Question: pls solve (a) (2 points) At December 31, 2003 and 2002, Gow Corp. had 100,000 shares of comtnon stock and 10,000 shares of 5%,$100 par

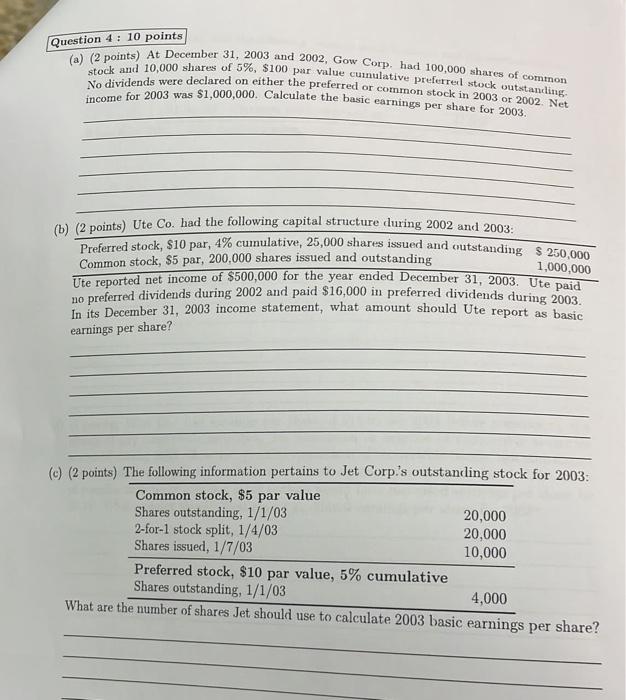

(a) (2 points) At December 31, 2003 and 2002, Gow Corp. had 100,000 shares of comtnon stock and 10,000 shares of 5%,$100 par value cumulative preferreal stock outstancling. No dividends were declared on either the preferred or common stock in 2003 or 2002 . Net income for 2003 was $1,000,000. Calculate the basic earnings per share for 2003. (b) (2 points) Ute Co. had the following capital structure during 2002 and 2003 : Preferred stock, $10 par, 4% cumulative, 25,000 shares issued and cutstanding $250,000 Common stock, $5 par, 200,000 shares issued and outstanding 1,000,000 Ute reported net income of $500,000 for the year ended December 31, 2003. Ute paid no preferred dividends during 2002 and paid $16,000 in preferred dividends during 2003. In its December 31,2003 income statement, what amount should Ute report as basic earnings per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts