Question: plz help with all three EXAMPLE 7: Assume a taxpayer has the option to invest in two bonds, Bond A and Bond B. Both bonds

plz help with all three

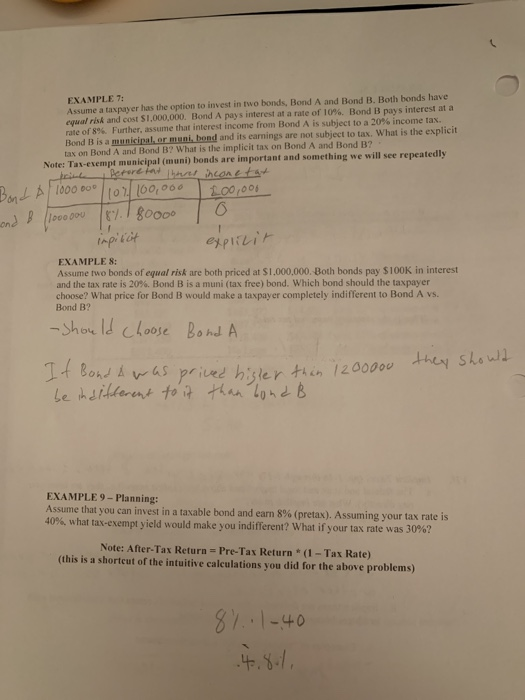

plz help with all three EXAMPLE 7: Assume a taxpayer has the option to invest in two bonds, Bond A and Bond B. Both bonds have ewal risk and cost $1,000,000. Bond A pays interest at a rate of 10%. Bond B pays interest at a rate of 89. Further, assume that interest income from Bond A is subject to a 20% income tax. Bond B is a municipal, or muni, bond and its earnings are not subject to tax. What is the explicit tax on Bond A and Bond B? What is the implicit tax on Bond A and Bond B? Note: Tax-exempt municipal (muni) bonds are important and something we will see repeatedly Betoretat Interes inconetat 101/100,000 200,000 and B (1000000 80000 o Bond A/1000000 impicct explicit EXAMPLES: Assume two bonds of equal risk are both priced at $1,000,000. Both bonds pay $100K in interest and the tax rate is 20%. Bond B is a muni (tax free) bond. Which bond should the taxpayer choose? What price for Bond B would make a taxpayer completely indifferent to Bond A vs. Bond B? -should choose Bond A A It Bond A was prived hister thin 1200000 they should be indifferent to it than bond B EXAMPLE 9 - Planning: Assume that you can invest in a taxable bond and earn 8% (pretax). Assuming your tax rate is 40%, what tax-exempt yield would make you indifferent? What if your tax rate was 30%? Note: After-Tax Return = Pre-Tax Return (1-Tax Rate) (this is a shortcut of the intuitive calculations you did for the above problems) 8%.1-40 .4.8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts