Question: please help me for solve this qustion.I don't know how to solve this question, can you please help me for solve this 2 question. Birch

please help me for solve this qustion.I don't know how to solve this question, can you please help me for solve this 2 question.

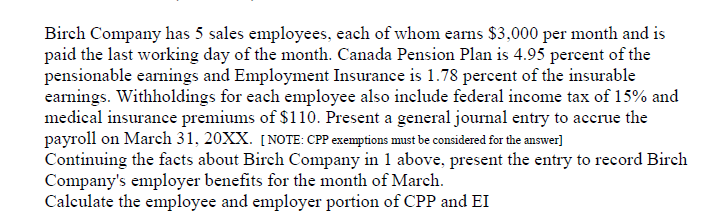

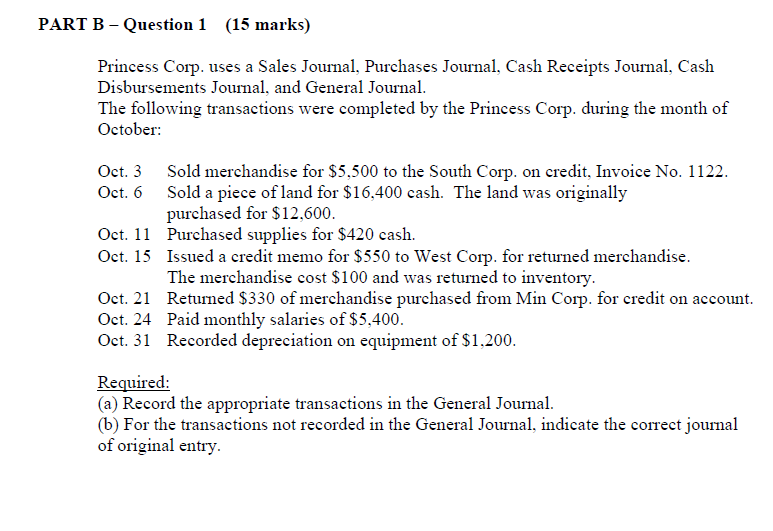

Birch Company has 5 sales employees, each of whom earns $3,000 per month and is paid the last working day of the month. Canada Pension Plan is 4.95 percent of the pensionable earnings and Employment Insurance is 1.78 percent of the insurable earnings. Withholdings for each employee also include federal income tax of 15% and medical insurance premiums of $110. Present a general journal entry to accrue the payroll on March 31, 20XX. [ NOTE: CPP exemptions must be considered for the answer] Continuing the facts about Birch Company in 1 above, present the entry to record Birch Company's employer benefits for the month of March. Calculate the employee and employer portion of CPP and EIPART B - Question 1 (15 marks) Princess Corp. uses a Sales Journal, Purchases Journal, Cash Receipts Journal, Cash Disbursements Journal, and General Journal. The following transactions were completed by the Princess Corp. during the month of October: Oct. 3 Sold merchandise for $5.500 to the South Corp. on credit, Invoice No. 1122. Oct. 6 Sold a piece of land for $16,400 cash. The land was originally purchased for $12,600. Oct. 11 Purchased supplies for $420 cash. Oct. 15 Issued a credit memo for $550 to West Corp. for returned merchandise. The merchandise cost $100 and was returned to inventory. Oct. 21 Returned $330 of merchandise purchased from Min Corp. for credit on account. Oct. 24 Paid monthly salaries of $5,400. Oct. 31 Recorded depreciation on equipment of $1,200. Required: (a) Record the appropriate transactions in the General Journal. (b) For the transactions not recorded in the General Journal, indicate the correct journal of original entry