Question: plz answer this asap,i need urgently data is below e) Identify the cash flow patterns for 2020 and 2019. What do these patterns tell us

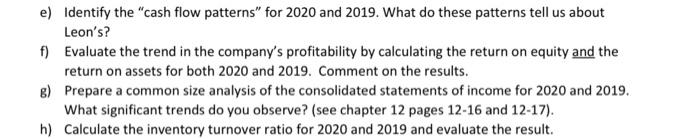

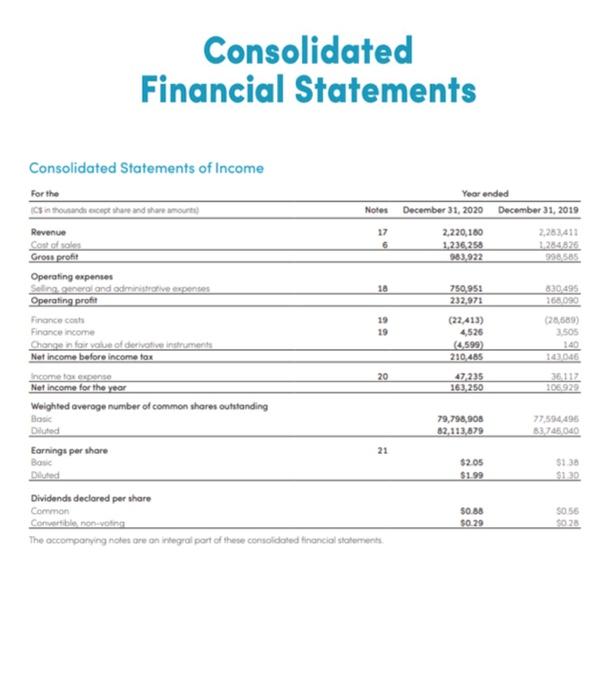

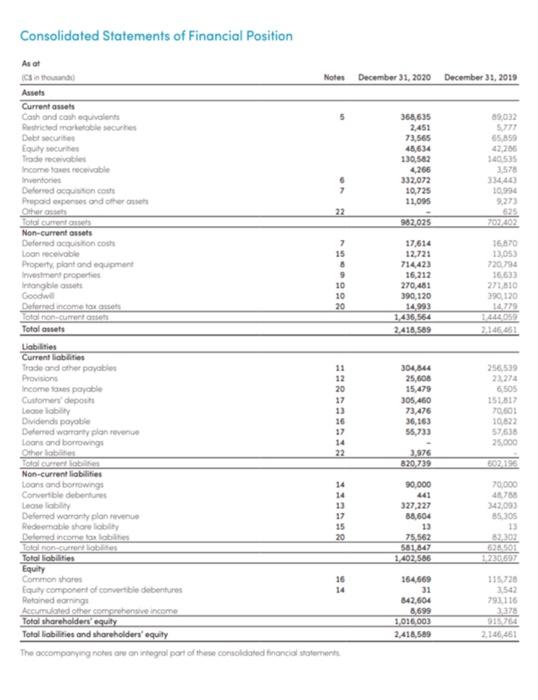

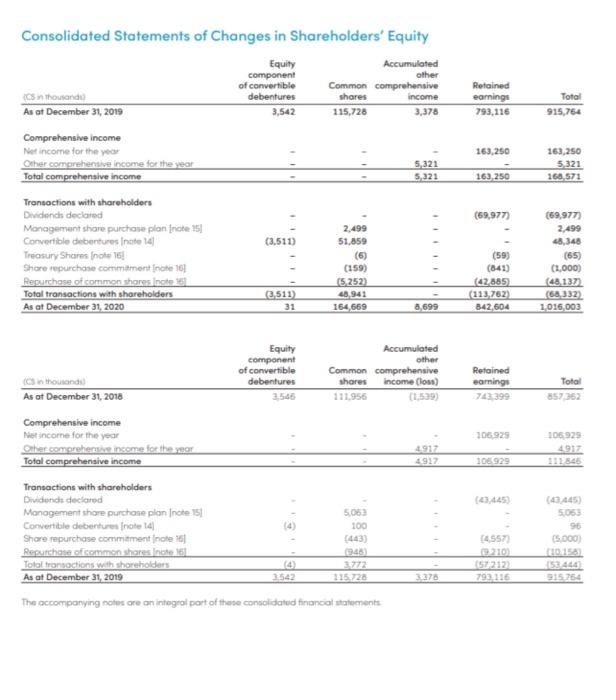

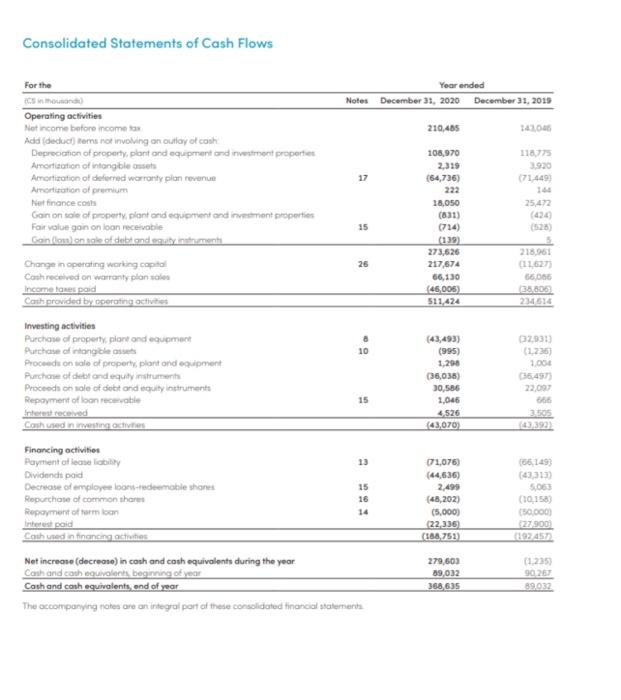

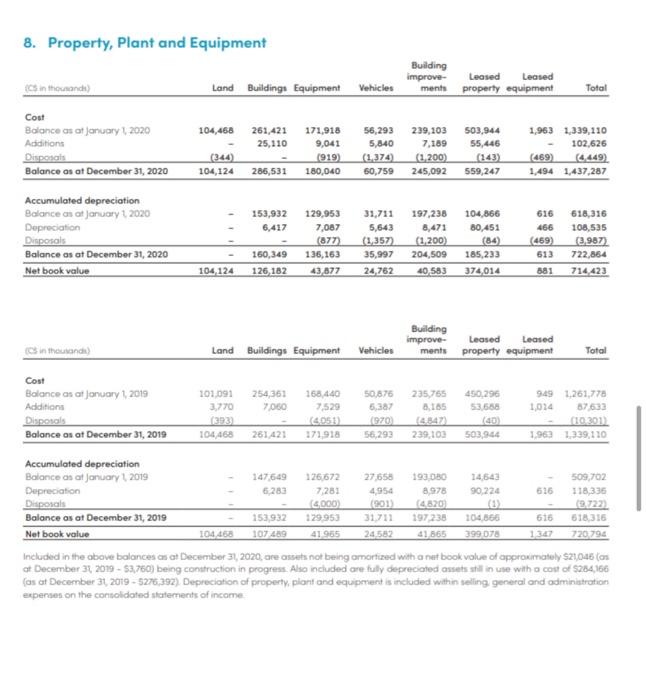

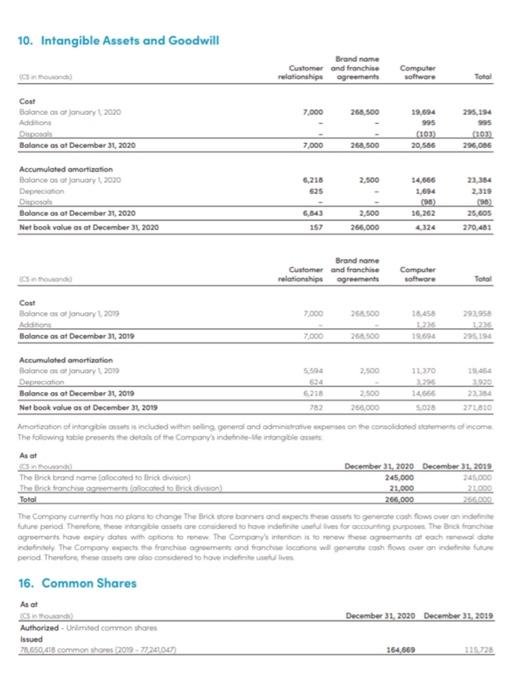

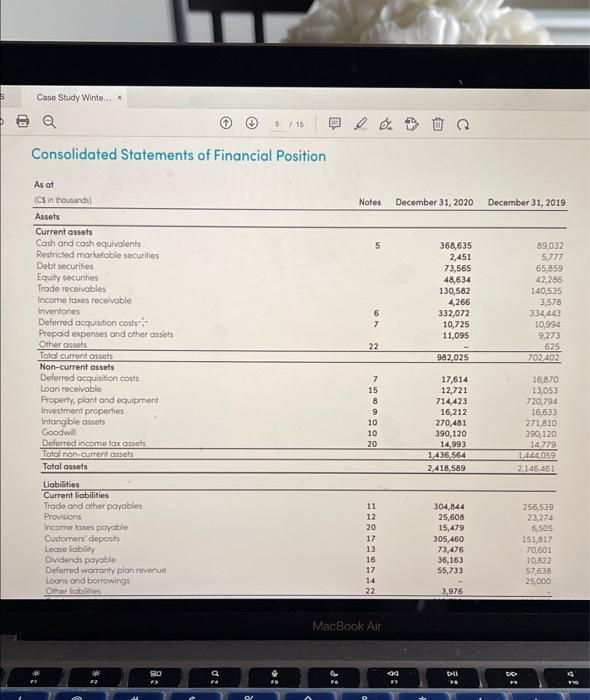

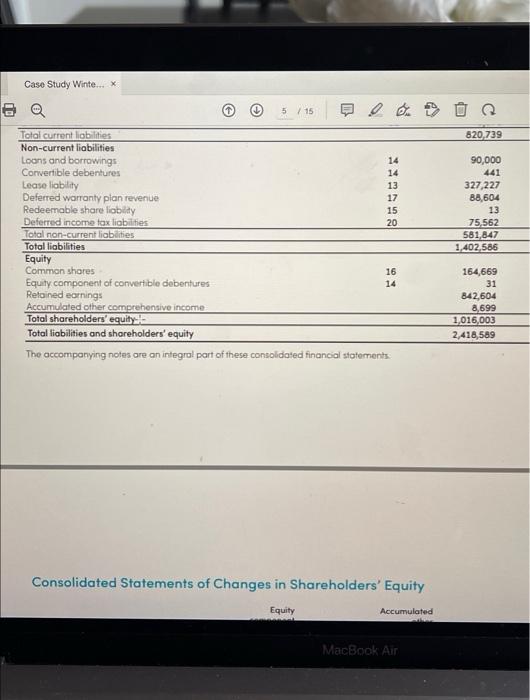

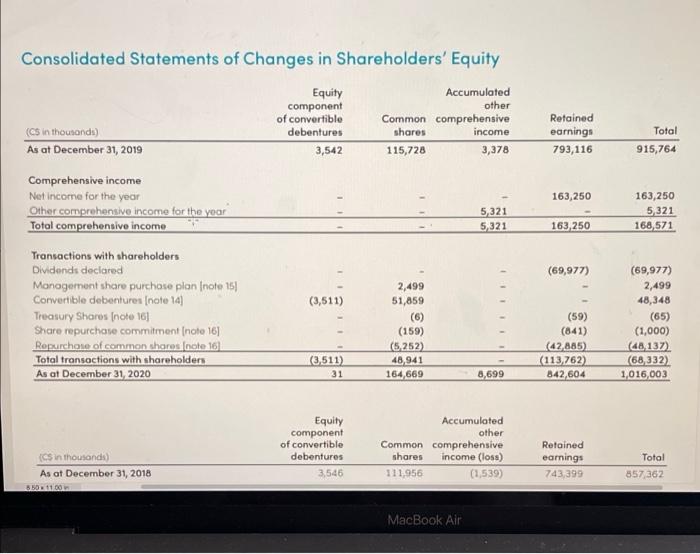

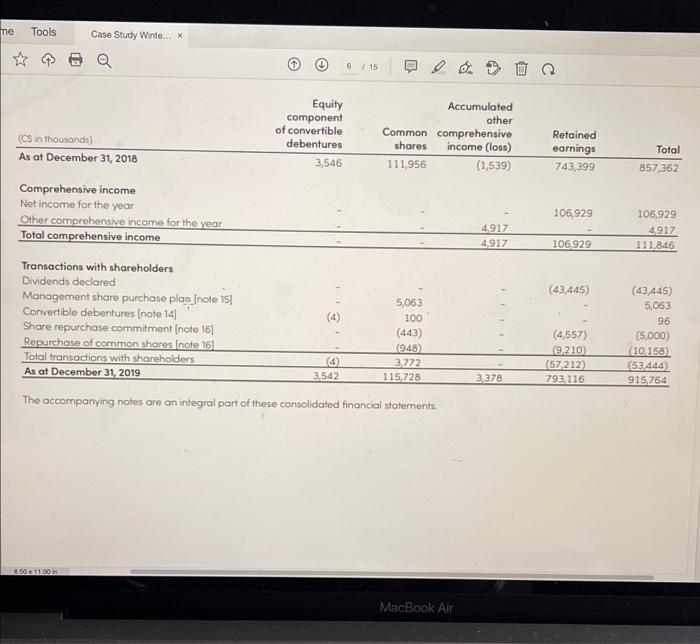

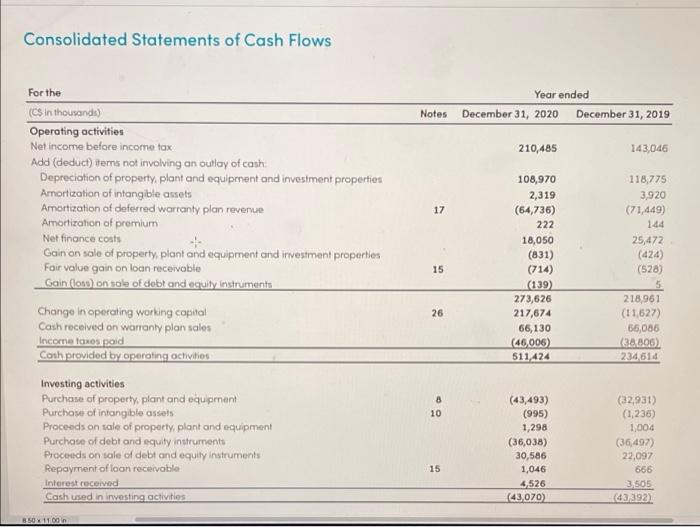

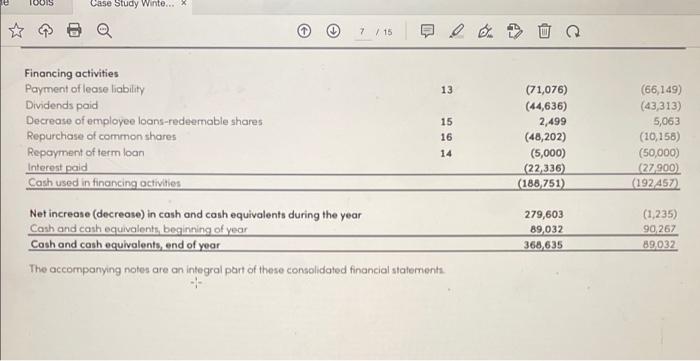

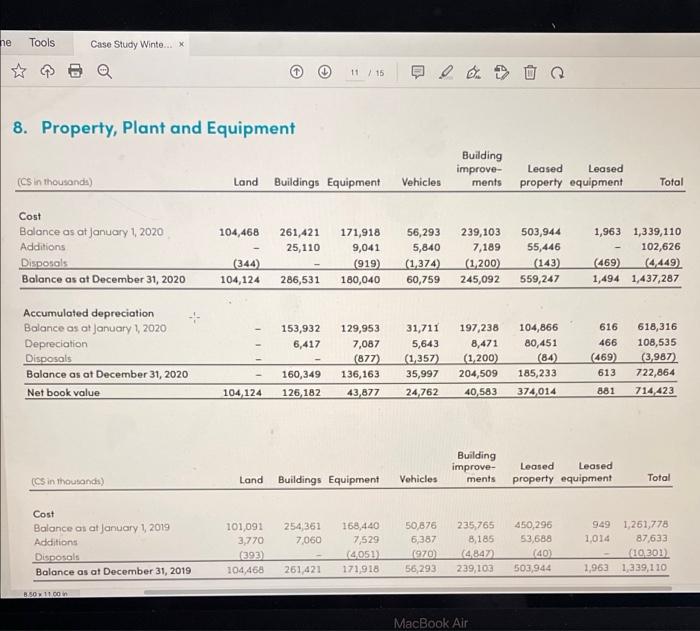

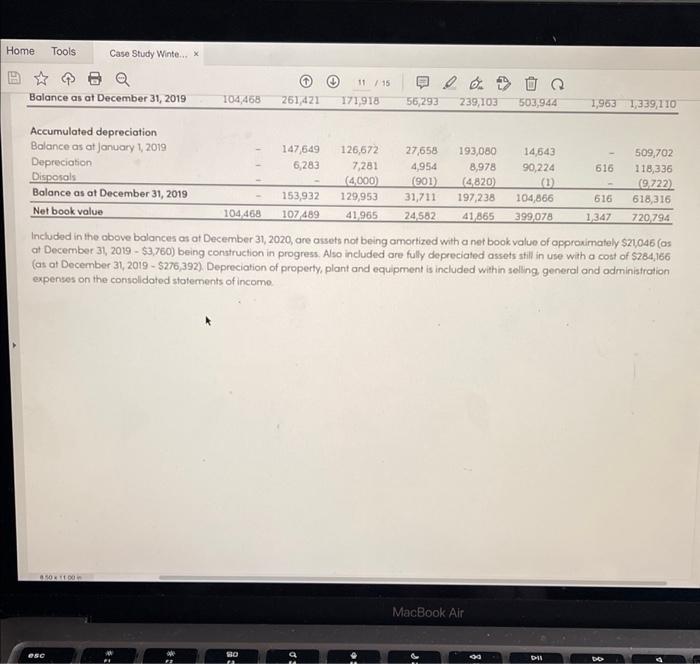

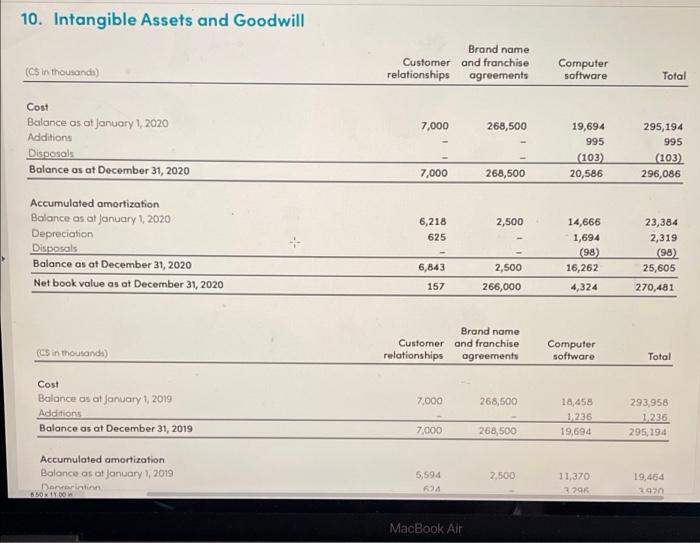

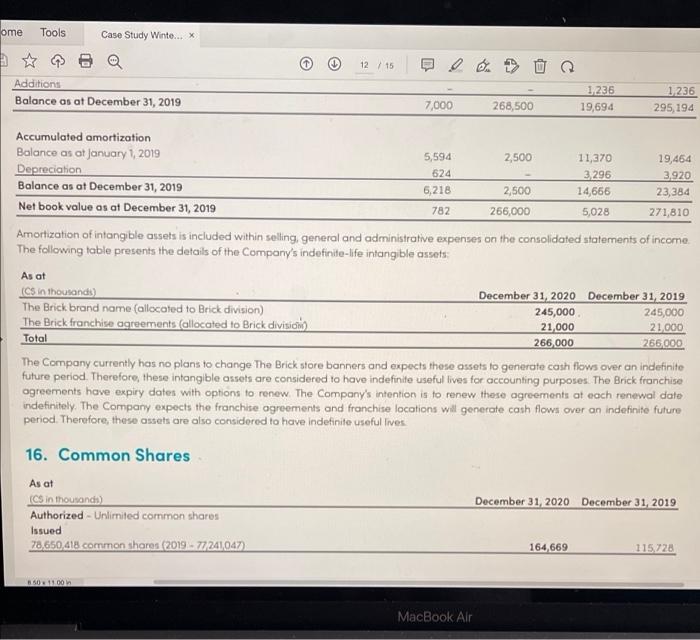

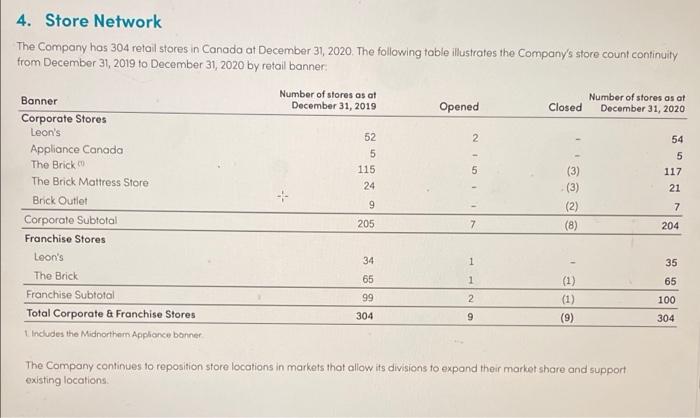

e) Identify the "cash flow patterns" for 2020 and 2019. What do these patterns tell us about Leon's? f) Evaluate the trend in the company's profitability by calculating the return on equity and the return on assets for both 2020 and 2019. Comment on the results. 8) Prepare a common size analysis of the consolidated statements of income for 2020 and 2019. What significant trends do you observe? (see chapter 12 pages 12-16 and 12-17). h) Calculate the inventory turnover ratio for 2020 and 2019 and evaluate the result. Consolidated Financial Statements Year ended December 31, 2020 December 31, 2019 2,220,160 2,262,411 1,236,258 12852 983.922 2985 17 6 10 750951 232,971 830.495 16800 19 19 Consolidated Statements of Income For the is in honadice here and there amorte Notes Revenue Cost of soles Gross profit Operating expenses Selinngangeland Operating profit Finance costs Finance income Changen for value of derivative Instruments Not income before income tox Income tax expense 20 Net Income for the year Weighted average number of common shares outstanding Bos Diluted Earnings per shore Bo Diluted Dividends declared per share Common Comitible, nonoting The accompanying notes are on integral part of these consolidated financial statements, (22.413) 4,526 6599) 210.485 (28.689) 3.505 140 10.00 47235 163,250 11 1062920 79,798,908 82.113.879 77,594,495 33745040 21 $1.30 $2.05 $1.99 50.88 $0 29 5050 9028 Consolidated Statements of Financial Position Notes December 31, 2020 December 31, 2018 As at in the Assets Current assets Cash and conheuvent Restricted more secure Debt Equity secure Teade receive comerciale Inventories Deferred to co Prepod opossond other 368,635 2,452 73,565 48,634 130,582 4.266 332,072 10,725 11,095 89,032 5.777 65.859 42.26 140535 3.578 10.994 22 982.025 025 702402 15 8 5 10 10 20 17,614 12,721 714 423 16,212 270,481 390,120 14993 1.436,564 2.418.589 1670 13,055 720794 16633 271510 390, 120 14.779 DULOS 2.146.663 Toto Non-current assets Deferred to co Loon recevable Property, plontond equipment Investment properties Intongbiet Goodwie Deferred income fosse Totalinoncueron Total costs Liabilities Current liabilities Trade and other pays Provisions Income ses payable Gustomers' depot Leonely Dividendi poole Deferred warranty on revenge Loons and borrowings Otherla Totem Non-current liabilities Loons and borrowings Convertible debentures Leonely Deferred warranty planned Redeemable shore lobi Doloredincome taxi Total con Tofaliabilities Equity Common the Equity component of convertible debentures Retained coming Accumulated other comprove income Total shareholders equity Total liabilities and shareholders' equity The accompanying notes are on tegral part of these comoldated financial ser 11 12 20 17 13 16 17 14 22 304.844 25,608 15,475 305,460 73.476 36,163 55,733 256,539 22274 6.505 151.81 70,001 10,822 57,638 25.000 3.976 820739 302190 14 14 13 90,000 441 327,227 38.604 13 75,562 581847 1.402.586 70,000 4.750 342,093 85.305 13 24302 SIMON 1220097 15 20 16 14 154669 31 842,604 8.699 1016003 2.418.589 115.728 3542 793.116 3275 2,146,451 Consolidated Statements of Changes in Shareholders' Equity Accumulated Equity component of convertible debentures 3,542 other Common comprehensive shores income 115,728 3,370 Retained eaming 793,116 Total 915,764 163,250 5321 5321 163,250 5321 168,571 163,250 Onthoodie As at December 31, 2019 Comprehensive income Net income for the year Other comprehensive income for the year Total comprehensive income Transactions with shareholders Dividendis declared Management shore purchase plan inte 15 Convertible debentures Inate 14 Treasury Shares (note 16 Shore repurchase commitment Inte 16 Repurchase of common shares inte Total transactions with shareholders As at December 31, 2020 (69,977) 2.499 51.859 (3.511) (69,977) 2.499 48,348 (65) (1,000) (48,137) (68332) 1,016,003 - (59) (841) (42.885) (113,762) 842.604 (159) (5.252) 48,941 164,669 6511) 31 6,699 Retained earings 743399 Total 857362 206 929 106.929 4917 111345 108929 Equity Accumulated component other of convertible Common comprehensive in thousands debentures shares income Clou) As at December 31, 2018 2545 111.956 (1.539) Comprehensive income Met income for the year Other comprehensive income for the year 4917 Total comprehensive income 4917 Transactions with shareholders Dividends declared Monagement shore purchase plan Inote 15 5,053 Convertible debent note 14 100 Share repurchase commitment note 16 (443) Repurchase of common shares inte 16 1948 Total transactions with shareholders 3772 As at December 31, 2019 3542 115.728 3378 The accompanying noore on integral part of these consolidated financal streets (3,445) (4557 210) (572122 793.116 5063 96 5000) 2016 915.754 Consolidated Statements of Cash Flows Year ended Notes December 31, 2020 December 31, 2019 210,465 149.046 17 11877 3.930 (71.449) 160 25472 15 For the Os non Operating activities Not income before income tax Add(deduct remaroinvolving an outlay of cash Depreciation of property, plant and equipment and investment properties Amortization of intangible uses Amortization of deferred warranty pion revenue Amortization of premium Net finance cos Gain on sale of property, plant and equipment and investment properties Fair value goin on loon receivable Goin (ona) on sale of debt and gay menti Change in operating working capital Cash received on warranty plans Income ones pod Cath provided by operating activities Investing activities Purchase of property, plontond equipment Purchase of ongible Proceede on sale of property, plant and equipment Purchase of debt and equity instruments Proceed on sale of debtond equity instruments Repayment of loon recevable 108,970 2,319 (64,736) 222 18,050 (831) (714) (839 273,626 217,674 66,130 (46005) 511,424 525 26 218.06 111627) 06.06 28.805 23: 4514 . 10 (43,493) (995) 1,290 (36,038) 30.586 1,046 4526 (43,070 2.931) (2235) 1.004 36.497) 22.097 666 3505 62392 15 Cash used in investing activities Financing activities Payment of loosely 13 Dividend paid Decrease of employee toonudeemableshores 15 Repechase of common shares 16 Repayment of formoon 14 interest paid Cathed in financing achines Net increase (decrease) in cash and cash equivalents during the year Cash and conheuvolants beginning of your Cash and cash equivalents, and of year The accompanying notes are an integral part of these consolidated financial statements 071,076) (44,636) 2,499 (48,202) 05.000) 22336 (188.751) (56.1493 43,313) 506 (10.158) (50,000) 27.900 (192457 279,603 89,032 368 635 (1235) 90.267 39.032 8. Property, Plant and Equipment Building improve- Leased Leased ments property equipment Land Buildings Equipment Vehicles Total 104,468 261,421 25,110 (344) 104,124 171,918 9,041 1919 180,040 56,293 5,840 (1.374 60,759 239,103 7,189 (1 200) 245,092 (cs in the sandu Cost Balance as of January 1 2020 Additions Disposals Balance as at December 31, 2020 Accumulated depreciation Balance as at January 1 2020 Depreciation Disposals Balance as at December 31, 2020 Net book value 503,944 55,446 (143) 559,247 1,963 1,339,110 102,626 (469 449 1.494 1,437,287 285,531 153,932 6,417 129,953 7,087 (877) 136,163 31,711 5,643 (1.357) 35,997 24,762 197,238 8,471 (1.200) 204,509 40583 104,866 80,451 (84) 185,233 374,014 616 466 (469) 613 618,316 108,535 (3.987) 722,884 714 423 160,349 126 182 104,124 43.877 881 Building improve- ments in thousand Land Buildings Equipment Vehicles Leased Leased property equipment Total Cost Balance as at January 1, 2013 101091 254,361 168,440 50.876 235,755 450.296 949 1.261,778 Additions 3.770 7,060 7,529 6,387 3,185 53,658 1,014 87633 Disposals 1393 16053 1920 140 20301 Balance as at December 31, 2019 104468 261421 171918 56,293 239.100 503,944 1.963 1939, 110 Accumulated depreciation Balance as at Jonuary 1 2019 147.649 126,672 27,658 1930BO 14,543 509,702 Depreciation 6,283 7,281 4,954 8.978 90.224 616 118.336 Disposals 6000 203 4.820 (3.722 Balance as at os at December 31, 2019 153,932 129 953 31.711 197.238 104,866 616 618,316 Net book value 104.458 107 489 41 955 24562 41865 399 078 1347 720,794 Included in the above balances as at December 31, 2020, are assets not being amortized with a netbook value of approximately $21,046 (as at December 31, 2019 - 53,760) being construction in progress. Also included are fully depreciated assets still in use with a cost of 284,166 (as at December 31, 2019 - 5276,392) Depreciation of property, plant and equipment is included within selling general and administration experces on the consolidated statements of income. 10. Intangible Assets and Goodwill Sin tamil Brand nome Customer and franchise relationship agreement Computer software To Cout Biance any 2000 7.000 268.500 295,194 19,694 995 0033 20.500 Balance on at December 31, 2020 7.000 003 296,006 268,500 6,216 625 2.000 23,354 2.318 Accumulated amortization Balance sonuary 2030 Deprecio Diap Bolonce os of December , 2020 Net book value os at December 24, 2020 34,666 1,094 (90) 16.262 6.643 25.605 2.500 266.000 270,481 Brand nome Customer and franchise relationship agreements Computer otware Total Cout Bolonce osolonuary 2013 7,000 2610 18.456 12 1969 12 Balance as at December 21, 2018 7.000 26100 Accumulated amortation Biance ay 2010 2.500 11370 Deprecation Balance or at December 31, 2019 5218 2.500 22154 Nat book value os et December 8, 2018 782 250.000 271310 Amortion of inforgbisinded within sling general and administrative person the consolidements come The following for the details of the Componente intong As December 31, 2020 December 31, 2015 The Brick brand name allocated to trick disc) 245.000 245.000 The Brick bronchogemerocomed to brickson 21,000 21099 Total 206.000 GRADE The Company currently has no plans to change the core banners and expects to generate howsoveronde future period. Therefore these fong ble recordered to hovedet for accounting purpos The Branch appertshove pay date with options to me. The Company's Interton is to row these agents at each were de The Company spect the fronchine agreements and franche con il genere cash flower and period. Therefore, the concordared to have deve 16. Common Shares As at December 31, 2020 December 31, 2019 Authorized Urime common shoes Issued 750.common 2002-200 364,669 111 Case Study Winte... 5/15 2 E Consolidated Statements of Financial Position Notes December 31, 2020 December 31, 2019 368,635 2,451 73,565 48,634 130,582 4,266 332,072 10,725 11,095 89,032 5,777 55,859 42,286 140,535 3,578 334443 10994 9,273 625 702402 7 22 982,025 As at (Cs in thousands) Assets Current assets Cash and cash equivalents Restricted marketable securities Debt securities Equity securities Trade receivables Income taxes receivable Inventories Deferred acquisition costs Prepaid expenses and other assets Other ossels Total current assets Non-current assets Deferred acquisition costs Loon receivable Property, plant and equipment Investment properties Intangible assets Goodwill Deferred income tax assets Total non-current assets Total assets Liabilities Current liabilities Trade and other payables Provisions Income taxes poyable Customers' deposits Lease liability Dividends payable Deferred warranty plan revenue toons and borrowing! Other lobilities 7 15 8 9 10 10 20 17,614 12,721 714,423 16,212 270,481 390,120 14,993 1.436 564 2.418,589 16,870 13,053 720,794 16,633 271610 390, 120 14,779 1444059 2.146,461 11 12 20 17 13 16 17 14 22 304,844 25,608 15,479 305,460 73,476 36,163 55,733 256,539 23.274 6505 151817 70,601 10.822 57,638 25.000 3,976 MacBook Air RO :D :8 Dil 16 * Case Study Winte... x 820,739 & Q 5 / 15 Total current liabilities Non-current liabilities Loons and borrowings 14 Convertible debentures 14 Lease liability 13 Deferred warranty plan revenue 17 Redeemable share liabidy 15 Deferred income tax liabilities 20 Total non-current liabdities Total liabilities Equity Common shores 16 Equity component of convertible debentures 14 Retained earnings Accumulated other comprehensive income Total shareholders' equity Total liabilities and shareholders' equity The accompanying notes are an integrol part of these consolidated financial statements 90,000 441 327,227 88,604 13 75,562 581,847 1,402.586 164,669 31 842,604 8,699 1,016,003 2,418,589 Consolidated Statements of Changes in Shareholders' Equity Equity Accumulated MacBook Air Consolidated Statements of Changes in Shareholders' Equity Equity Accumulated component other of convertible Common comprehensive (Cs in thousands) debentures shares income As at December 31, 2019 3,542 115,728 3,378 Retained earnings 793,116 Total 915,764 163,250 Comprehensive income Net Income for the year Other comprehensive income for the year Total comprehensive income 5,321 5321 163,250 5,321 168,571 163 250 (69,977) (3,511) Transactions with shareholders Dividends declared Management share purchase plan note 15) Convertible debentures (note 14) Treasury Shores (note 16 Share repurchase commitment (note 16] Repurchase of common shares (note 16) Total transactions with shareholders As at December 31, 2020 2,499 51,859 (6) (159) (5252) 48,941 164, 669 (59) (841) 42 885) (113,762) 842,604 (69,977) 2,499 48,348 (65) (1,000) (48,137) (68,332) 1,016,003 (3,511) 31 8,699 Equity component of convertible debentures 3,546 Accumulated other Common comprehensive shares income (loss) 111,956 (1,539) Retained earnings 743,399 (cs in thousands) As at December 31, 2018 850*1100 Total 857 362 MacBook Air me Tools Case Study Winte... X 6 / 15 Accumulated other (Cs in thousands As at December 31, 2018 Equity component of convertible debentures 3,546 Common comprehensive shares income (loss) 111,956 (1,539) Retained earnings 743,399 Total 857,362 Comprehensive income Net income for the year Other comprehensive income for the year Total comprehensive income 106,929 4,917 4917 106,929 4917 111.846 206,929 (43,445) Transactions with shareholders Dividends declared Management share purchase plan Inote 15) 5,063 Convertible debentures (note 14 100 Share repurchase commitment (note 16] (443) Repurchase of common shares (note 16] 1948) Total transactions with shareholders (6) 3,772 As at December 31, 2019 3,542 115,728 The accompanying notes are an integral part of these consolidated financial statements. (4.557) (9210) 157 212) 793.116 (43,445) 5,063 96 (5,000) (10150) (53444) 915,764 3,378 8.50x11.00 MacBook Air Consolidated Statements of Cash Flows Year ended Notes December 31, 2020 December 31, 2019 210,485 143,046 17 For the (Cs in thousands) Operating activities Net income before income tax Add (deduct) items not involving an outlay of cash Depreciation of property, plant and equipment and investment properties Amortization of intangible assets Amortization of deferred warranty plan revenue Amortization of premium Net finance costs Gain on sale of property, plant and equipment and investment properties Fair value gain on loan receivable Gain (011) on sale of debt and equity Instruments Change in operating working capital Cash received on warranty plan sales Income taxes paid Canh provided by operating activities 108,970 2,319 (64,736) 222 18,050 (831) (714) (139) 273,626 217,674 66,130 (46,006) 511,424 118,775 3,920 (71,449) 144 25,472 (424) (520) 15 26 218.961 (11,627 56,086 (38806) 234,614 8 10 Investing activities Purchase of property, plant and equipment Purchase of intangible assets Proceeds on sale of property, plant and equipment Purchase of debt and equity instruments Proceeds on sale of debt and equity instruments Repayment of loan receivable Interest received Cash used in investing activities (43,493) (995) 1,298 (36,038) 30,586 1,046 4,526 43,070) (32,931) (1,236) 1,004 (36,497) 22,097 666 3.505 (43,392) 15 3.50% 11 00 10OIS Case Study Winte... 7 / 15 0 end > 13 15 16 14 Financing activities Payment of lease liability Dividends paid Decrease of employee loans-redeemable shares Repurchase of common shares Repayment of term loan Interest paid Cash used in financing activities Net increase (decrease in cash and cosh equivalents during the year Cash and cash equivalents, beginning of year Cosh and cash equivalents, end of year The accompanying notes are an integral part of these consolidated financial statement (71,076) (44,636) 2,499 (48,202) (5,000) (22,336) (188,751) (66,149) (43,313) 5,063 (10,158) (50,000) 27900) (192457 279,603 89,032 368,635 (1,235) 90.267 89032 ne Tools Case Study Winte... X 11/15 8. Property, Plant and Equipment Building improve- ments (Cs in thousands) Land Buildings Equipment Vehicles Leased Leased property equipment Total 104,468 Cost Balance as at January 1, 2020 Additions Disposals Balance as at December 31, 2020 261,421 25,110 171,918 9,041 (919) 180,040 56,293 5,840 (1,374) 60,759 239,103 7,189 (1,200) 245,092 503,944 55,446 (143) 559,247 1,963 1,339,110 102,626 (469) 4,449) 1,494 1,437,287 (344) 104,124 286,531 153,932 6,417 Accumulated depreciation Balance as at January 1, 2020 Depreciation Disposals Balance as at December 31, 2020 Net book value 129,953 7,087 (877) 136,163 43,877 31,711 5,643 (1,357) 35,997 24,762 197,238 8,471 (1,200) 204,509 40,583 104,866 80,451 (84) 185,233 374,014 616 466 (469) 613 618,316 108,535 (3,987) 722,864 714,423 160,349 104, 124 126 182 881 Building improve- ments Leosed Leased property equipment (cs in Thousands) Land Buildings Equipment Vehicles Total Cost Balance as at January 1, 2019 Additions Disposals Balance as at December 31, 2019 254,361 7,060 101,091 3,770 (393) 104,468 168,440 7,529 14051) 171,918 50,876 6,387 (970) 56,293 235,765 8,185 (4847 239,103 450,296 53,688 (40) 503,944 949 1,261,778 1,014 87,633 (10201 1,963 1,339,110 261,421 8.50 1100 MacBook Air Home Tools Case Study Winte... X 11/15 Balance as at December 31, 2019 104,468 261,421 171,918 56,293 239,103 503,944 1,953 1,339,110 Accumulated depreciation Balance as at January 1, 2019 147,649 126,672 27,658 193,080 14,543 509,702 Depreciation 6,283 7,281 4,954 8,978 90,224 616 118,336 Disposals (4000) (901 (4820 (1 0722) Balance as at December 31, 2019 153,932 129,953 31,711 197,238 104,866 616 618,316 Net book value 104,468 107489 41965 24.582 41 865 399078 1,347 720 794 Included in the above balances as at December 31, 2020, are ossets not being amortized with a netbook value of approximately $21046 (os at December 31, 2019 - $3,760) being construction in progress. Also included are fully depreciated assets still in use with a cost of $284,166 {as at December 31, 2019 - 5276,392) Depreciation of property, plant and equipment is included within selling general and administration expenses on the consolidated statements of incomo. BE MacBook Air ese SO DIN 10. Intangible Assets and Goodwill Brand name Customer and franchise relationships agreements (Cs in thousanda) Computer software Total 7,000 268,500 Cost Balance as at January 1, 2020 Additions Disposals Balance os at December 31, 2020 19,694 995 (103) 20,586 295,194 995 (103) 296,086 7,000 268,500 2,500 6,218 625 Accumulated amortization Balance as at January 1, 2020 Depreciation Disposals Balance as of December 31, 2020 Net book value as at December 31, 2020 --- 14,666 1,694 (98) 16,262 23,384 2,319 (98) 25,605 270,481 6,843 157 2,500 266,000 4,324 (cs in thousands) Brand name Customer and franchise relationships agreements Computer software Total 7,000 268,500 Cost Balance as at January 1, 2019 Additions Balance as at December 31, 2019 18,458 1236 19,694 293,958 1.235 295,194 7,000 268,500 Accumulated amortization Balance os at January 1, 2019 Darvarini 6011 5,594 2.500 11,370 2296 19,464 2920 MacBook Air ome Tools Case Study Winte... X 12 15 Additions Balance as at December 31, 2019 7,000 1236 19,694 1,236 295,194 268,500 Accumulated amortization Balance as at January 1, 2019 5,594 2,500 11,370 19,464 Depreciation 624 3,296 3920 Balance as at December 31, 2019 6,218 2,500 14,666 23,384 Net book value os at December 31, 2019 782 266,000 5,028 271,810 Amortization of intangible assets is included within seling, general and administrative expenses on the consolidated statements of income The following table presents the details of the Company's indefinite-life intangible assets: As at (C$ in thousands) December 31, 2020 December 31, 2019 The Brick brand name (allocated to Brick division) 245,000 245,000 The Brick franchise agreements (allocated to Brick divisich 21,000 21.000 Total 266,000 266,000 The Company currently has no plans to change The Brick store banners and expects these assets to generate cash flows over an indefinite future period. Therefore, these intangible assets are considered to have indefinite useful lives for accounting purposes. The Brick franchise agreements have expiry dates with options to renew. The Company's intention is to renew these agreements at each renewal date indefinitely. The Company expects the franchise agreements and franchise locations will generate cash flows over an indefinite future period. Therefore, these assets are also considered to have indefinite useful lives 16. Common Shares As at (Cs in thousands) December 31, 2020 December 31, 2019 Authorized - Unlimited common shares Issued 78,650,418 common shares 2019-77241047) 164,669 115,728 850 1100 MacBook Air Number of stores as at 2 52 5 115 54 5 5 4. Store Network The Company has 304 retail stores in Canada at December 31, 2020. The following table illustrates the Company's store count continuity from December 31, 2019 to December 31, 2020 by retail banner Banner Number of stores as at December 31, 2019 Opened Closed December 31, 2020 Corporate Stores Leon's Appliance Canada The Brick (3) 117 The Brick Mattress Store (3) 21 Brick Outlet (2) Corporate Subtotal 205 (8) 204 Franchise Stores Leon's The Brick (1) Franchise Subtotal 2 (1) Total Corporate & Franchise Stores (9) 304 1 Indudes the Midnorthern Applonce bonner 24 9 7 7 34 1 35 65 1 65 99 100 304 9 The Company continues to reposition store locations in markets that allow its divisions to expand their market share and support existing locations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts