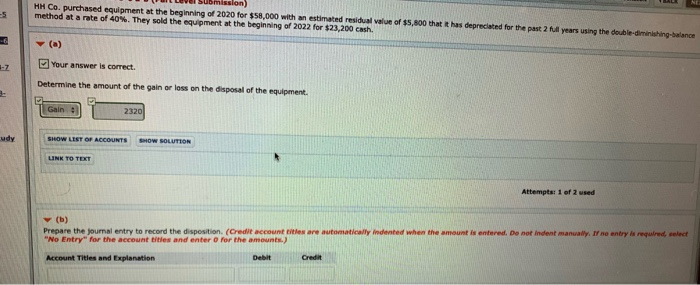

Question: pls help with part B - - - HH Co. purchased equipment at the beginning of 2020 for $58,000 with an estimated residual value of

pls help with part B

pls help with part B

- - - HH Co. purchased equipment at the beginning of 2020 for $58,000 with an estimated residual value of $5,800 that it has deprecated for the past 2 method at a rate of 40 . They sold the equipment at the beginning of 2022 for $23.200 cash years using the double-diminishing-balance Your answer is correct. Determine the amount of the gain or loss on the disposal of the equipment. Tana 2:20 udy SHOW LIST OF ACCOUNTS HOW SOLUTION Attempt of 2 used (b) Prepare the journal entry to record the disposition. (Credit accountries are automatically "No Entry for the account titles and enter for the amounts) when the amount infered. De morient manually. If any rere lect Account Titles and Explanation Debit Credit (b) Prepare the journal entry to record the disposition. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is requi "No Entry for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts