Question: Plz Help Problem 2-54 (LO 2-2, LO 2-3) (Algo) Convers Corporation (calendar year-end) acquired the following assets during the current tax year: (ignore 179 expense

Plz Help

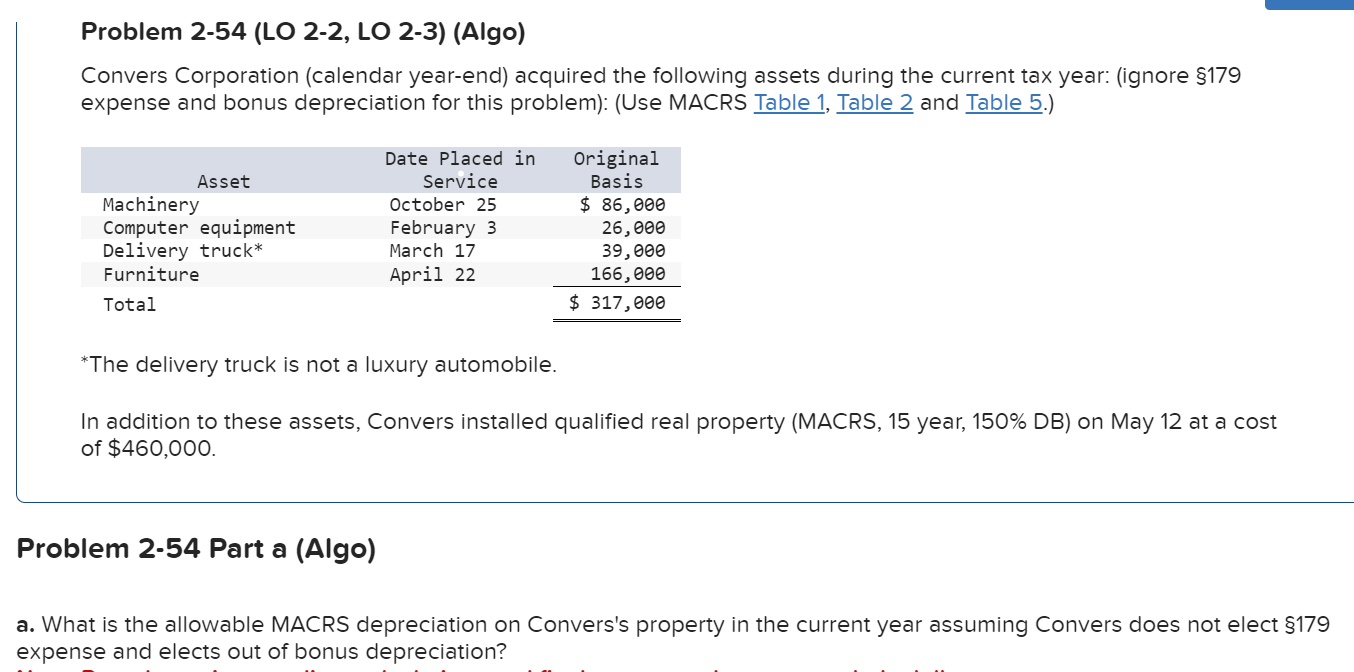

Problem 2-54 (LO 2-2, LO 2-3) (Algo) Convers Corporation (calendar year-end) acquired the following assets during the current tax year: (ignore 179 expense and bonus depreciation for this problem): (Use MACRS Table 1, Table 2 and *The delivery truck is not a luxury automobile. In addition to these assets, Convers installed qualified real property (MACRS, 15 year, 150% DB) on May 12 at a cost of $460,000. roblem 2-54 Part a (Algo) What is the allowable MACRS depreciation on Convers's property in the current year assuming Convers does not elect 179 xpense and elects out of bonus depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts