Question: plss solve it fast i will give you a like The following prices are for 1-year European options on a stock priced at 30: Strike

plss solve it fast i will give you a like

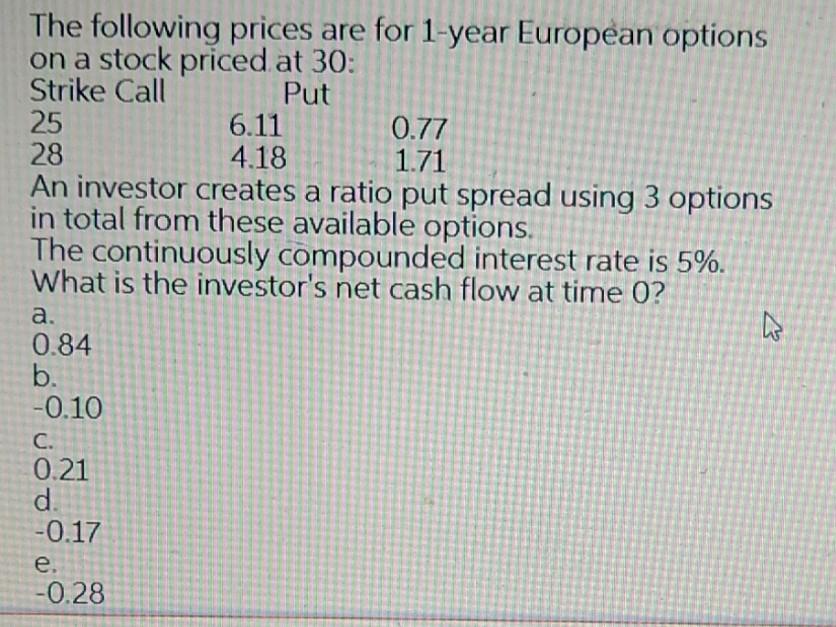

The following prices are for 1-year European options on a stock priced at 30: Strike Call Put 25 6.11 0.77 28 4.18 1.71 An investor creates a ratio put spread using 3 options in total from these available options. The continuously compounded interest rate is 5%. What is the investor's net cash flow at time 0? a 0.84 b. -0.10 C. 0.21 d. -0.17 e. -0.28 a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts