Question: Plz answer with steps! Thx! Mars must decide on the mixture of new colors to introduce to their M&M product lines. The firm's cost of

Plz answer with steps! Thx!

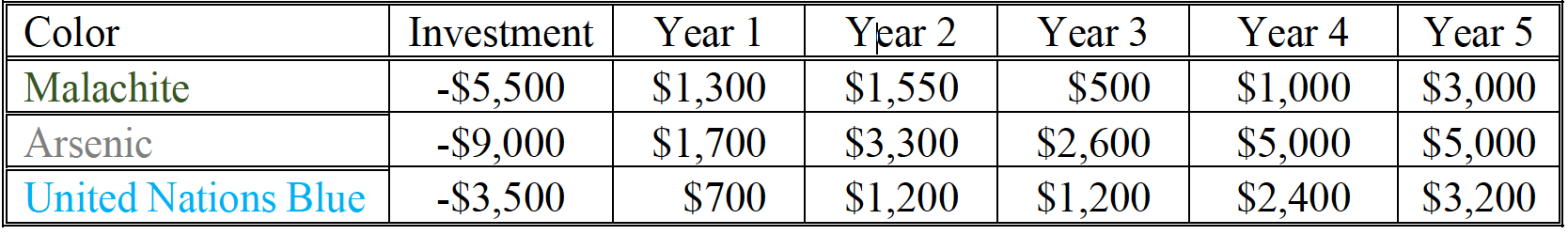

Mars must decide on the mixture of new colors to introduce to their M&M product lines. The firm's cost of capital is 13%. The after-tax cash flows ($s) are listed below along with initial investments. All product lines are independent for parts (a) through (d).

(a) Calculate the payback period for each product. Assume all cash inflows are received at year-end. Products with a payback of fewer than four years are acceptable. Which are acceptable according to this criterion? Do not extrapolate between years.

(b) Calculate the products NPV's. Which are acceptable according to this criterion?

(c) Calculate the products IRR's. Which are acceptable according to this criterion?

(d) Which product(s) should be chosen? Why?

(e) Suppose you are faced with the decision of selecting between the Arsenic and United Nations Blue colors. Suppose your boss prefers to use IRR as her investment criterion. Demonstrate how you can adapt the IRR rule to arrive at the optimal decision.

\begin{tabular}{|l|c|r|r|r|r|r|} \hline Color & Investment & Year 1 & Year 2 & Year 3 & Year 4 & Year 5 \\ \hline Malachite & $5,500 & $1,300 & $1,550 & $500 & $1,000 & $3,000 \\ \hline Arsenic & $9,000 & $1,700 & $3,300 & $2,600 & $5,000 & $5,000 \\ \hline United Nations Blue & $3,500 & $700 & $1,200 & $1,200 & $2,400 & $3,200 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts