Question: pls help with b) drop menu sections below Henry Inc. purchased $2,500 of Container Corporation's 5% bonds at par. The purchase was made on January

pls help with b)

drop menu sections below

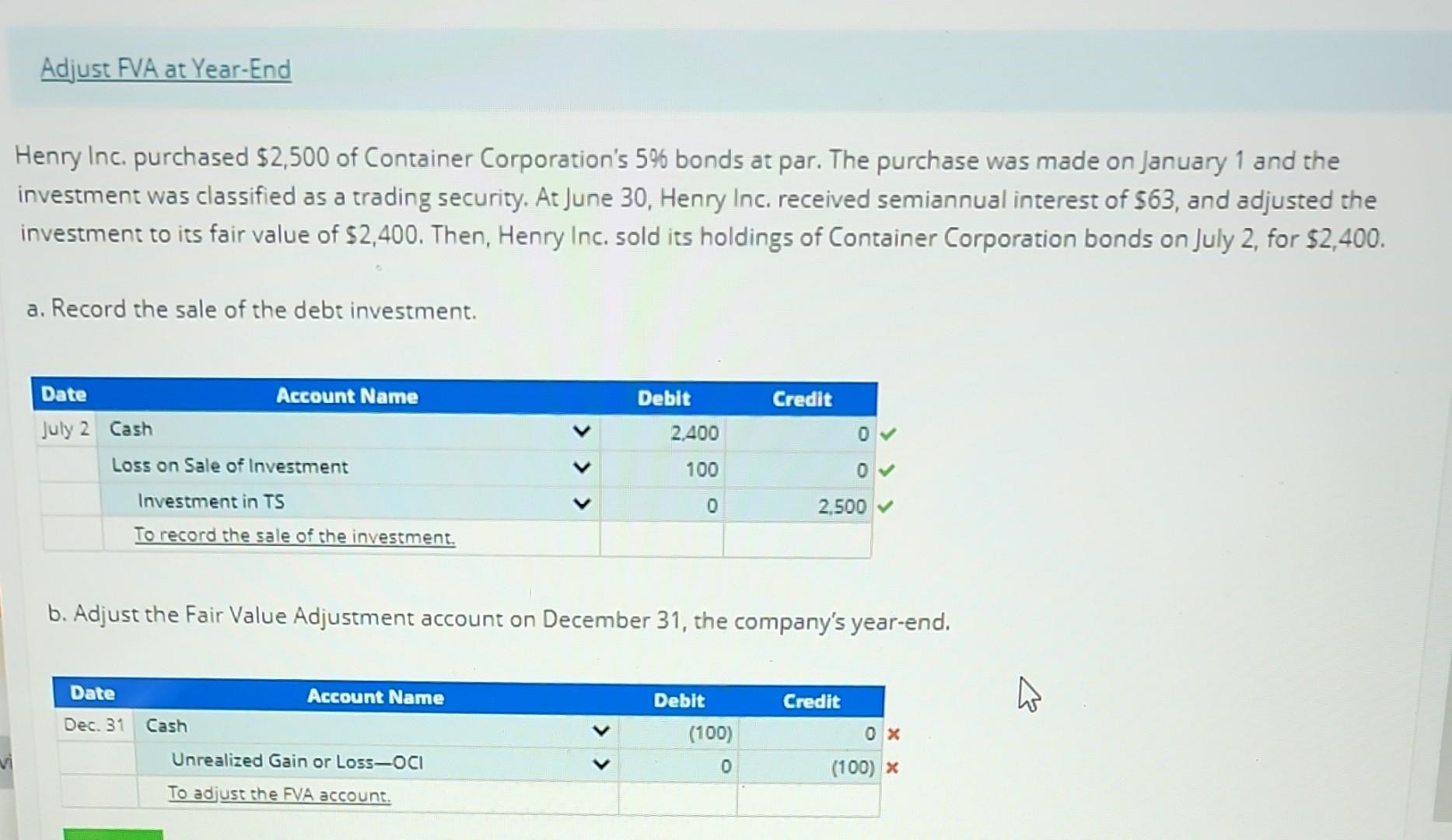

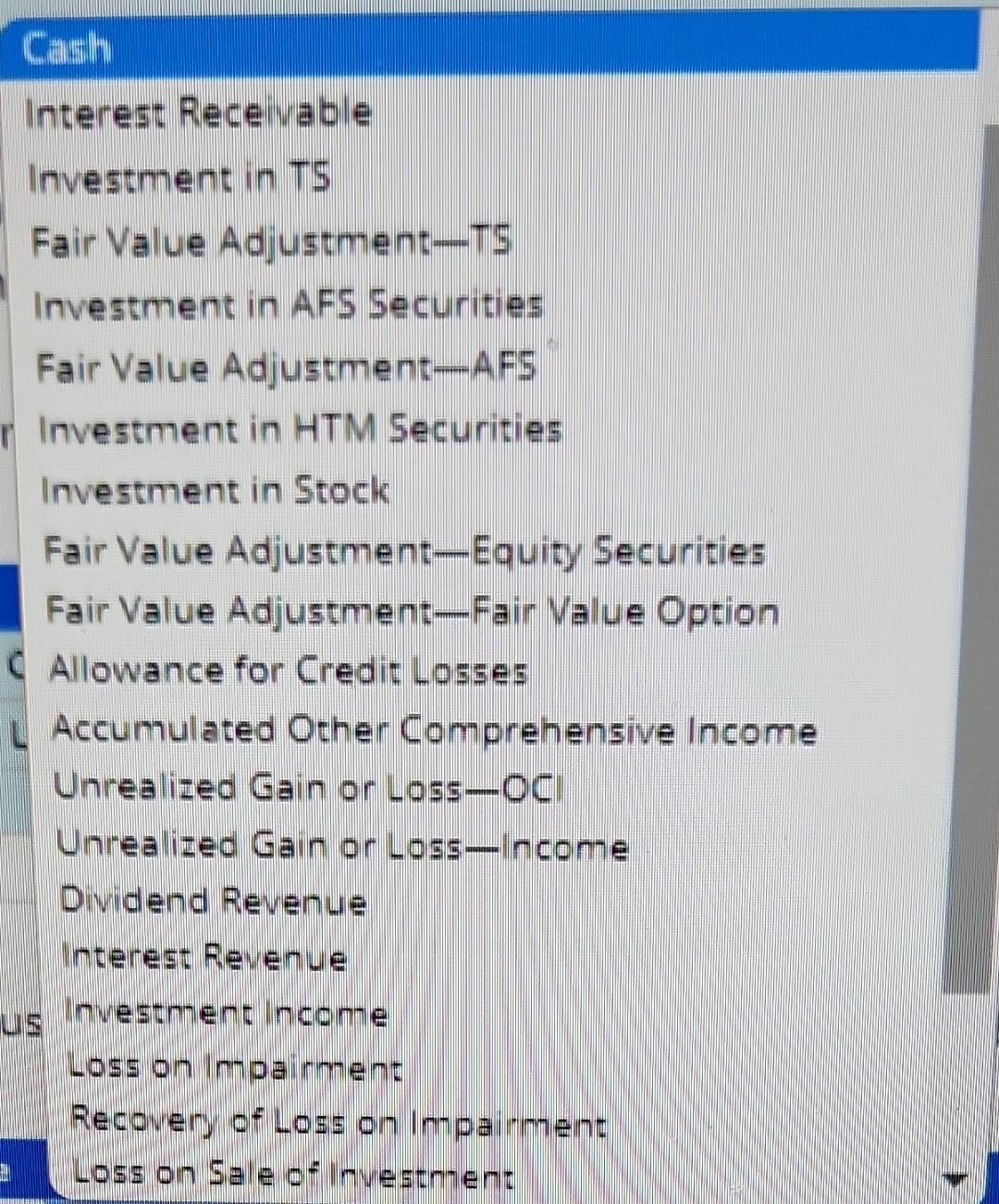

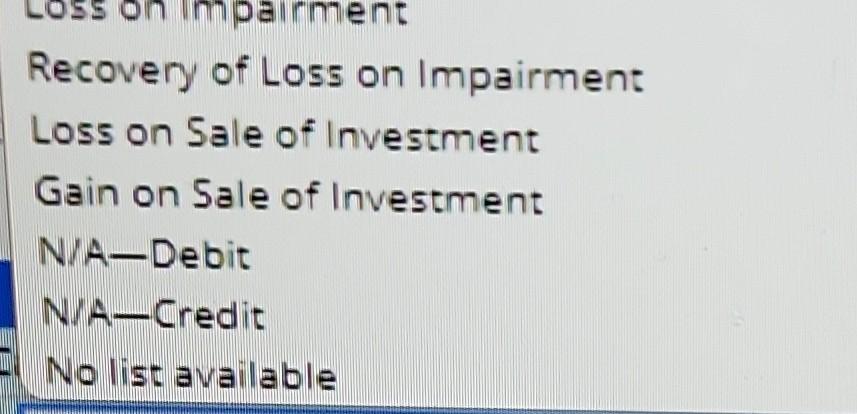

Henry Inc. purchased $2,500 of Container Corporation's 5% bonds at par. The purchase was made on January 1 and the investment was classified as a trading security. At June 30 , Henry Inc. received semiannual interest of $63, and adjusted the investment to its fair value of $2,400. Then, Henry Inc. sold its holdings of Container Corporation bonds on July 2 , for $2,400. a. Record the sale of the debt investment. b. Adjust the Fair Value Adjustment account on December 31, the company's year-end. Cash Interest Receivable Investment in TS Fair Value Adjugtment-TS Investment in AFS Securities Fair Value Adjustment-AFS Investment in HTM Securities Investment in Stock Fair Value Adjustment-Equity Securities Fair Value Adjustment-Fair Value Option Allowance for Credit Losses Accumulated Other Comprehensive Income Unrealized Gain or Loss-OC Unrealized Gain or Loss-income Dividend Revenue Interest Revenue Investment income Loss on inpairment Recovery of Loss on inpairment Loss on Sale of Investment Recovery of Loss on Impairment Loss on Sale of Investment Gain on Sale of Investment N/A-Debit N/A-Credit No list available

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts