Question: Can someone please show me exactly which formula I should use for the last table. I don't want just the answer I need to know

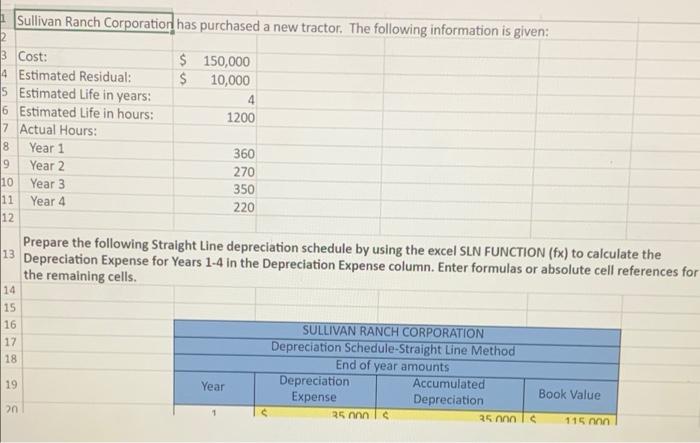

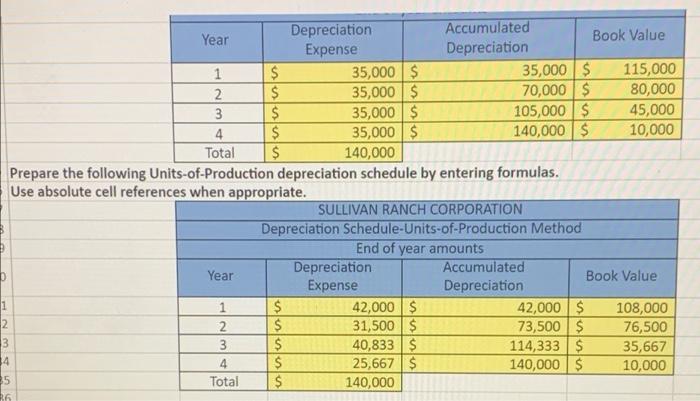

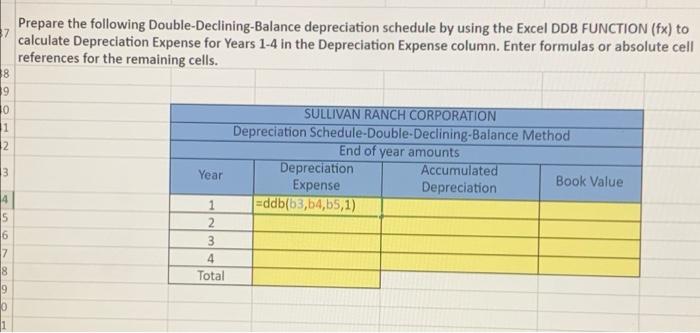

Sullivan Ranch Corporation has purchased a new tractor. The following information is given: 4 8 3 Cost: $ 150,000 4 Estimated Residual: $ 10,000 5 Estimated Life in years: 6 Estimated Life in hours: 1200 7 Actual Hours: Year 1 360 9 Year 2 270 10 Year 3 350 11 Year 4 220 12 Prepare the following Straight Line depreciation schedule by using the excel SLN FUNCTION (fx) to calculate the 13 Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. 14 15 16 17 18 SULLIVAN RANCH CORPORATION Depreciation Schedule-Straight Line Method End of year amounts Depreciation Accumulated Book Value Expense Depreciation 25 on I 25 ml 115 19 Year 2n 1 sus Depreciation Accumulated Year Book Value Expense Depreciation 1 $ 35,000$ 35,000 $ 115,000 2 $ 35,000 $ 70,000 $ 80,000 3 $ 35,000 $ 105,000 $ 45,000 4 $ 35,000 $ 140,000 $ 10,000 Total $ 140,000 Prepare the following Units-of-Production depreciation schedule by entering formulas. Use absolute cell references when appropriate. SULLIVAN RANCH CORPORATION Depreciation Schedule-Units-of-Production Method End of year amounts Year Depreciation Accumulated Book Value Expense Depreciation 1 $ 42,000 $ 42,000 $ 108,000 2 2 $ 31,500 $ 73,500 $ 76,500 3 3 $ 40,833 $ 114,333 $ 35,667 4 $ 25,667 $ 140,000 $ 10,000 Total $ 140,000 D WINP uuuuu 14 95 26 7 Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB FUNCTION (fx) to calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. 8 9 10 1 2 SULLIVAN RANCH CORPORATION Depreciation Schedule-Double-Declining-Balance Method End of year amounts Depreciation Accumulated Book Value Expense Depreciation =ddb(63, 64, 65,1) 3 Year 4 5 6 7 1 2 3 8 19 4 Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts