print Done HW Score: 22.9. - X etua er t COS

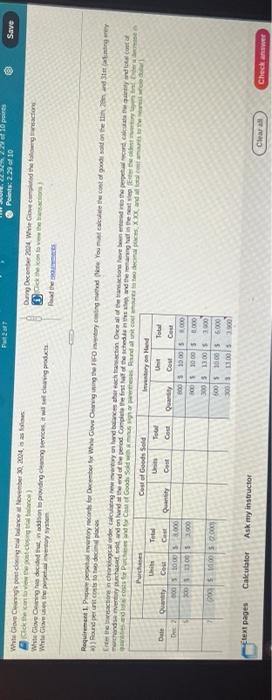

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts