Question: plz answer the questions individually Basic Income Tax Formula Minimizing Tax Audits Gross income less adjustments - adjusted gross income (AGI) Less standard deduction or

plz answer the questions individually

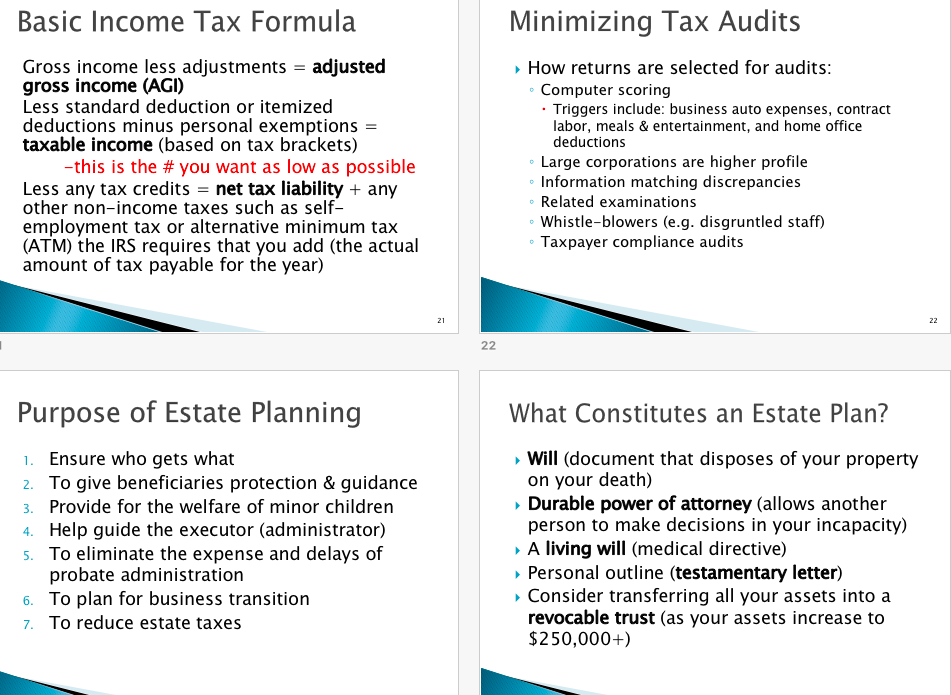

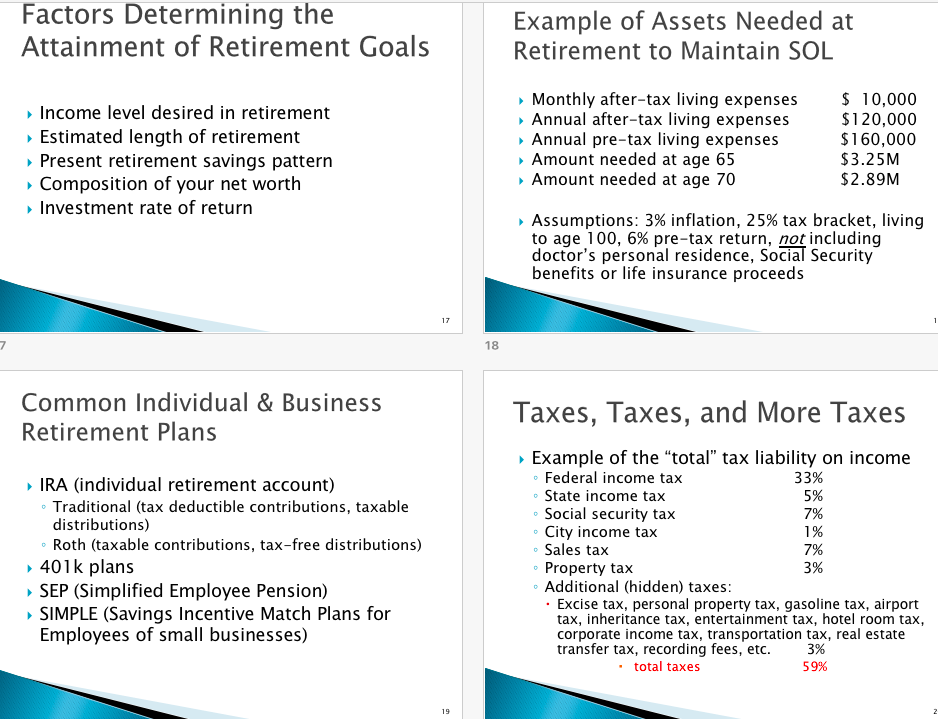

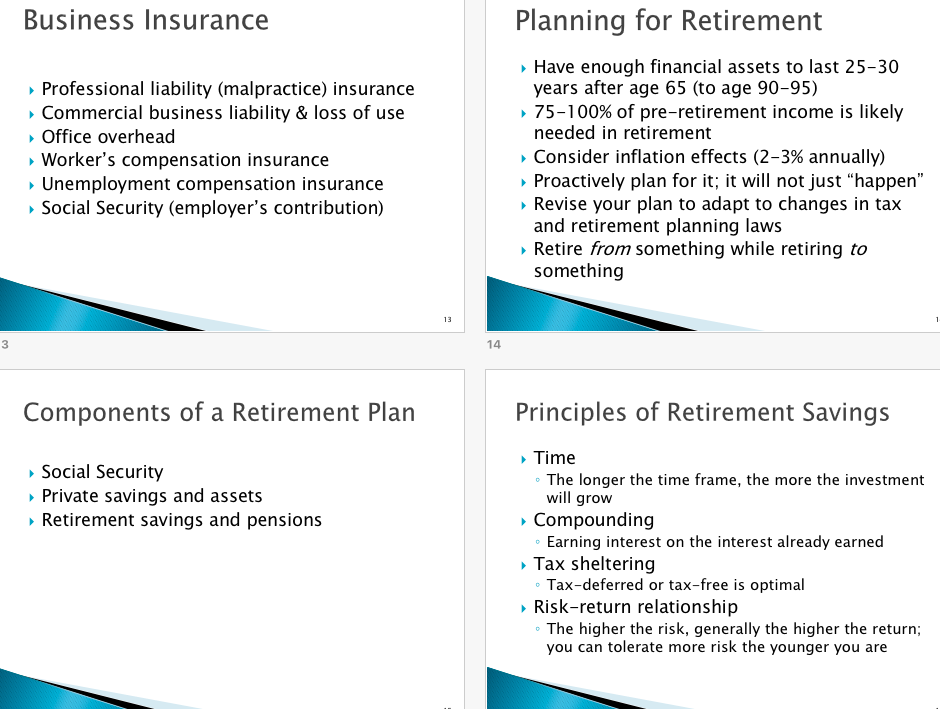

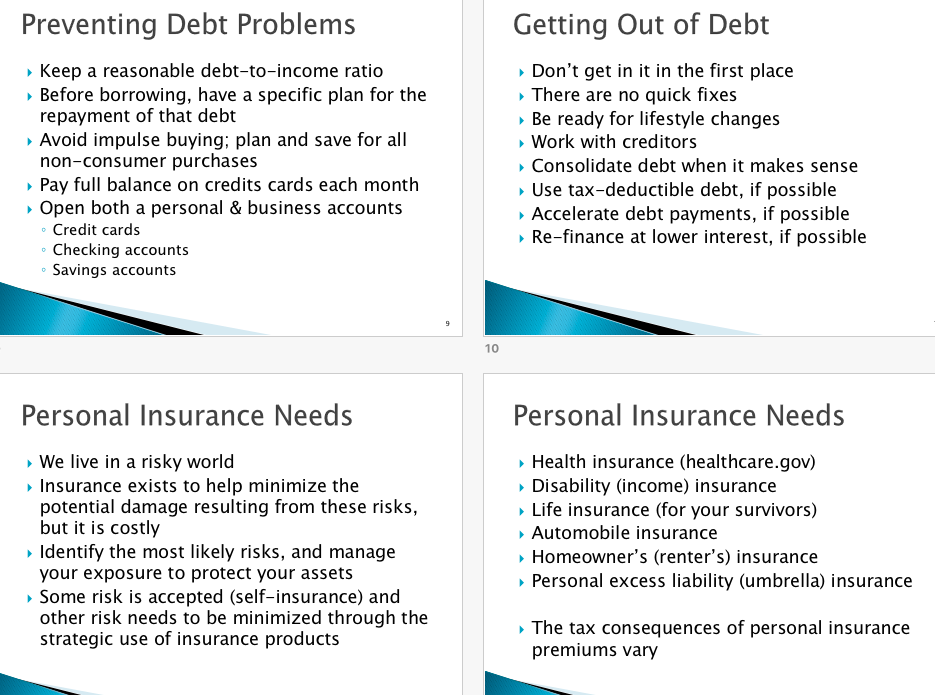

Basic Income Tax Formula Minimizing Tax Audits Gross income less adjustments - adjusted gross income (AGI) Less standard deduction or itemized deductions minus personal exemptions taxable income (based on tax brackets) How returns are selected for audits Computer scoring Triggers include: business auto expenses, contract labor, meals & entertainment, and home office deductions -this is the # you want as low as possible Large corporations are higher profile o Information matching discrepancies Less any tax credits -net tax liability any other non-income taxes such as self- employment tax or alternative minimum tax (ATM) the IRS requires that you add (the actual amount of tax payable for the year) Related examinations Whistle-blowers (e.g. disgruntled staff) Taxpayer compliance audits Purpose of Estate Planning What Constitutes an Estate Plan? >Will (document that disposes of your property 1. Ensure who gets what z. To give beneficiaries protection & guidance 3. Provide for the welfare of minor children 4. Help guide the executor (administrator) s. To eliminate the expense and delays of on your death) Durable power of attorney (allows another person to make decisions in your incapacity) A living will (medical directive) Personal outline (testamentary letter) Consider transferring all your assets into a revocable trust (as your assets increase to $250,000+) probate administration 6. To plan for business transition 7. To reduce estate taxes Basic Income Tax Formula Minimizing Tax Audits Gross income less adjustments - adjusted gross income (AGI) Less standard deduction or itemized deductions minus personal exemptions taxable income (based on tax brackets) How returns are selected for audits Computer scoring Triggers include: business auto expenses, contract labor, meals & entertainment, and home office deductions -this is the # you want as low as possible Large corporations are higher profile o Information matching discrepancies Less any tax credits -net tax liability any other non-income taxes such as self- employment tax or alternative minimum tax (ATM) the IRS requires that you add (the actual amount of tax payable for the year) Related examinations Whistle-blowers (e.g. disgruntled staff) Taxpayer compliance audits Purpose of Estate Planning What Constitutes an Estate Plan? >Will (document that disposes of your property 1. Ensure who gets what z. To give beneficiaries protection & guidance 3. Provide for the welfare of minor children 4. Help guide the executor (administrator) s. To eliminate the expense and delays of on your death) Durable power of attorney (allows another person to make decisions in your incapacity) A living will (medical directive) Personal outline (testamentary letter) Consider transferring all your assets into a revocable trust (as your assets increase to $250,000+) probate administration 6. To plan for business transition 7. To reduce estate taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts