Question: plz answer asap and correctly, will upvote. taking timed test! As a financial analyst at Bank of America Merni Lynch, you are collocting and analyzing

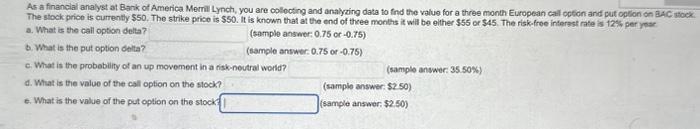

As a financial analyst at Bank of America Merni Lynch, you are collocting and analyzing data to find the value for a three month European call opticn and put oplion on aA 4 stlock. The stock prico is currently $50. The strike prico is $50. It is known that at the end of theee months it will be olther $55 or $45. The risk-free interast rate is 12% per yer a. What is the call option delta? (sample answer: 0.75 or -0.75 ) b. What is the put option delta? (sample answer: 0.75 or -0.75 ) c. What is the probebilify of an up movement in a risk-neutral world? d. What is the value of the call option on the stock? (sample anwwer. 35.50\%) e. What is the value of the put option on the stock: (sample answer: \$2.50) (sample answer: 52.50 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts