Question: Pls show all work thank you SECTION 2 Max Laboratories is evaluating three independent projects. Project 1: Dog Treats, Project 2: Dog Food, and Project

Pls show all work thank you

Pls show all work thank you

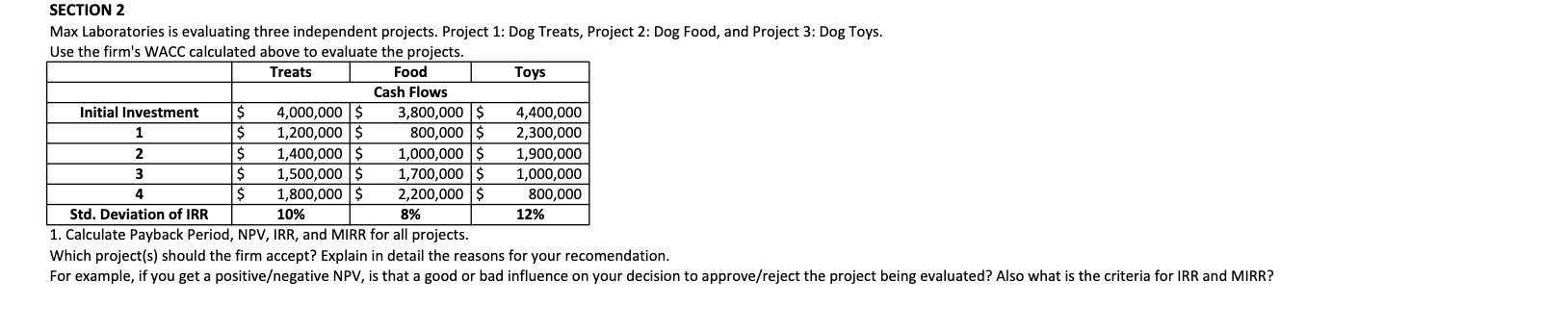

SECTION 2 Max Laboratories is evaluating three independent projects. Project 1: Dog Treats, Project 2: Dog Food, and Project 3: Dog Toys. Use the firm's WACC calculated above to evaluate the projects. Treats Food Toys Cash Flows Initial Investment $ 4,000,000 $ 3,800,000 $ 4,400,000 1 $ 1,200,000 $ 800,000 $ 2,300,000 2 $ 1,400,000 $ 1,000,000 $ 1,900,000 3 $ 1,500,000 $ 1,700,000 $ 1,000,000 4 $ 1,800,000 $ 2,200,000 $ 800,000 Std. Deviation of IRR 10% 8% 12% 1. Calculate Payback Period, NPV, IRR, and MIRR for all projects. Which project(s) should the firm accept? Explain in detail the reasons for your recomendation. For example, if you get a positiveegative NPV, is that a good or bad influence on your decision to approve/reject the project being evaluated? Also what is the criteria for IRR and MIRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts