Question: PLZ PLZ HELP ASAP QUESTION 1 QUESTION 2 QUESTION 3 1. You are given the following information on the performance of a fund and on

PLZ PLZ HELP ASAP

QUESTION 1

QUESTION 2

QUESTION 3

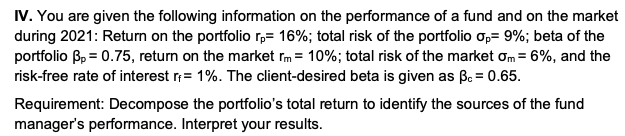

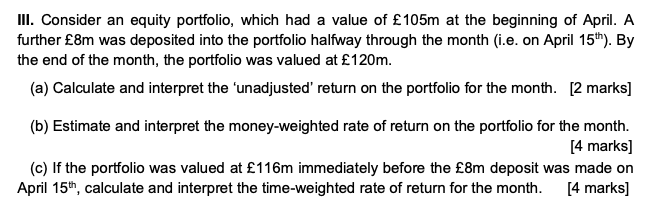

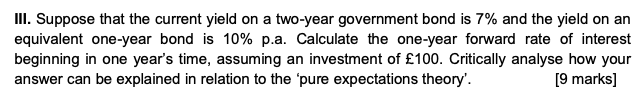

1. You are given the following information on the performance of a fund and on the market during 2021: Return on the portfolio r = 16%; total risk of the portfolio Op=9%; beta of the portfolio Bo = 0.75, return on the market rm = 10%; total risk of the market om = 6%, and the risk-free rate of interest ra= 1%. The client-desired beta is given as Bc = 0.65. Requirement: Decompose the portfolio's total return to identify the sources of the fund manager's performance. Interpret your results. III. Consider an equity portfolio, which had a value of 105m at the beginning of April. A further 8m was deposited into the portfolio halfway through the month (i.e. on April 15th). By the end of the month, the portfolio was valued at 120m. (a) Calculate and interpret the 'unadjusted' return on the portfolio for the month. [2 marks] (b) Estimate and interpret the money-weighted rate of return on the portfolio for the month. [4 marks) (c) If the portfolio was valued at 116m immediately before the 8m deposit was made on April 15th, calculate and interpret the time-weighted rate of return for the month. [4 marks] III. Suppose that the current yield on a two-year government bond is 7% and the yield on an equivalent one-year bond is 10% p.a. Calculate the one-year forward rate of interest beginning in one year's time, assuming an investment of 100. Critically analyse how your answer can be explained in relation to the 'pure expectations theory'. [9 marks] 1. You are given the following information on the performance of a fund and on the market during 2021: Return on the portfolio r = 16%; total risk of the portfolio Op=9%; beta of the portfolio Bo = 0.75, return on the market rm = 10%; total risk of the market om = 6%, and the risk-free rate of interest ra= 1%. The client-desired beta is given as Bc = 0.65. Requirement: Decompose the portfolio's total return to identify the sources of the fund manager's performance. Interpret your results. III. Consider an equity portfolio, which had a value of 105m at the beginning of April. A further 8m was deposited into the portfolio halfway through the month (i.e. on April 15th). By the end of the month, the portfolio was valued at 120m. (a) Calculate and interpret the 'unadjusted' return on the portfolio for the month. [2 marks] (b) Estimate and interpret the money-weighted rate of return on the portfolio for the month. [4 marks) (c) If the portfolio was valued at 116m immediately before the 8m deposit was made on April 15th, calculate and interpret the time-weighted rate of return for the month. [4 marks] III. Suppose that the current yield on a two-year government bond is 7% and the yield on an equivalent one-year bond is 10% p.a. Calculate the one-year forward rate of interest beginning in one year's time, assuming an investment of 100. Critically analyse how your answer can be explained in relation to the 'pure expectations theory'. [9 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts