Question: PLZ HELP and dont use AI Case study 1 A couple Jackie, and Walter are looking forward to retirement. Both are 69 years old and

PLZ HELP and dont use AI

Case study 1

A couple Jackie, and Walter are looking forward to retirement. Both are 69 years old and are Australian by birth. The couple never applied for an Australian passport as they have never travelled overseas. They are non-homeownersand own the following assets jointly:

| Assets | Value | Income |

| Savings account | $40,000.00 | $319.00 |

| Term deposit | $115,000.00 | $5,016.00 |

| Car and Contents | $84,000.00 | - |

| Funeral bond | $7,500.00 | - |

| Holiday farm | $410,000.00 | (rental income) $7,800.00 |

REQUIRED:

Question 1

- Assess and calculate the Age Pension entitlement for Walter and Jackie under the means (Income and Assets) Test, including the Pension Supplement and Energy Supplement.

- Under which test would Walter and Jackie receive a Centrelink Age Pension? Explain why?

- Due to Australias ageing population, governments over the past few decades have increasingly realised that they are going to find it more and more difficult to be able to fully support all retirees with an age pension. Discuss how the government has attempted to address this issue through its policies.

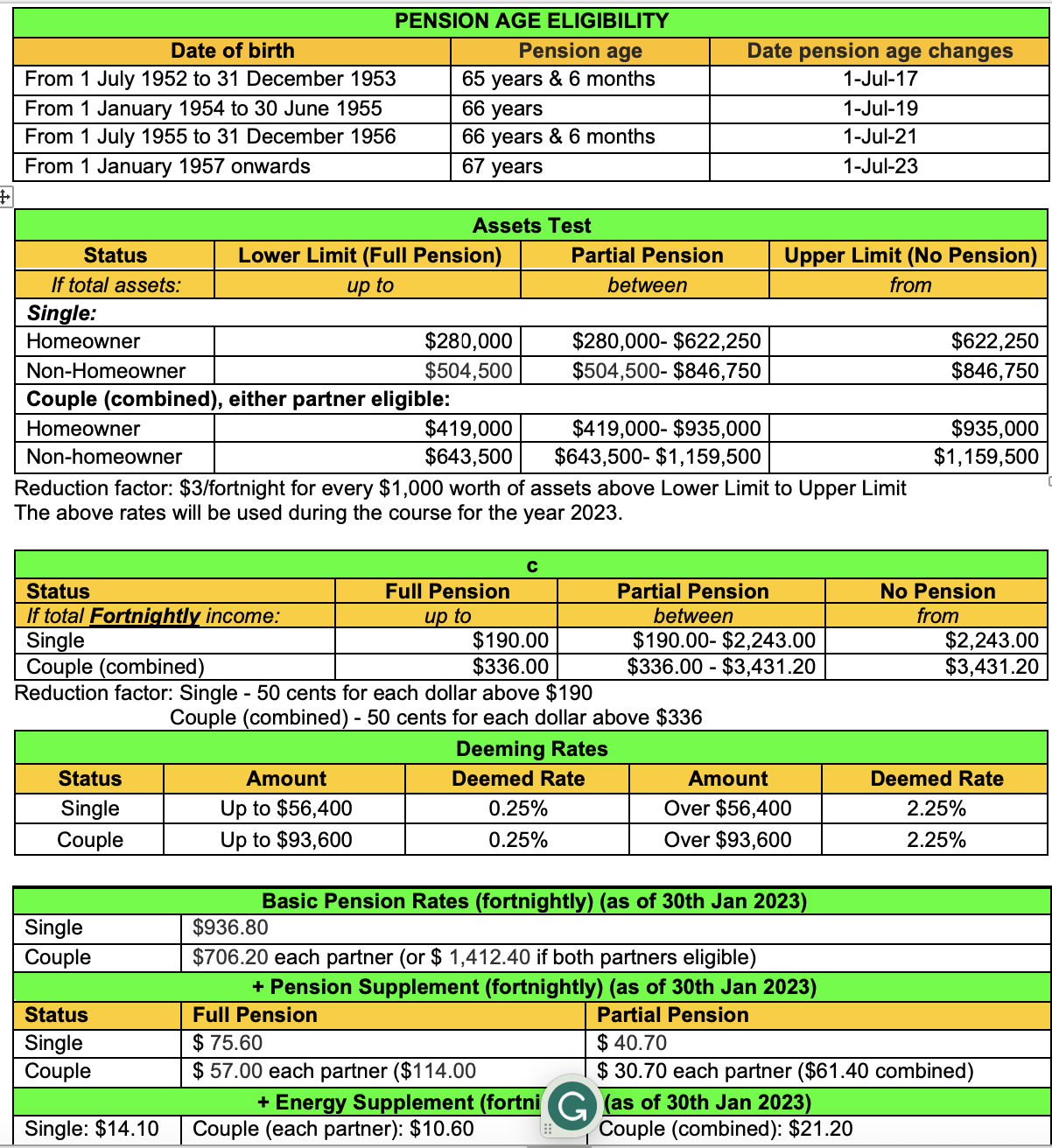

\begin{tabular}{|l|l|c|} \hline \multicolumn{3}{|c|}{ PENSION AGE ELIGIBILITY } \\ \hline \multicolumn{1}{|c|}{ Date of birth } & \multicolumn{1}{|c|}{ Pension age } & Date pension age changes \\ \hline From 1 July 1952 to 31 December 1953 & 65 years \& 6 months & 1-Jul-17 \\ \hline From 1 January 1954 to 30 June 1955 & 66 years & 1 -Jul-19 \\ \hline From 1 July 1955 to 31 December 1956 & 66 years \& 6 months & 1-Jul-21 \\ \hline From 1 January 1957 onwards & 67 years & 1-Jul-23 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|r|} \hline \multicolumn{5}{|c|}{ Assets Test } \\ \hline \multicolumn{1}{|c|}{ Status } & Lower Limit (Full Pension) & Partial Pension & Upper Limit (No Pension) \\ \hline \multicolumn{1}{|c|}{ If total assets: } & up to & between & from \\ \hline Single: & $280,000 & $280,000$622,250 & $622,250 \\ \hline Homeowner & $504,500 & $504,500$846,750 & $846,750 \\ \hline Non-Homeowner & $419,000 & $419,000$935,000 & $935,000 \\ \hline \multicolumn{2}{|c|}{ Couple (combined), either partner eligible: } \\ \hline Homeowner & $643,500 & $643,500$1,159,500 & $1,159,500 \\ \hline Non-homeowner & \multicolumn{2}{|c|}{} \end{tabular} Reduction factor: $3/ fortnight for every $1,000 worth of assets above Lower Limit to Upper Limit The above rates will be used during the course for the year 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts