Question: pls help Paul bought a computer ( 5 year property) for $15,000 for business use on March 18, 2020. This was his only purchase for

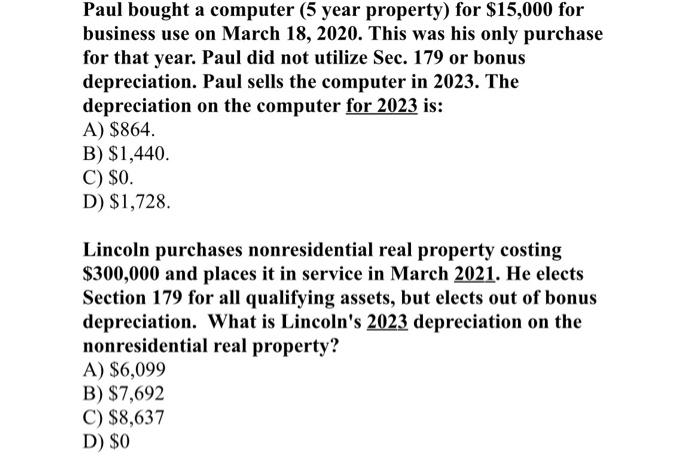

Paul bought a computer ( 5 year property) for $15,000 for business use on March 18, 2020. This was his only purchase for that year. Paul did not utilize Sec. 179 or bonus depreciation. Paul sells the computer in 2023. The depreciation on the computer for 2023 is: A) $864. B) $1,440. C) $0. D) $1,728. Lincoln purchases nonresidential real property costing $300,000 and places it in service in March 2021. He elects Section 179 for all qualifying assets, but elects out of bonus depreciation. What is Lincoln's 2023 depreciation on the nonresidential real property? A) $6,099 B) $7,692 C) $8,637 D) $0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts