Question: plz fast CLASS EXERCISE: PARTNERSHIP - FORMATION AND CHANGES IN OWNERSHIP INTEREST INTERMEDIATE ACCOUNTING II SEMESTER 2, 2021-2022 Anna and Bess share partnership profits and

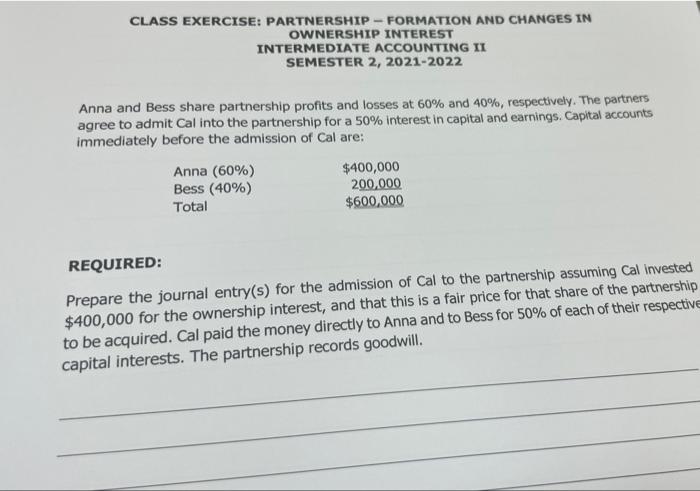

CLASS EXERCISE: PARTNERSHIP - FORMATION AND CHANGES IN OWNERSHIP INTEREST INTERMEDIATE ACCOUNTING II SEMESTER 2, 2021-2022 Anna and Bess share partnership profits and losses at 60% and 40%, respectively. The partners agree to admit Cal into the partnership for a 50% interest in capital and earnings. Capital accounts immediately before the admission of Cal are: Anna (60%) $400,000 Bess (40%) 200.000 Total $600,000 REQUIRED: Prepare the journal entry(s) for the admission of Cal to the partnership assuming Cal invested $400,000 for the ownership interest, and that this is a fair price for that share of the partnership to be acquired. Cal paid the money directly to Anna and to Bess for 50% of each of their respective capital interests. The partnership records goodwill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts