Question: please explain part B not just answer. I have tried several different answers I was sure it was and was wrong not sure why. these

please explain part B not just answer. I have tried several different answers I was sure it was and was wrong not sure why.

these are choices from drop down

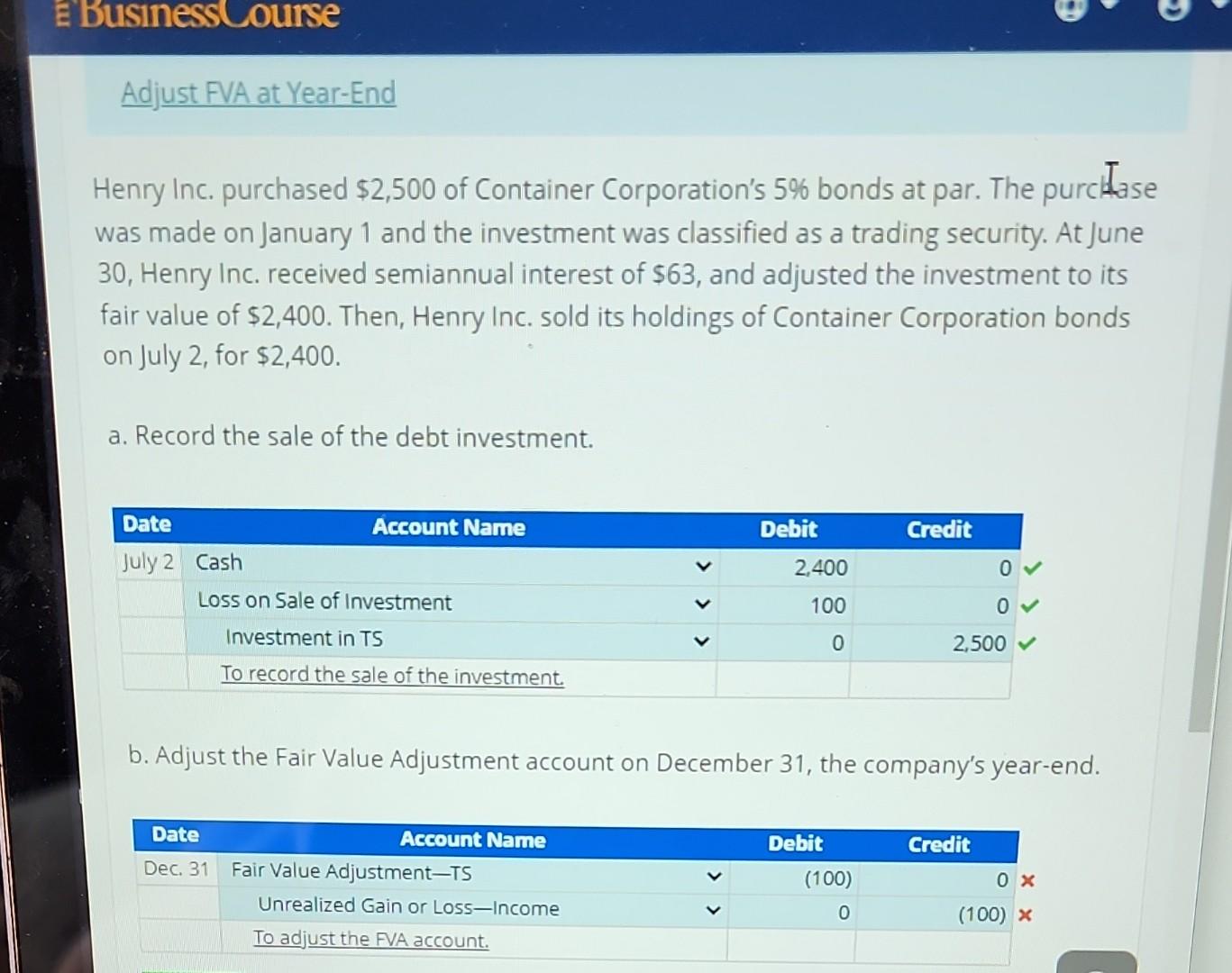

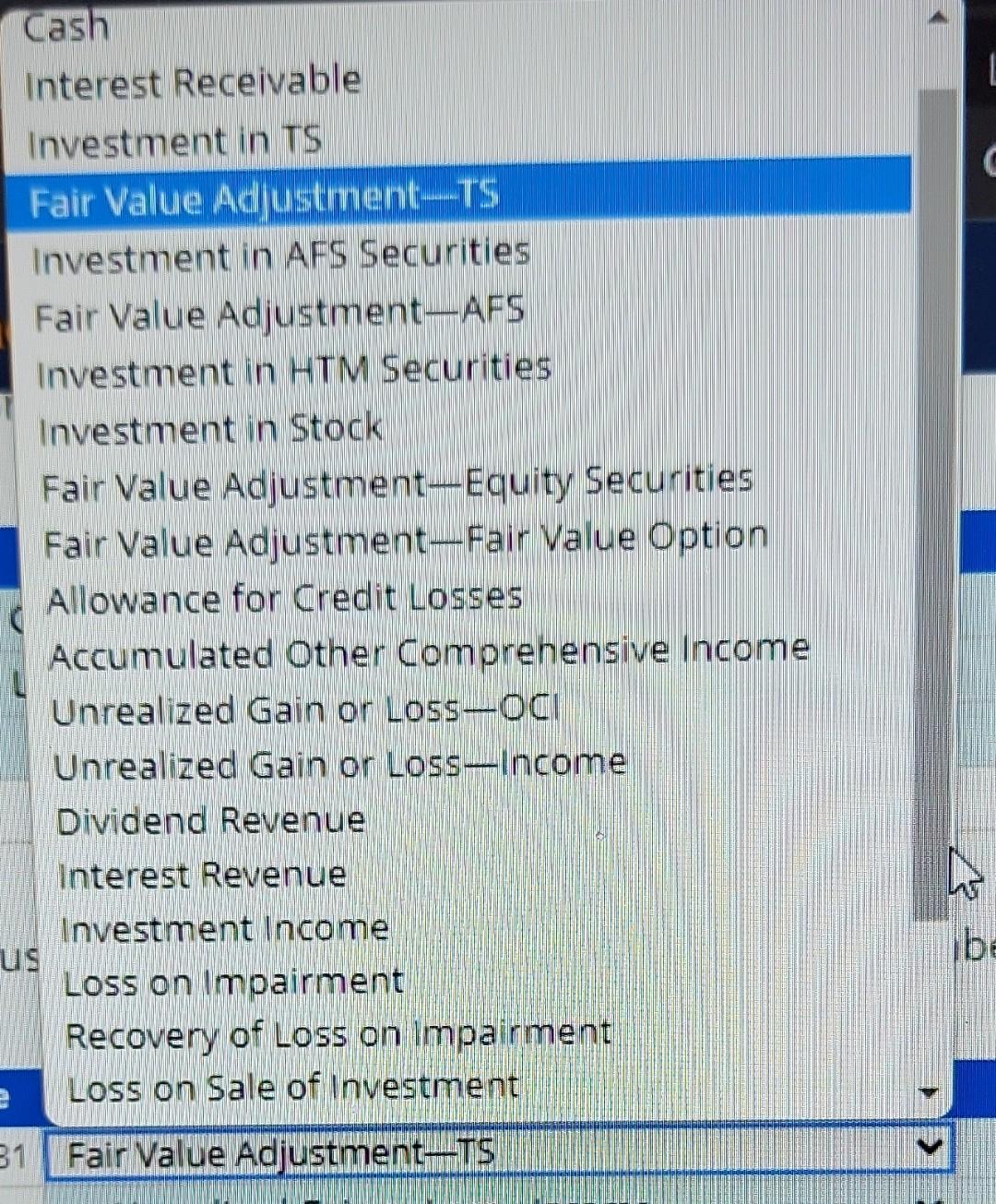

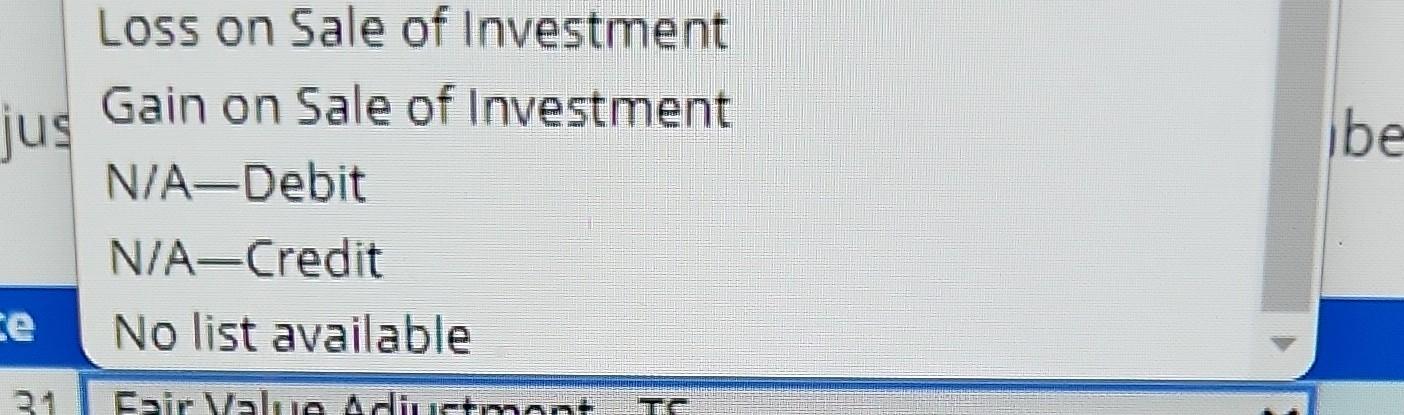

Henry Inc. purchased $2,500 of Container Corporation's 5% bonds at par. The purcitase was made on January 1 and the investment was classified as a trading security. At June 30 , Henry Inc. received semiannual interest of $63, and adjusted the investment to its fair value of $2,400. Then, Henry Inc. sold its holdings of Container Corporation bonds on July 2 , for $2,400. a. Record the sale of the debt investment. b. Adjust the Fair Value Adjustment account on December 31, the company's year-end. Interest Receivable Investment in TS Fair Value Adjustiment-TS Investment in AFS Securities Fair Value Adjustment-AFS Investment in HTM Securities Investment in Stock Fair Value Adjustment-Equity Securities Fair Value Adjustment Fair Value Option Allowance for Credit Losses Accumulated Other Comprehensive Income Unrealized Gain or Loss - OCI Unrealized Gain or Loss - Income Dividend Revenue Interest Revenue Investment income Loss on Impairment Recovery of Loss on impairment Loss on Sale of Investment Fair Value Adjustment-TS Loss on Sale of Investment Gain on Sale of Investment N/A-Debit N/A-Credit No list available

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts