Question: Pls solve Consider that a value weighted index is based on 4 companies given below. Total number Promoter's Government of Company share ownership shares 20%

Pls solve

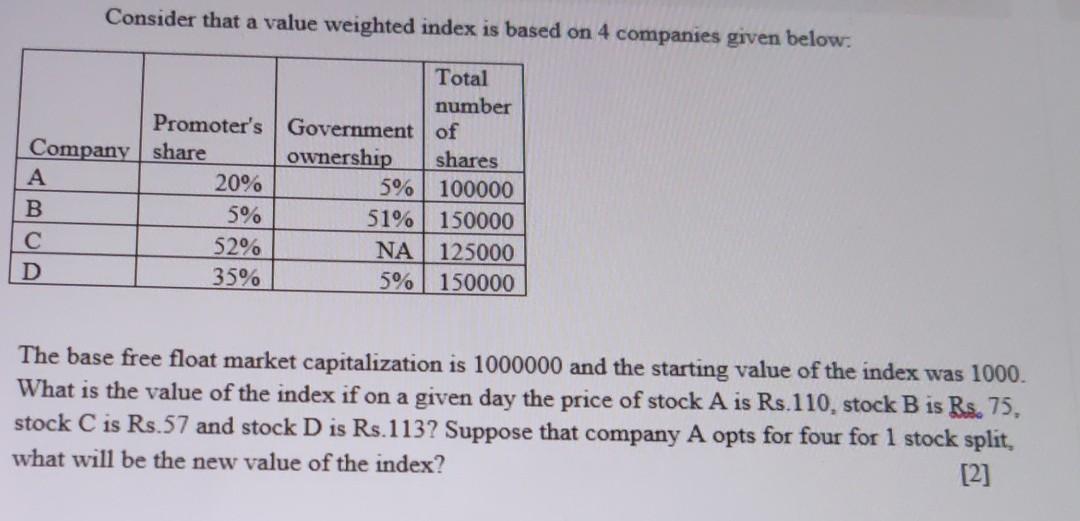

Consider that a value weighted index is based on 4 companies given below. Total number Promoter's Government of Company share ownership shares 20% 5% 100000 B 5% 51% 150000 C 52% NA 125000 D 35% 5% 150000 The base free float market capitalization is 1000000 and the starting value of the index was 1000. What is the value of the index if on a given day the price of stock A is Rs.110, stock B is Rs. 75, stock C is Rs.57 and stock D is Rs.113? Suppose that company A opts for four for 1 stock split, what will be the new value of the index? [2]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts