Question: plz answer both questions :) Question 3 (1 point) Which of the following about Roth IRAs and 401Ks is true: O Withdrawals during retirement are

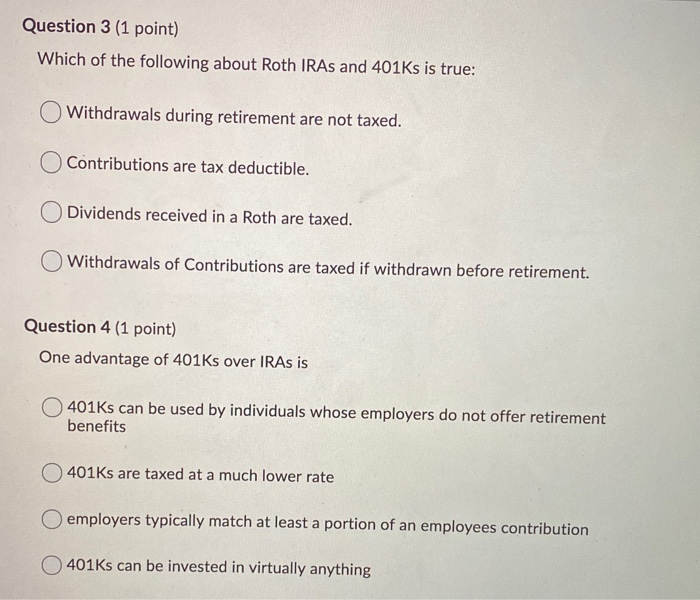

Question 3 (1 point) Which of the following about Roth IRAs and 401Ks is true: O Withdrawals during retirement are not taxed. O Contributions are tax deductible. Dividends received in a Roth are taxed. Withdrawals of Contributions are taxed if withdrawn before retirement. Question 4 (1 point) One advantage of 401Ks over IRAs is 401Ks can be used by individuals whose employers do not offer retirement benefits 401Ks are taxed at a much lower rate O employers typically match at least a portion of an employees contribution 401Ks can be invested in virtually anything

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts