Question: Pls just explain how to do problem 11. 10) A firm is evaluating a proposal which has an initial investment of $150,000 and has cash

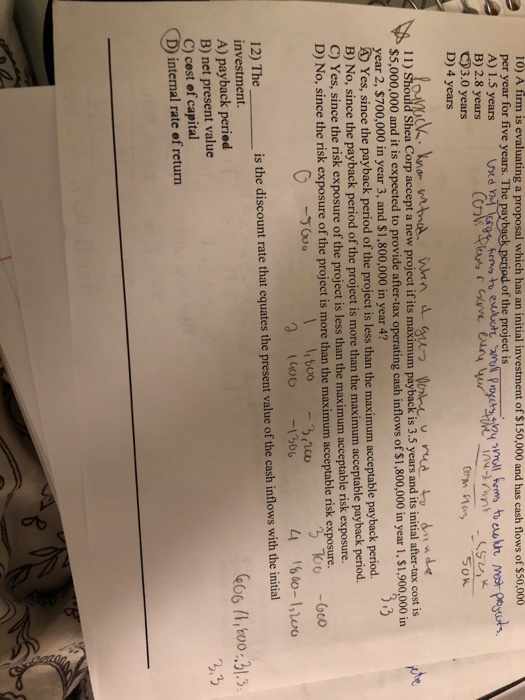

10) A firm is evaluating a proposal which has an initial investment of $150,000 and has cash flows of $50,000 per year for five years. The payback period of the project is B) 2.8 years C)3.0 years D) 4 years 1 1) Should Shea Corp accept a new project if its maximum payback i S5,000,000 and it is expected to provide after-tax operating cash inflows of $1,800,000 in year 1, $1,900,000 in year 2, $700,000 in year 3, and $1,800,000 in year 4? D Yes, since the payback period of the project is less than the maximum acceptable payback period B) No, since the payback period of the project is more than the maximum acceptable payback period is 3.5 years and its initial after-tax cost is the risk exposure of the project is less than the maximum acceptable risk exposure. of the project is more than the maximum acceptable risk exposure. 10 no 14 106 D) No, since the risk exposure oto is the discount rate that equates the present value of the cash inflows with the initial 12) The investment. A) payback peried B) net present value C) cest of capital I,31. 2,2 D) internal rate of returr

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts