Question: Pls use the new data to solve the problem Your firm has 9 million shares outstanding, and you are about to issue 4 million new

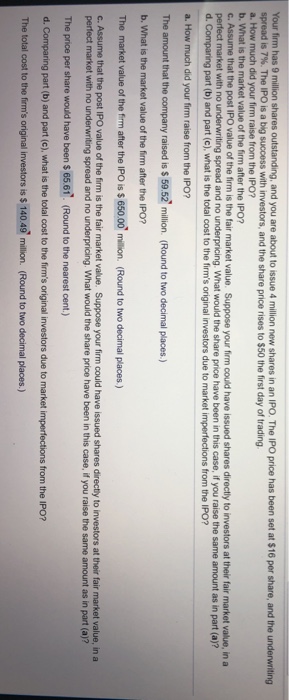

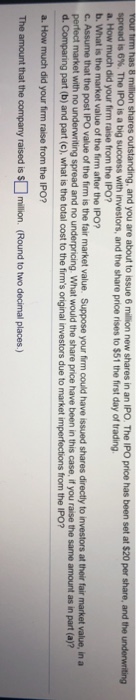

Your firm has 9 million shares outstanding, and you are about to issue 4 million new shares in an IPO. The IPO price has been set at $16 per share, and the underwriting spread is 7% The IPO is a big success with investors, and the share price rises to $50 the first day of trading a. How much did your firm raise from the IPO? b. What is the market value of the firm after the IPO? c. Assume that the post IPO value of the firm is the fair market value. Suppose your firm could have issued shares directly to investors at their fair market value, in a perfect market with no underwriting spread and no underpricing. What would the share price have been in this case, if you raise the same amount as in part (a)? d. part (b) and part (c), what is the total cost to the firm's original investors due to market imperfections from the IPO? a. How much did your firm raise from the IPO? The amount that the company raised is S 59.52 million. (Round to two decimal places,) b. What is the market value of the firm after the IPO? The market value of the firm after the IPO is $ 650.00 milion. (Round to two decimal places.) c. Assume that the post IPO value of the firm is the fair market value. Suppose your firm could have issued shares directy to investors at their fair market value, in a perfect market with no underwriting spread and no underpricing. What would the share price have been in this case, if you raise the same amount as in part (a)? The price per share would have been $ 65.61. (Round to the nearest cent) d. Comparing part (b) and part (c), what is the total cost to the firm's original investors due to market The total cost to the firm's original investors is $ 140.49 million. (Round to two decimal places.) from the IPO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts