Question: pls help with the question below whats your question? As described in the chapter, in their book The End of Accounting, Lev and Gu call

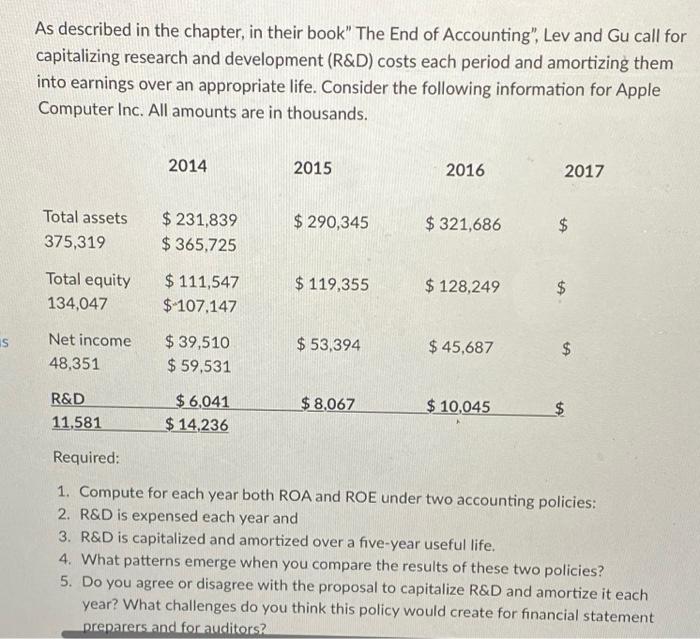

As described in the chapter, in their book The End of Accounting", Lev and Gu call for capitalizing research and development (R&D) costs each period and amortizing them into earnings over an appropriate life. Consider the following information for Apple Computer Inc. All amounts are in thousands. 2014 2015 2016 2017 Total assets 375,319 $ 290,345 $ 231,839 $365,725 $321,686 $ Total equity 134,047 $ 119,355 $ 111,547 $ 107,147 $ 128,249 $ IS Net income 48,351 $ 53,394 $ 39,510 $ 59,531 $ 45,687 $ R&D 11,581 $ 8,067 $ 6,041 $ 14,236 $ 10,045 Required: 1. Compute for each year both ROA and ROE under two accounting policies: 2. R&D is expensed each year and 3. R&D is capitalized and amortized over a five-year useful life. 4. What patterns emerge when you compare the results of these two policies? 5. Do you agree or disagree with the proposal to capitalize R&D and amortize it each year? What challenges do you think this policy would create for financial statement preparers and for auditors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts