Question: PLZ ANSWER WITH FULL STEPS During 2004, IWMA (I will miss accounting) Company started a construction job with a contract price of $4,500,000. The job

PLZ ANSWER WITH FULL STEPS

PLZ ANSWER WITH FULL STEPS

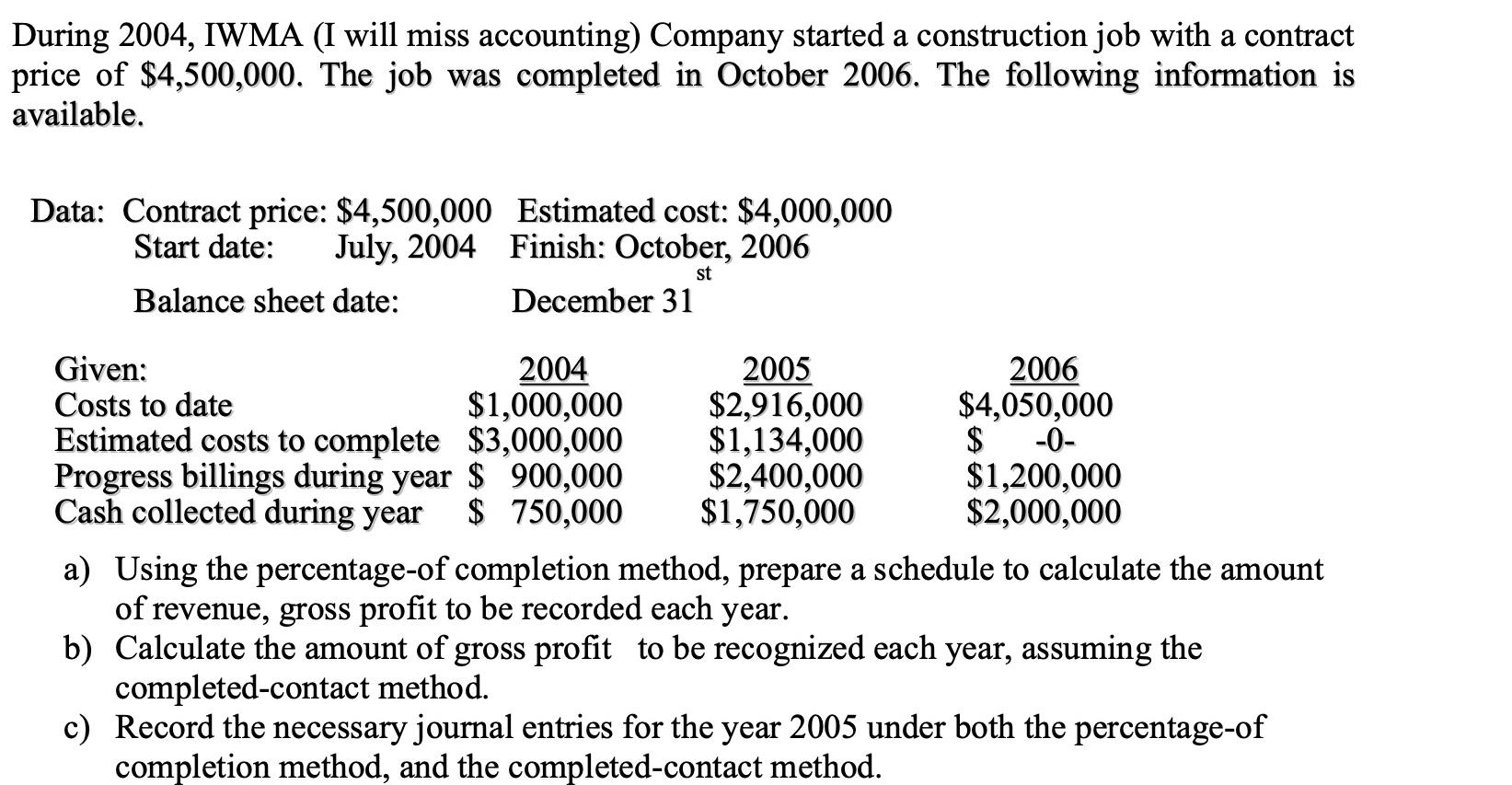

During 2004, IWMA (I will miss accounting) Company started a construction job with a contract price of $4,500,000. The job was completed in October 2006. The following information is available, Data: Contract price: $4,500,000 Estimated cost: $4,000,000 Start date: July, 2004 Finish: October, 2006 Balance sheet date: December 31 st Given: 2004 2005 2006 Costs to date $1,000,000 $2,916,000 $4,050,000 Estimated costs to complete $3,000,000 $1,134,000 $ -O- Progress billings during year $ 900,000 $2,400,000 $1,200,000 Cash collected during year $ 750,000 $1,750,000 $2,000,000 a) Using the percentage-of completion method, prepare a schedule to calculate the amount of revenue, gross profit to be recorded each year. b) Calculate the amount of gross profit to be recognized each year, assuming the completed-contact method. c) Record the necessary journal entries for the year 2005 under both the percentage-of completion method, and the completed-contact method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts