Question: Pls help. Only need the last one - please solve using excel formulas. Thx 2 Sullivan Ranch Corporation has purchased a new tractor. The following

Pls help. Only need the last one - please solve using excel formulas. Thx

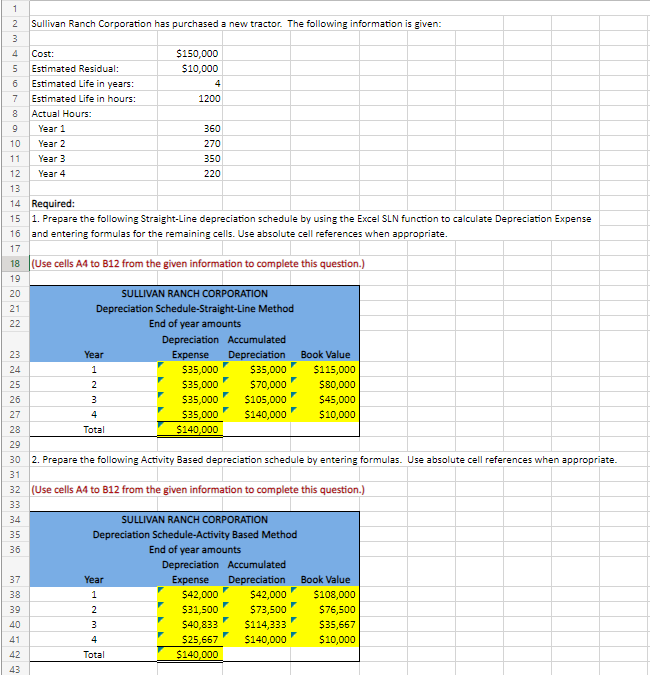

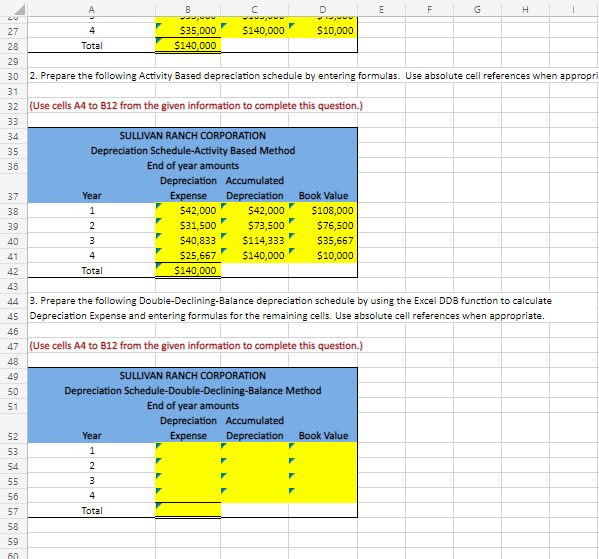

2 Sullivan Ranch Corporation has purchased a new tractor. The following information is given: and entering formulas for the remaining cells. Use absolute cell references when appropriate. (Use cells A4 to B12 from the given information to complete this question.) SULLIVAN RANCH CORPORATION Depreciation Schedule-Straight-Line Method End of year amounts Depreciation Accumulated 2. Prepare the following Activity Based depreciation schedule by entering formulas. Use absolute cell references when appropriate. (Use cells A4 to B12 from the given information to complete this question.) SULLIVAN RANCH CORPORATION Depreciation Schedule-Activity Based Method End of year amounts Depreciation Accumulated \begin{tabular}{|c|crrrr|} \hline 37 & Year & Expense & Depreciation & Book Value \\ \hline 38 & 1 & 542,000 & $42,000 & $108,000 \\ \hline 39 & 2 & $31,500 & $73,500 & $76,500 \\ \hline 40 & 3 & $40,833 & $114,333 & $35,667 \\ \hline 41 & 4 & $25,657 & $140,000 & $10,000 \\ \hline 42 & Total & $140,000 & & \\ \hline 43 & & & \end{tabular} 3. Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB function to calculate Depreciation Expense and entering formulas for the remaining cells. Use absolute cell references when appropriate. (Use cells A4 to B12 from the given information to complete this question.) SULLIVAN RANCH CORPORATION Depreciation Schedule-Double-Declining-Balance Method End of year amounts Depreciation Accumulated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts