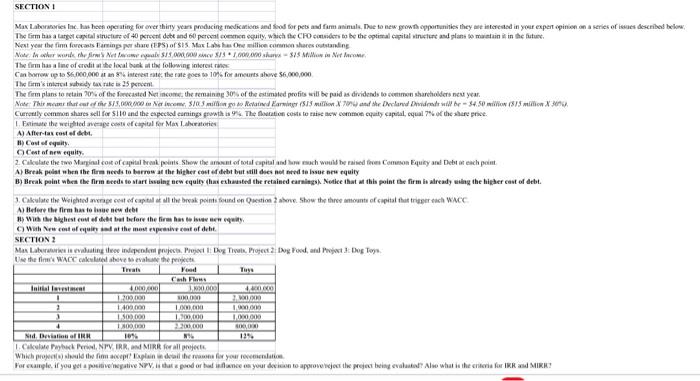

Question: SECTION 1 Max Laboratories Inc. has been operating for over thinty years producing medications and food for pets and famimal. The to new growth opportunities

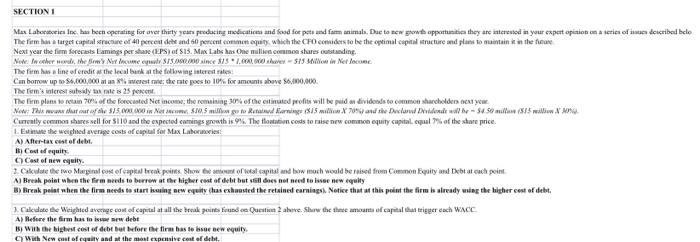

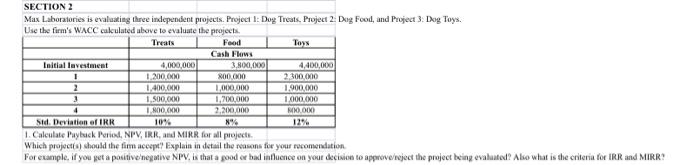

SECTION 1 Max Laboratories Inc. has been operating for over thinty years producing medications and food for pets and famimal. The to new growth opportunities they are interested in your expert opinion on a series of es described below The firm has a large capital structure of 40 percent date and 60 percent comme equity, which he CFO cendens to be the optimal capital structure and plans to maintain it in the future, Next year the firm forecasts Burning share EPS of St. Max Lashes will come shares standing Note Incolor want the firm Netfa SIS 0,00 8/8.000.000 Minut Pro The firm has a line of credit at the local bank at the following interest rate Cos borren up to 56.000.000 3 8% interest rate the rate poes to 10% for amounts sheve 56,000,000 The firm's interested tax rate 25 percent The form plans to retain 20% of the forecasted Net income the remaining 30% of the estimated profits will be paid as dividends to shareholders ne year Note: This means that eat of 385,00R/Com Newcom, 3/0.5 million de Rotatud Earning (513 million and the Declared Divided will be - 34.50 million (575 million X300 Currently common shares sell for $110 and the expected coming wth 9. The costs to sew comme quity capital cqual 7% of the share pe Fatimate the weighted average of capital for Men Lahore A) After fax cost of debt. ) Colequity. Cost of new equity. 2. Calculate the two Marginal cost of capital brak points show the meant of total capital and how much would be raised from Common Equity and Debt teach point A) Break pelat when the firm needs to borrow at the Wither conte debt but still dies not need to insure equity B) Breakpoint when the firm eed to start issuing new equlty has exhausted the retained carnes Notice that this point the firm is already using the higher cast of debt. Cakulate the Weighted average cost of capital et all the break point found on Question ? show. Show the three amount of capital that traperich WMCC A Before the firm has to be new deb By was the bighest cost of the trut before the firm has to be wealty With New cost of us at the most presive cast of debt. SECTION 2 Mas Laboratoriet in evaluating the independent projects Project Dog Tivats. Profect 2. Ing Pood, and Project Dog Toys Use the fine WACC cakestel het evaluate the price Yand Cash Initiallar 400 MO 4 1.700.000 0000 AWO 2 1,00000 10,000 1.000.000 3 1.500.000 10.00 100 100.000 200.000 Nid Devil RH 10 N96 124 1.Cake Print, NTV. IRRO MIRR for all projects Which osudil fimplexplain ideal them for your relations For example, if you yolpitiveative NPV. that pood or balance your doon to approvenejo te pre bring evol? Also what is there for IKRAMIK SECTION 1 Mer Laboratories Inc. has been operating for over thirty years producing medications and food for pets and form animal. Dac to new growth opportunities they are interested in your expert opinion on a series of stes de cribed belo The firm has a target capital careef 41 percent and 60 percent comme quity which the CO comides to be the optimal capital structure and plans to maintain it in their Next year the firm forecasts Lamings per shas (EPS) of Sis. Max Labs has one million common shares outstanding Nole Interiore, Me By Niy nome 8/590.00 ince 15.1.000.000 fer-515 in Nerfeconc The firm has a line oferedits the local bank at the following interest rates Can bomow up to $4,000,000 at an 8 interest rate the rate poes to 10% for amounts above 56,100,000 The Erm's interest stay at its 25 percent The firm plans to return of the forecasted Net income the remaining 30% of the estimated profit will be paid a dividends to come hardholder den you New This was that eat of the $35.000 in Net som $10,5 millist go to Retard karming (85 millowX 700 aw she Declared widende wall br - 5450 milie (515 milliww. Currently common shares sell for $110 and the expected comings growth is 9%. The flotion cods to raise new common equity capital equal of the stare price 1. Estimate the weighted average costs of capital for Max Labormes A) After-tax cost of debt. It; Coquity Cast of new equity 2 Cake the two Marginal cost of capital break points. Show all capital and how much would be raised from Common Equity and Debt at cach point A) Break point when the firm needs to borrow at the higher cost of debt but does not need to see new equity B) Break point when the firm needs to start issuing new equity has exhausted the retained earnings. Notice that at this point the timbs already using the higher cent of debt. 1.Caledote de Weighted average cost of capital at all the best points found ce Question 2 above. Slow the state mom of capital that trigger ench WACC A) Refore the firm as in i brw debt 1) With Right cost of debt but before firm has to lise new equity. With New custofcquity and at the most expensive cost of debt. SECTION 2 Max Laboratories is evaluating three independent projects. Project 1: Dog Treats, Project 2 Dig Food, and Project 3. Dog Toys. Use the firm's WACC calculated above to evaluate the projects Treats Food Toys Cash Flows Initial lavestment 4,000,000 3.800,000 4,400,000 1.200.000 200.000 2.300.000 1.400.000 1,000,000 1.900.000 3 1.500.000 1,200,000 1.000.000 100.000 2,200,000 M0.000 Sid. Deviation of IRR N% 12% 1. Calculate Payluck Pro, NPV, IRR, MIRR for all projects Which projects) should the tim accept? Explain in detail the reasons for your recomendation For example, if you get a positive negative NPV. is that a good or bad influence on your decision to approve/reject the project being evaluated? Also what is the criteria for IRR and MIRR! SECTION 1 Max Laboratories Inc. has been operating for over thinty years producing medications and food for pets and famimal. The to new growth opportunities they are interested in your expert opinion on a series of es described below The firm has a large capital structure of 40 percent date and 60 percent comme equity, which he CFO cendens to be the optimal capital structure and plans to maintain it in the future, Next year the firm forecasts Burning share EPS of St. Max Lashes will come shares standing Note Incolor want the firm Netfa SIS 0,00 8/8.000.000 Minut Pro The firm has a line of credit at the local bank at the following interest rate Cos borren up to 56.000.000 3 8% interest rate the rate poes to 10% for amounts sheve 56,000,000 The firm's interested tax rate 25 percent The form plans to retain 20% of the forecasted Net income the remaining 30% of the estimated profits will be paid as dividends to shareholders ne year Note: This means that eat of 385,00R/Com Newcom, 3/0.5 million de Rotatud Earning (513 million and the Declared Divided will be - 34.50 million (575 million X300 Currently common shares sell for $110 and the expected coming wth 9. The costs to sew comme quity capital cqual 7% of the share pe Fatimate the weighted average of capital for Men Lahore A) After fax cost of debt. ) Colequity. Cost of new equity. 2. Calculate the two Marginal cost of capital brak points show the meant of total capital and how much would be raised from Common Equity and Debt teach point A) Break pelat when the firm needs to borrow at the Wither conte debt but still dies not need to insure equity B) Breakpoint when the firm eed to start issuing new equlty has exhausted the retained carnes Notice that this point the firm is already using the higher cast of debt. Cakulate the Weighted average cost of capital et all the break point found on Question ? show. Show the three amount of capital that traperich WMCC A Before the firm has to be new deb By was the bighest cost of the trut before the firm has to be wealty With New cost of us at the most presive cast of debt. SECTION 2 Mas Laboratoriet in evaluating the independent projects Project Dog Tivats. Profect 2. Ing Pood, and Project Dog Toys Use the fine WACC cakestel het evaluate the price Yand Cash Initiallar 400 MO 4 1.700.000 0000 AWO 2 1,00000 10,000 1.000.000 3 1.500.000 10.00 100 100.000 200.000 Nid Devil RH 10 N96 124 1.Cake Print, NTV. IRRO MIRR for all projects Which osudil fimplexplain ideal them for your relations For example, if you yolpitiveative NPV. that pood or balance your doon to approvenejo te pre bring evol? Also what is there for IKRAMIK SECTION 1 Mer Laboratories Inc. has been operating for over thirty years producing medications and food for pets and form animal. Dac to new growth opportunities they are interested in your expert opinion on a series of stes de cribed belo The firm has a target capital careef 41 percent and 60 percent comme quity which the CO comides to be the optimal capital structure and plans to maintain it in their Next year the firm forecasts Lamings per shas (EPS) of Sis. Max Labs has one million common shares outstanding Nole Interiore, Me By Niy nome 8/590.00 ince 15.1.000.000 fer-515 in Nerfeconc The firm has a line oferedits the local bank at the following interest rates Can bomow up to $4,000,000 at an 8 interest rate the rate poes to 10% for amounts above 56,100,000 The Erm's interest stay at its 25 percent The firm plans to return of the forecasted Net income the remaining 30% of the estimated profit will be paid a dividends to come hardholder den you New This was that eat of the $35.000 in Net som $10,5 millist go to Retard karming (85 millowX 700 aw she Declared widende wall br - 5450 milie (515 milliww. Currently common shares sell for $110 and the expected comings growth is 9%. The flotion cods to raise new common equity capital equal of the stare price 1. Estimate the weighted average costs of capital for Max Labormes A) After-tax cost of debt. It; Coquity Cast of new equity 2 Cake the two Marginal cost of capital break points. Show all capital and how much would be raised from Common Equity and Debt at cach point A) Break point when the firm needs to borrow at the higher cost of debt but does not need to see new equity B) Break point when the firm needs to start issuing new equity has exhausted the retained earnings. Notice that at this point the timbs already using the higher cent of debt. 1.Caledote de Weighted average cost of capital at all the best points found ce Question 2 above. Slow the state mom of capital that trigger ench WACC A) Refore the firm as in i brw debt 1) With Right cost of debt but before firm has to lise new equity. With New custofcquity and at the most expensive cost of debt. SECTION 2 Max Laboratories is evaluating three independent projects. Project 1: Dog Treats, Project 2 Dig Food, and Project 3. Dog Toys. Use the firm's WACC calculated above to evaluate the projects Treats Food Toys Cash Flows Initial lavestment 4,000,000 3.800,000 4,400,000 1.200.000 200.000 2.300.000 1.400.000 1,000,000 1.900.000 3 1.500.000 1,200,000 1.000.000 100.000 2,200,000 M0.000 Sid. Deviation of IRR N% 12% 1. Calculate Payluck Pro, NPV, IRR, MIRR for all projects Which projects) should the tim accept? Explain in detail the reasons for your recomendation For example, if you get a positive negative NPV. is that a good or bad influence on your decision to approve/reject the project being evaluated? Also what is the criteria for IRR and MIRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts