Question: plz urgent solve all accurately and completely. The elements that cause problems with the use of the IRR in projects that are mutually exclusive are

plz urgent solve all accurately and completely.

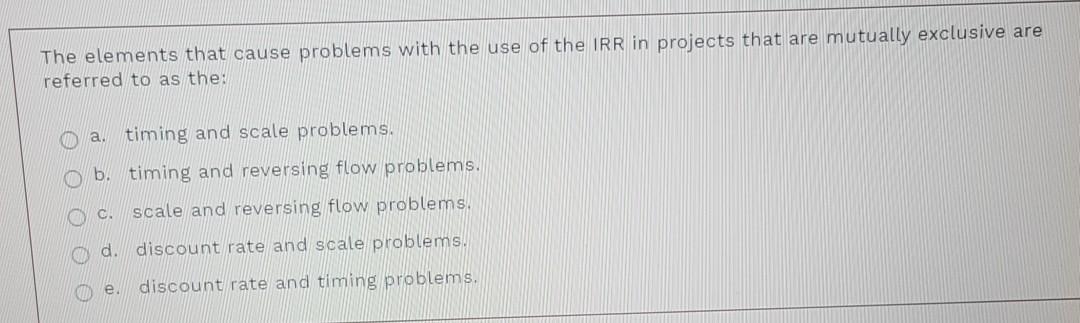

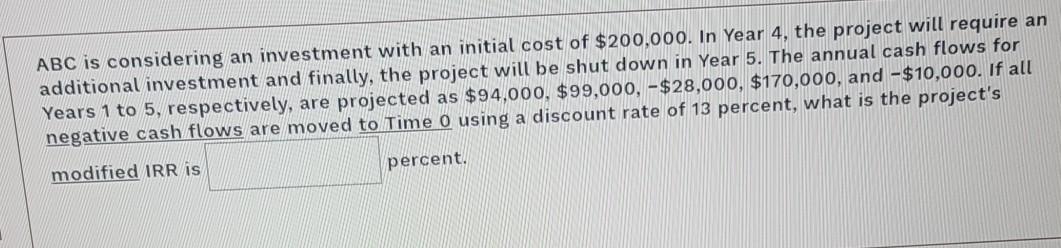

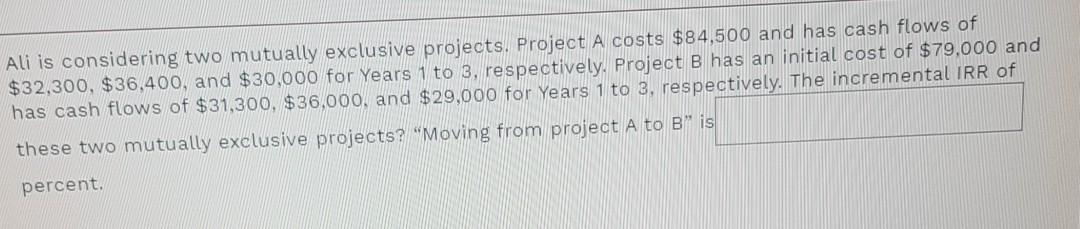

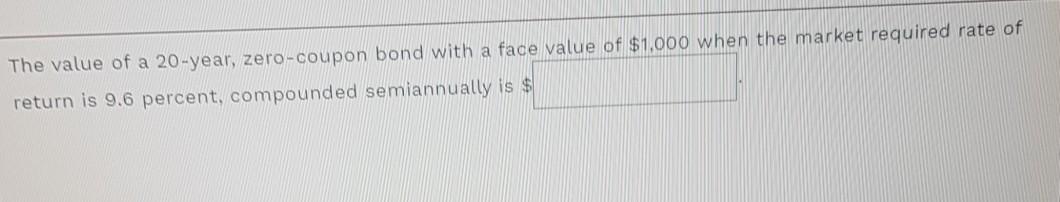

The elements that cause problems with the use of the IRR in projects that are mutually exclusive are referred to as the: a. timing and scale problems. b. timing and reversing flow problems. C. scale and reversing flow problems. d. discount rate and scale problems. discount rate and timing problems, e ABC is considering an investment with an initial cost of $200,000. In Year 4, the project will require an additional investment and finally, the project will be shut down in Year 5. The annual cash flows for Years 1 to 5, respectively, are projected as $94,000, $99,000, -$28,000, $170,000, and -$10,000. If all negative cash flows are moved to Time O using a discount rate of 13 percent, what is the project's percent. modified IRR is Ali is considering two mutually exclusive projects. Project A costs $84,500 and has cash flows of $32,300, $36,400, and $30,000 for Years 1 to 3, respectively. Project B has an initial cost of $79,000 and has cash flows of $31,300, $36,000, and $29,000 for Years 1 to 3, respectively. The incremental IRR of these two mutually exclusive projects? "Moving from project A to B is percent. The value of a 20-year, zero-coupon bond with a face value of $1,000 when the market required rate of return is 9.6 percent, compounded semiannually is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts