Question: Pls type it for me to be able to copy paste it in word or excel. Thanks. WILL GIVE YOU VERY GOOD RATING Below is

Pls type it for me to be able to copy paste it in word or excel. Thanks. WILL GIVE YOU VERY GOOD RATING

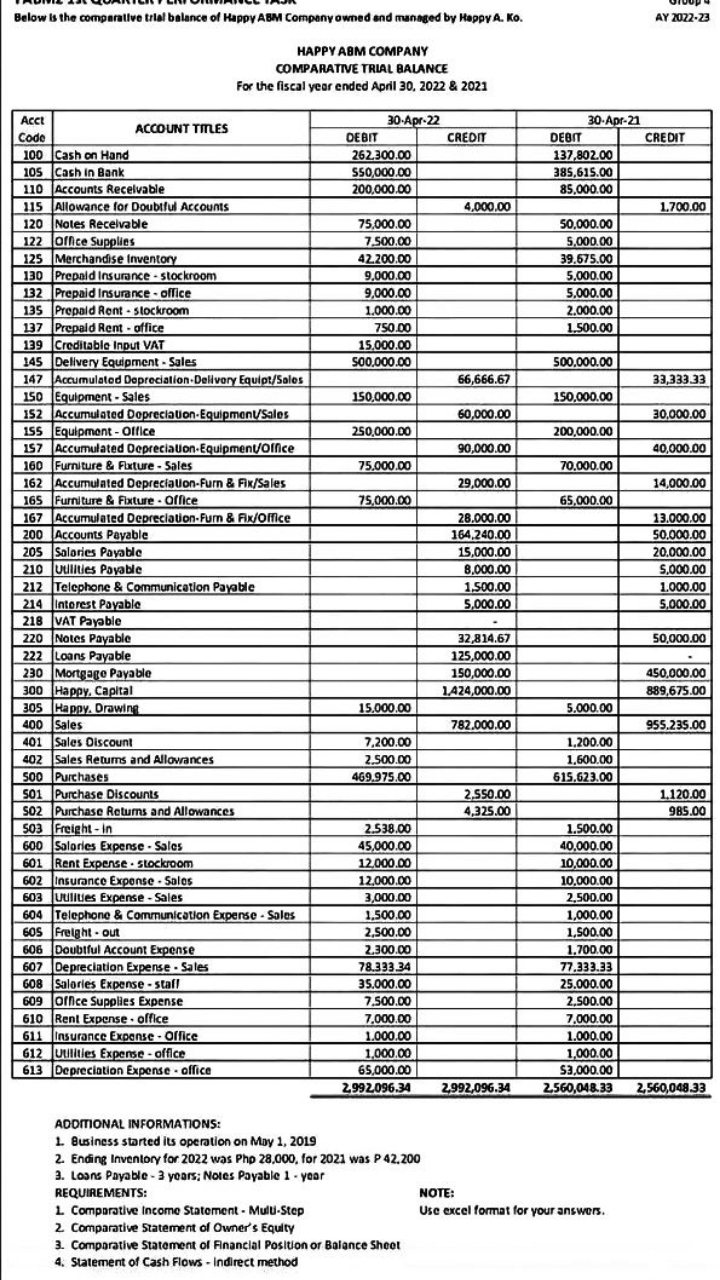

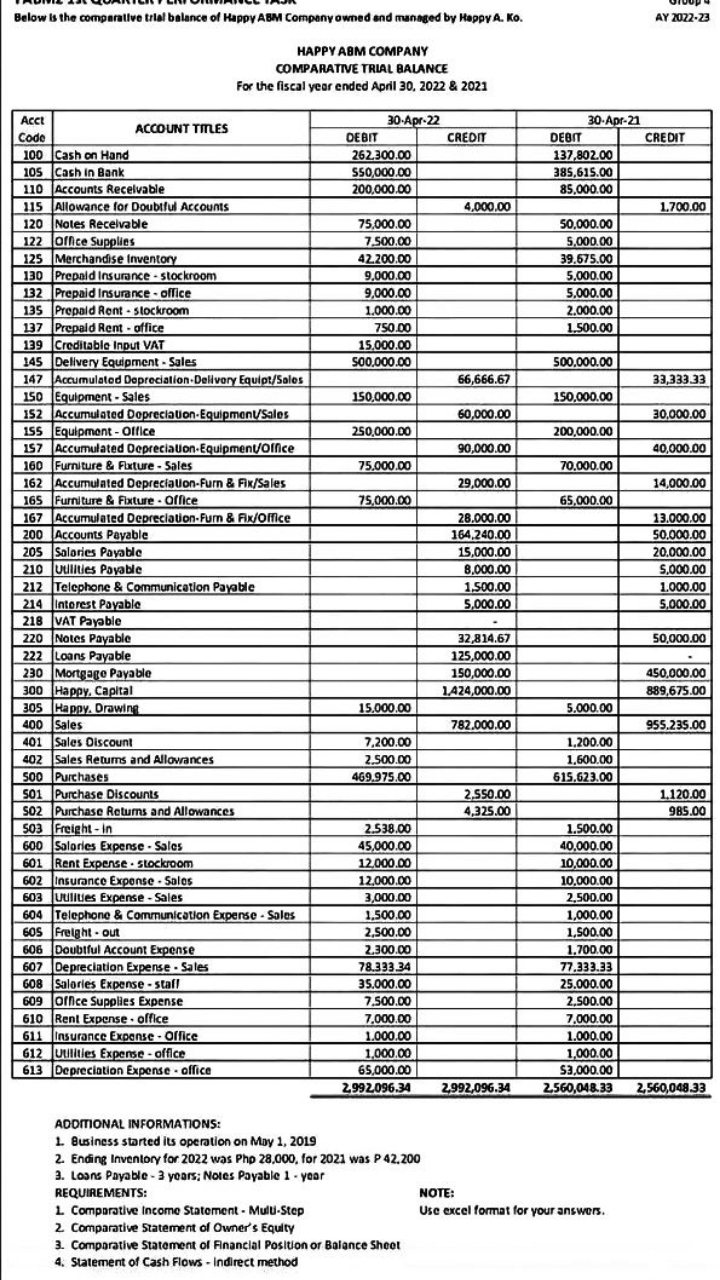

Below is the comparative trial balance of Happy ABM Company owned and managed by Happy A. Ko. AY 2072-23 HAPPY ABM COMPANY COMPARATIVE TRIAL BALANCE For the fiscal year ended April 30, 2022 & 2021 Acc ACCOUNT TITLES 30.Apr-22 30-Apr-21 Code DEBIT CREDIT DEBn CREDIT 100 Cash on Hand 262.300.00 137,802.00 105 Cash in Bank $50,000.00 385,615.00 110 Accounts Receivable 200,000.00 85,000.00 115 Allowance for Doubtful Accounts 4,000,00 1.700,00 120 Nates Receivable 75,000.00 50,000.00 122 Office Supplies 7.500.00 5.000.00 125 Merchandise Inventory 12.200.00 39.675.00 130 Prepaid Insurance . stockroom 9.000.00 5.000.00 132 Prepaid Insurance - office 9.000.00 5,000.00 135 Prepaid Rent - stockroom 1.000.00 2.000.00 137 Prepaid Rent - office 750.00 1.500.00 139 Creditable Input VAT 15.000.00 145 Delivery Equipment - Sales 500.000.00 500.000.00 147 Accumulated Depreciation.Delivery Equipt/Sales 66,666.67 EEEEE'EE 150 Equipment - Sales 150,000.00 150,000.00 152 Accumulated Dopreciation.Equipment/Sales 60,000,00 30,000.00 155 Equipment - Office 250,000.00 200,000.00 157 Accumulated Depreciation.Equipment/Office 10,000.00 40,000.00 160 Furniture & Fixture - Sales 75.000.00 70.000.00 162 Accumulated Depreciation-Furn & Fix/Sales 29,000.00 14,000.00 165 Furniture & Fixture . Office 75,000.00 65,000.00 167 Accumulated Depreciation-Fum & Fix/Office 28,000.00 13.000.00 200 Accounts Payable 164.240.00 50,000.00 205 Salaries Payable 15,000.00 20,000.00 210 Utilties Payable 8,000.00 $,000.00 212 Telephone & Communication Payable 1,500.00 1,000.00 214 Interest Payable 5,000.00 5,000.00 218 VAT Payable 220 Notes Payable 32,814.67 50,000.00 222 Loans Payable 125,000.00 230 Mortgage Payable 150,000.00 450,000.00 300 Happy. Capital 1.424,000.00 889,675.00 30S Happy. Drawing 15.000.00 5.000.00 400 Sales 782.000,00 955.235.00 401 Sales Discount 7.200.00 1.200.00 402 Sales Returns and Allowances 2.500.00 1.600.00 500 Purchases 469.975.00 615.623.00 501 Purchase Discounts 2.550.00 1,120.00 502 Purchase Returns and Allowances 4,325.00 985.00 503 Freight - In 2.538.00 1.500.00 600 Salaries Expense - Sales 45,000.00 10.000.00 601 Rent Expense . stockroom 12.000.00 10,000.00 602 Insurance Expense . Sales 12,000.00 10,000.00 603 Uullues Expense - Sales 3,000.00 2,500.00 604 Telephone & Communication Expense - Sales 1.500.00 1,000.00 Freight - out 2,500.00 1,500.00 606 Doubtful Account Expense 2.300.00 1.700.00 507 Depreciation Expense . Sales 78.333.34 77.333.33 608 Salories Expense - stall 35.000.00 25.000.00 Office Supplies Expense 7.500.00 2.500.00 610 Rent Expense . office 7.000.00 7.000.00 611 Insurance Expense - Office 1.000.00 1.000.00 612 Utilities Expense - office 1,000.00 1,000.00 613 Depreciation Expense - office 65,000.00 $3,000.00 2.992096.34 2992,096.34 2.560,048.33 2,560,048.33 ADDITIONAL INFORMATIONS: 1. Business started its operation on May 1, 2019 2. Ending Inventory for 2022 was Php 28,000, for 2021 was P 42.200 3. Loans Payable - 3 years; Notes Payable 1 - year REQUIREMENTS: NOTE: 1. Comparative Income Statement - Mulu-Step Use excel format for your answers. 2. Comparative Statement of Owner's Equity 3. Comparative Statement of Financial Position or Balance Sheet 4. Statement of Cash Flows - Indirect method