Question: Pls only answer if able to fully ans the questions, Pls also give details workings Question 1 The SUSS Manufacturing Inc. produces two products, in

Pls only answer if able to fully ans the questions, Pls also give details workings

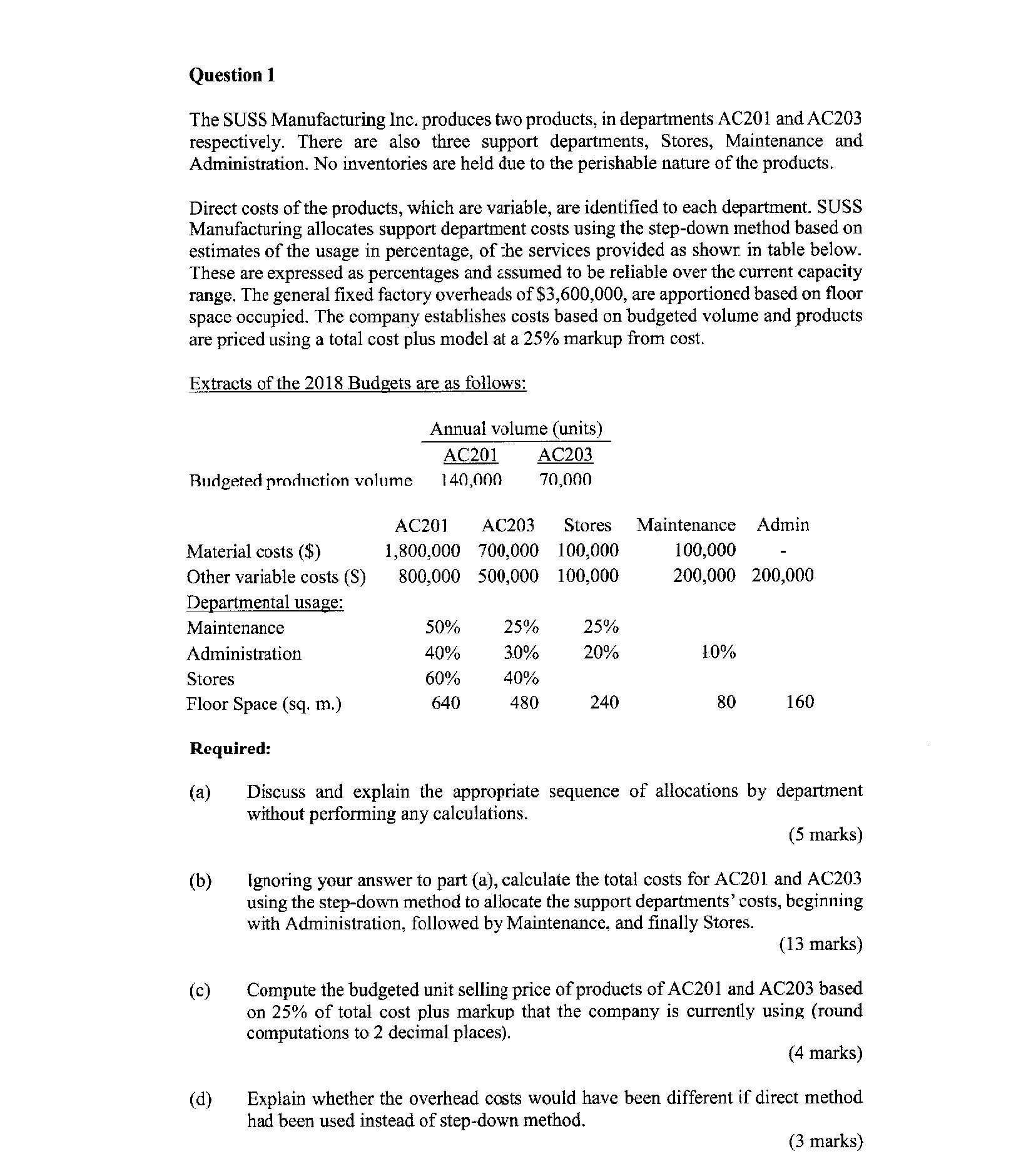

Question 1 The SUSS Manufacturing Inc. produces two products, in departments ACZOl and AC203 respectively. There are also three support departments, Stores, Maintenance and Administration No inventories are held due to the perishable nature of the products. Direct costs of the products, which are variable, are identied to each department. SUSS Manufacturing allocates support department costs using the step-down method based on estimates of the usage in percentage, of :'ne services provided as showr. in table below. These are expressed as percentages and assumed to be reliable over the current capacity range. The general xed factory overheads of $3,600,000, are apportioned based on oor space occupied. The company establishes costs based on budgeted volume and products are priced using a total cost plus model at a 25% markup from cost. Extracts of the 2018 Budgets are as follows: Annual volume (units) AC201 AC203 Budgeted production volume 140,000 70,000 AC201 AC203 Stores Maintenance Admin Material costs ($) 1,800,000 700,000 100,000 100,000 - Other variable costs (S) 800,000 500,000 100,000 200,000 200,000 Departmental usage: Maintenance 50% 25% 25% Administration 40% 3.0% 20% 10% Stores 60% 40% Floor Space (sq. m.) 640 480 240 80 160 Required: (a) Discuss and explain the appropriate sequence of allocations by department (19) 01) without performing any calculations. (5 marks) Ignoring your answer to part (a), calculate the total costs for AC201 and AC203 using the step-down method to allocate the support departments' costs, beginning with Administration, followed by Maintenance, and nally Stores. (13 marks) Compute the budgeted unit selling price of products of AC201 and AC203 based on 25% of total cost plus markup that the company is currently using (round computations to 2 decimal places). (4 marks) Explain whether the overhead costs would have been different if direct method had been used instead of step'down method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts