Question: Pls solve the problem urgently I will give upvote Question Description Capital Structure. Value TodayCF BoomCF BustExp. CF Equity Financing 0.75M 1.35M 0.45M 0.9M Debt

Pls solve the problem urgently I will give upvote

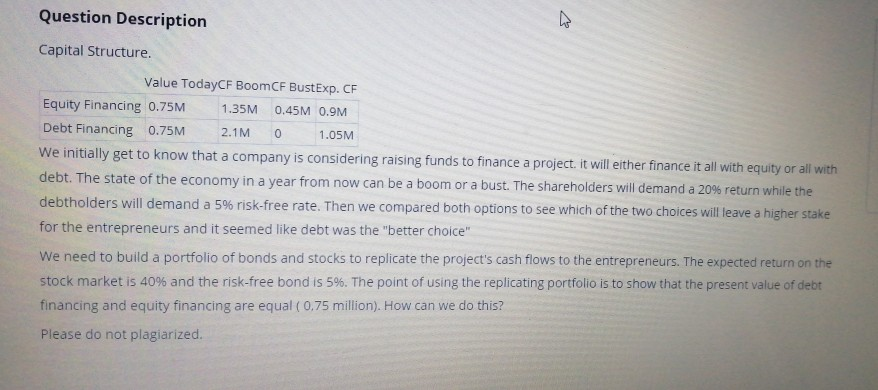

Question Description Capital Structure. Value TodayCF BoomCF BustExp. CF Equity Financing 0.75M 1.35M 0.45M 0.9M Debt Financing 0.75M 2.1M 0 1.05M We initially get to know that a company is considering raising funds to finance a project. it will either finance it all with equity or all with debt. The state of the economy in a year from now can be a boom or a bust. The shareholders will demand a 20% return while the debtholders will demand a 5% risk-free rate. Then we compared both options to see which of the two choices will leave a higher stake for the entrepreneurs and it seemed like debt was the "better choice" We need to build a portfolio of bonds and stocks to replicate the project's cash flows to the entrepreneurs. The expected return on the stock market is 40% and the risk-free bond is 5%. The point of using the replicating portfolio is to show that the present value of debt financing and equity financing are equal (0,75 million). How can we do this? Please do not plagiarized. Question Description Capital Structure. Value TodayCF BoomCF BustExp. CF Equity Financing 0.75M 1.35M 0.45M 0.9M Debt Financing 0.75M 2.1M 0 1.05M We initially get to know that a company is considering raising funds to finance a project. it will either finance it all with equity or all with debt. The state of the economy in a year from now can be a boom or a bust. The shareholders will demand a 20% return while the debtholders will demand a 5% risk-free rate. Then we compared both options to see which of the two choices will leave a higher stake for the entrepreneurs and it seemed like debt was the "better choice" We need to build a portfolio of bonds and stocks to replicate the project's cash flows to the entrepreneurs. The expected return on the stock market is 40% and the risk-free bond is 5%. The point of using the replicating portfolio is to show that the present value of debt financing and equity financing are equal (0,75 million). How can we do this? Please do not plagiarized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts