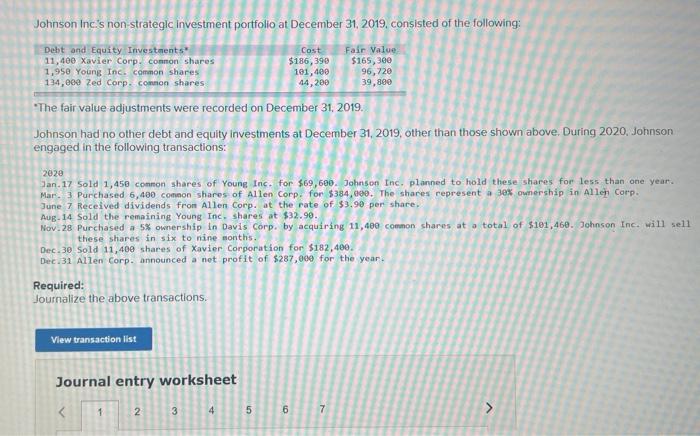

Question: plz solve it as it is and in a table! Johnson Inc's non-strategic investment portfolio at December 31, 2019, consisted of the following: -The fair

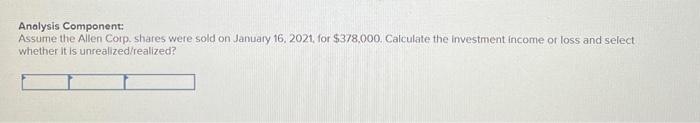

Johnson Inc's non-strategic investment portfolio at December 31, 2019, consisted of the following: -The fair value adjustments were recorded on December 31, 2019. Johnson had no other debt and equity investments at December 31, 2019, other than those shown above. During 2020, Johnson engaged in the following transactions: 2020 June 7 Received dividends fron Allen Corp. at the rate of $3,90 per share. Aug-14 Sold the remaining Young Inc. shares at $32.90. these shares in six to nine months. Dec. 30 sold 11,400 shares of Xavier Corporation for $182,400. Dec. 31 Allen Corp. announced a net profit of $287,909 for the year. Required: Journalize the above transactions. Journal entry worksheet Analysis Component: Assume the Allen Corp. shares were sold on January 16, 2021, for $378,000. Calculate the investment income or loss and select whether it is unrealized/realized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts