Question: plz answer should be correct . Answer every question separately do not mix it. Give every answer in detail. Especially solve numericals with help of

plz answer should be correct . Answer every question separately do not mix it. Give every answer in detail. Especially solve numericals with help of formula and mention that formula. Do not solve numericals with help of Excel. because in excel you can not put necessary detaill and answer is too short

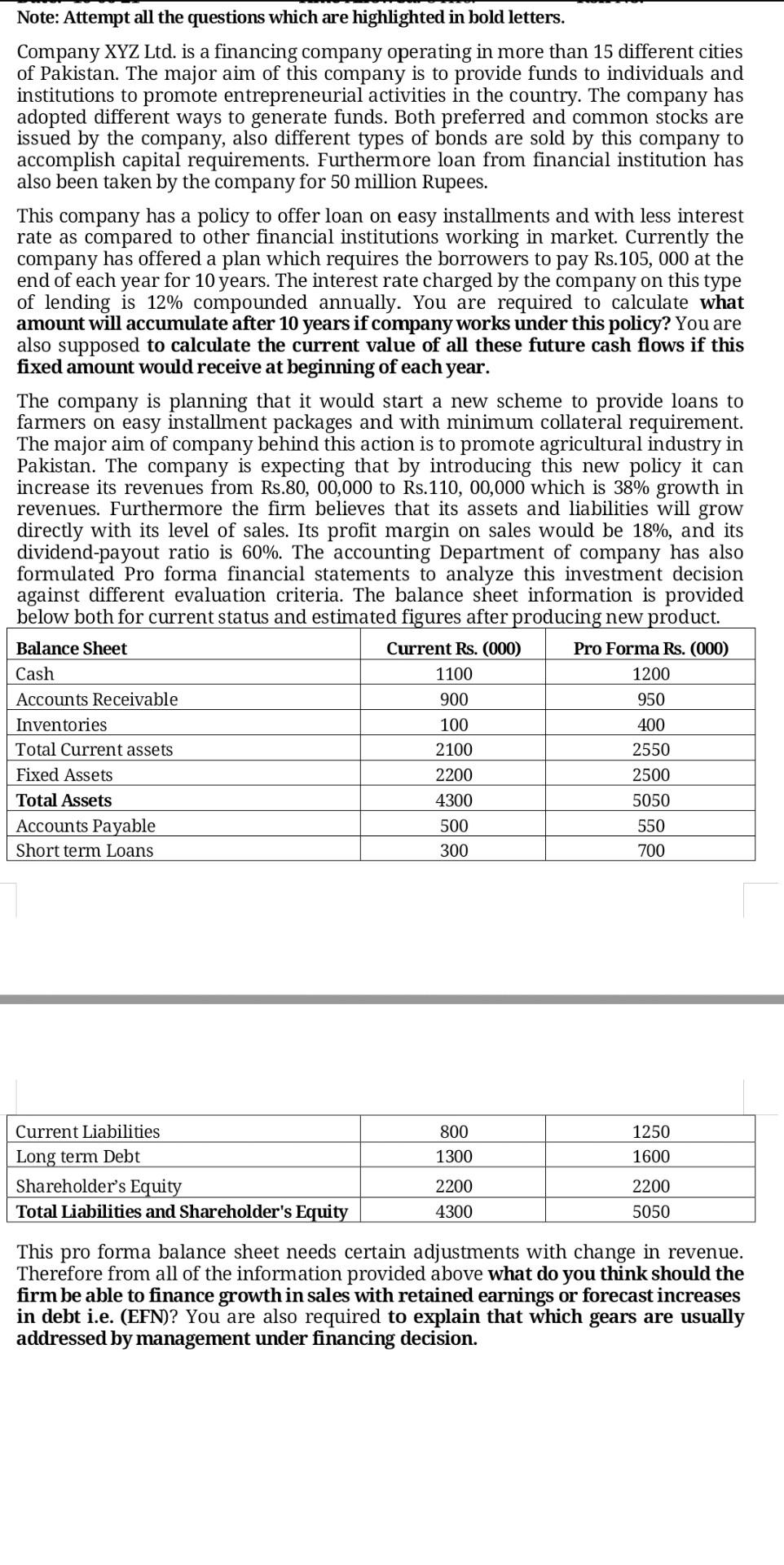

Note: Attempt all the questions which are highlighted in bold letters. Company XYZ Ltd. is a financing company operating in more than 15 different cities of Pakistan. The major aim of this company is to provide funds to individuals and institutions to promote entrepreneurial activities in the country. The company has adopted different ways to generate funds. Both preferred and common stocks are issued by the company, also different types of bonds are sold by this company to accomplish capital requirements. Furthermore loan from financial institution has also been taken by the company for 50 million Rupees. This company has a policy to offer loan on easy installments and with less interest rate as compared to other financial institutions working in market. Currently the company has offered a plan which requires the borrowers to pay Rs.105, 000 at the end of each year for 10 years. The interest rate charged by the company on this type of lending is 12% compounded annually. You are required to calculate what amount will accumulate after 10 years if company works under this policy? You are also supposed to calculate the current value of all these future cash flows if this fixed amount would receive at beginning of each year. The company is planning that it would start a new scheme to provide loans to farmers on easy installment packages and with minimum collateral requirement. The major aim of company behind this action is to promote agricultural industry in Pakistan. The company is expecting that by introducing this new policy it can increase its revenues from Rs.80, 00,000 to Rs.110, 00,000 which is 38% growth in revenues. Furthermore the firm believes that its assets and liabilities will grow directly with its level of sales. Its profit margin on sales would be 18%, and its dividend-payout ratio is 60%. The accounting Department of company has also formulated Pro forma financial statements to analyze this investment decision against different evaluation criteria. The balance sheet information is provided below both for current status and estimated figures after producing new product. Balance Sheet Current Rs. (000) Pro Forma Rs. (000) Cash 1100 1200 Accounts Receivable 900 950 Inventories 100 400 Total Current assets 2100 2550 Fixed Assets 2200 2500 4300 5050 Total Assets Accounts Payable 500 550 Short term Loans 300 700 800 1250 1300 1600 Current Liabilities Long term Debt Shareholder's Equity Total Liabilities and Shareholder's Equity 2200 2200 4300 5050 This pro forma balance sheet needs certain adjustments with change in revenue. Therefore from all of the information provided above what do you think should the firm be able to finance growth in sales with retained earnings or forecast increases in debt i.e. (EFN)? You are also required to explain that which gears are usually addressed by management under financing decision. Note: Attempt all the questions which are highlighted in bold letters. Company XYZ Ltd. is a financing company operating in more than 15 different cities of Pakistan. The major aim of this company is to provide funds to individuals and institutions to promote entrepreneurial activities in the country. The company has adopted different ways to generate funds. Both preferred and common stocks are issued by the company, also different types of bonds are sold by this company to accomplish capital requirements. Furthermore loan from financial institution has also been taken by the company for 50 million Rupees. This company has a policy to offer loan on easy installments and with less interest rate as compared to other financial institutions working in market. Currently the company has offered a plan which requires the borrowers to pay Rs.105, 000 at the end of each year for 10 years. The interest rate charged by the company on this type of lending is 12% compounded annually. You are required to calculate what amount will accumulate after 10 years if company works under this policy? You are also supposed to calculate the current value of all these future cash flows if this fixed amount would receive at beginning of each year. The company is planning that it would start a new scheme to provide loans to farmers on easy installment packages and with minimum collateral requirement. The major aim of company behind this action is to promote agricultural industry in Pakistan. The company is expecting that by introducing this new policy it can increase its revenues from Rs.80, 00,000 to Rs.110, 00,000 which is 38% growth in revenues. Furthermore the firm believes that its assets and liabilities will grow directly with its level of sales. Its profit margin on sales would be 18%, and its dividend-payout ratio is 60%. The accounting Department of company has also formulated Pro forma financial statements to analyze this investment decision against different evaluation criteria. The balance sheet information is provided below both for current status and estimated figures after producing new product. Balance Sheet Current Rs. (000) Pro Forma Rs. (000) Cash 1100 1200 Accounts Receivable 900 950 Inventories 100 400 Total Current assets 2100 2550 Fixed Assets 2200 2500 4300 5050 Total Assets Accounts Payable 500 550 Short term Loans 300 700 800 1250 1300 1600 Current Liabilities Long term Debt Shareholder's Equity Total Liabilities and Shareholder's Equity 2200 2200 4300 5050 This pro forma balance sheet needs certain adjustments with change in revenue. Therefore from all of the information provided above what do you think should the firm be able to finance growth in sales with retained earnings or forecast increases in debt i.e. (EFN)? You are also required to explain that which gears are usually addressed by management under financing decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts