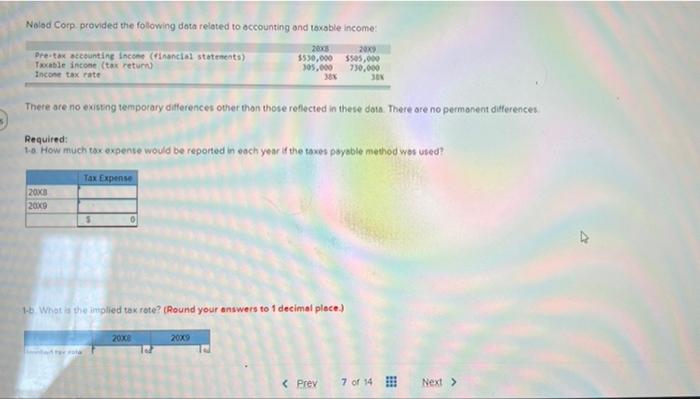

Question: pls reply fast and accurate Noled Corp provided the folowing data related to accounting and taxable income 2009 pre-tax atcounting income (Financial statements) $530,000 $505,000

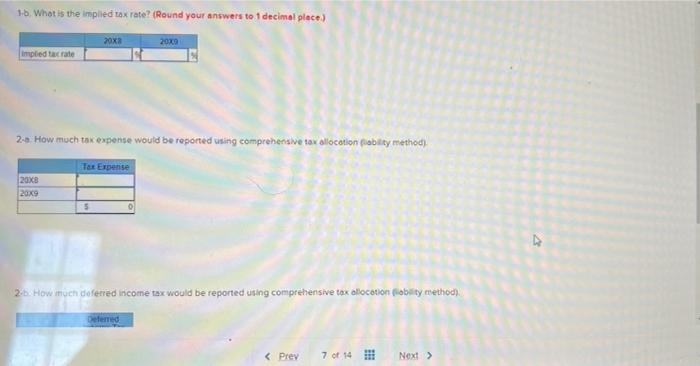

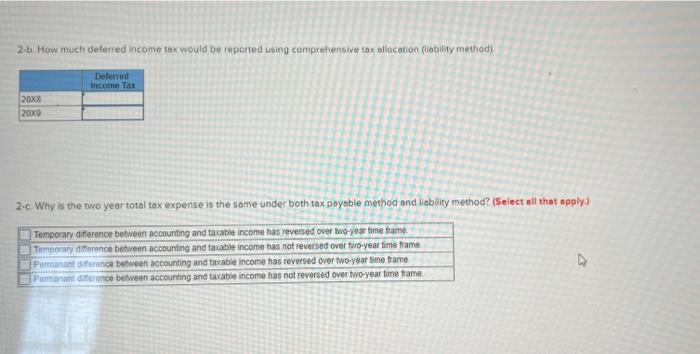

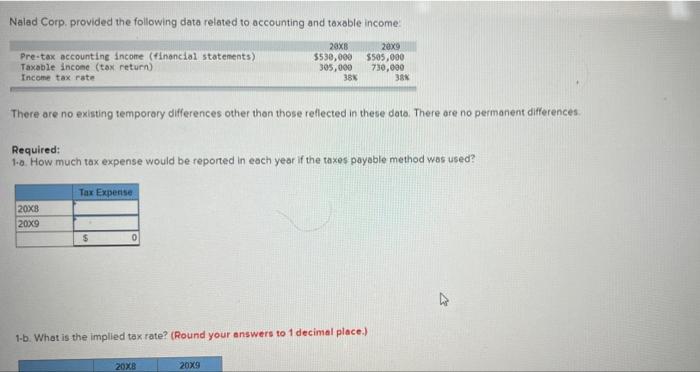

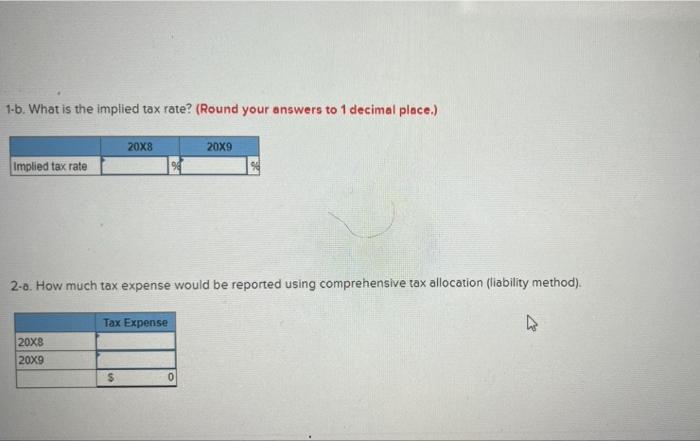

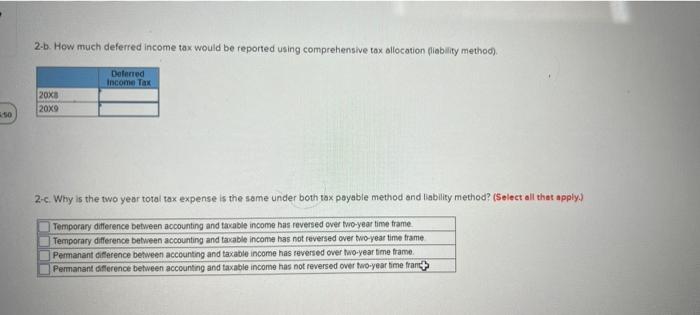

Noled Corp provided the folowing data related to accounting and taxable income 2009 pre-tax atcounting income (Financial statements) $530,000 $505,000 Txable income tax return 395,000 730,000 Income tax rate SON 205 There are no existing temporary differences other than those reflected in these doma. There are no permanent differences Required: 13. How much tox expense would be reported in each year if the taxes payable method was used? Tax Expense 20x8 20x9 5 0 1. What is the implied tax rate? (Round your answers to 1 decimal place.) 20x 2009 132 1-6. What is the implied tox rate? (Round your answers to 1 decimal place) ox 20x8 implied tarrate 2.5. How much tax expense would be reported using comprehenswe taw allocation ability method) Tax Expense 20x8 20x9 5 26. How much doferred income tax would be reported using comprehensive tax allocation obrity method Deferred 2.b. How much deferred income tax would be reported using comprehensive tax allocation (lability method) Deferred Income Tax 20x8 20x9 2-c Why is the two year total tax expense is the same under both tax poyable method and liability method? (Select all that apply.) Temporary difference between accounting and taxable income has reversed over to year time frame. Temporary difference between accounting and taxable income has not reversed over two-year time frame Permanence between accounting and taxable income has reversed over two-year time frame Parmantence between accounting and taxable income has not reversed over two-year time frame D Nalad Corp, provided the following data related to accounting and taxable income Pre-tax accounting income (financial statements) Taxable income (tax return) Income tax rate 20x8 5530,000 305,000 38 20x9 $505,000 730,000 38 There are no existing temporary differences other than those reflected in these data. There are no permanent differences Required: 1-0. How much tax expense would be reported in each year if the taxes payable method was used? Tax Experise 20x8 20x9 $ 0 1-b. What is the implied tax rate? (Round your answers to 1 decimal place.) 20x8 20x9 1-5. What is the implied tax rate? (Round your answers to 1 decimal place.) 20x8 20x9 Implied tax rate 194 2-0. How much tax expense would be reported using comprehensive tax allocation (liability method). Tax Expense . 20x8 20x9 $ 0 2-b. How much deferred income tax would be reported using comprehensive tax allocation liability method). Deferred Income Tax 20x8 20x9 450 2-c Why is the two year total tax expense is the same under both tax payable method and liability method? (Select all that apply) Temporary difference between accounting and taxable income has reversed over two-year time frame Temporary difference between accounting and taxable income has not reversed over two-year time frame Permanant difference between accounting and taxable income has reversed over two-year time frame. Permanant difference between accounting and taxable income has not reversed over two-year timefranet Noled Corp provided the folowing data related to accounting and taxable income 2009 pre-tax atcounting income (Financial statements) $530,000 $505,000 Txable income tax return 395,000 730,000 Income tax rate SON 205 There are no existing temporary differences other than those reflected in these doma. There are no permanent differences Required: 13. How much tox expense would be reported in each year if the taxes payable method was used? Tax Expense 20x8 20x9 5 0 1. What is the implied tax rate? (Round your answers to 1 decimal place.) 20x 2009 132 1-6. What is the implied tox rate? (Round your answers to 1 decimal place) ox 20x8 implied tarrate 2.5. How much tax expense would be reported using comprehenswe taw allocation ability method) Tax Expense 20x8 20x9 5 26. How much doferred income tax would be reported using comprehensive tax allocation obrity method Deferred 2.b. How much deferred income tax would be reported using comprehensive tax allocation (lability method) Deferred Income Tax 20x8 20x9 2-c Why is the two year total tax expense is the same under both tax poyable method and liability method? (Select all that apply.) Temporary difference between accounting and taxable income has reversed over to year time frame. Temporary difference between accounting and taxable income has not reversed over two-year time frame Permanence between accounting and taxable income has reversed over two-year time frame Parmantence between accounting and taxable income has not reversed over two-year time frame D Nalad Corp, provided the following data related to accounting and taxable income Pre-tax accounting income (financial statements) Taxable income (tax return) Income tax rate 20x8 5530,000 305,000 38 20x9 $505,000 730,000 38 There are no existing temporary differences other than those reflected in these data. There are no permanent differences Required: 1-0. How much tax expense would be reported in each year if the taxes payable method was used? Tax Experise 20x8 20x9 $ 0 1-b. What is the implied tax rate? (Round your answers to 1 decimal place.) 20x8 20x9 1-5. What is the implied tax rate? (Round your answers to 1 decimal place.) 20x8 20x9 Implied tax rate 194 2-0. How much tax expense would be reported using comprehensive tax allocation (liability method). Tax Expense . 20x8 20x9 $ 0 2-b. How much deferred income tax would be reported using comprehensive tax allocation liability method). Deferred Income Tax 20x8 20x9 450 2-c Why is the two year total tax expense is the same under both tax payable method and liability method? (Select all that apply) Temporary difference between accounting and taxable income has reversed over two-year time frame Temporary difference between accounting and taxable income has not reversed over two-year time frame Permanant difference between accounting and taxable income has reversed over two-year time frame. Permanant difference between accounting and taxable income has not reversed over two-year timefranet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts