Jackson, a self-employed taxpayer, uses his automobile 90% for business and during 2022 drove a total of

Question:

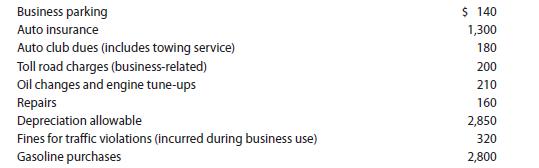

Jackson, a self-employed taxpayer, uses his automobile 90% for business and during 2022 drove a total of 14,000 business miles. Information regarding his car expenses is listed below.

What is Jackson’s deduction in 2022 for the use of his car if he uses:

a. The actual cost method?

b. The automatic mileage method?

c. What records must Jackson maintain?

Transcribed Image Text:

Business parking Auto insurance Auto club dues (includes towing service) Toll road charges (business-related) Oil changes and engine tune-ups Repairs Depreciation allowable Fines for traffic violations (incurred during business use) Gasoline purchases $ 140 1,300 180 200 210 160 2,850 320 2,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

a 7090 140 200 901300 180 210 160 2850 2800 Even though the...View the full answer

Answered By

Hemstone Ouma

"Hi there! My name is Hemstone Ouma and I am a computer scientist with a strong background in hands-on experience skills such as programming, sofware development and testing to name just a few. I have a degree in computer science from Dedan Kimathi University of Technology and a Masters degree from the University of Nairobi in Business Education. I have spent the past 6 years working in the field, gaining a wide range of skills and knowledge. In my current role as a programmer, I have had the opportunity to work on a variety of projects and have developed a strong understanding of several programming languages such as python, java, C++, C# and Javascript.

In addition to my professional experience, I also have a passion for teaching and helping others to learn. I have experience as a tutor, both in a formal setting and on a one-on-one basis, and have a proven track record of helping students to succeed. I believe that with the right guidance and support, anyone can learn and excel in computer science.

I am excited to bring my skills and experience to a new opportunity and am always looking for ways to make an impact and grow as a professional. I am confident that my hands-on experience as a computer scientist and tutor make me a strong candidate for any role and I am excited to see where my career will take me next.

5.00+

8+ Reviews

22+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Jackson uses his automobile 90% for business and during 2016 drove a total of 14,000 business miles. Information regarding his car expenses is listed below. Business parking...

-

Jackson uses his automobile 90% for business and during 2014 drove a total of 14,000 miles. Information regarding his car expenses is listed below. Business parking...

-

Jackson uses his automobile 90% for business and during 2015 drove a total of 14,000 miles. Information regarding his car expenses is listed below. Business...

-

In Exercises 5 and 6, the transition matrix P for a Markov chain with states 0 and 1 is given. Assume that in each case the chain starts in state 0 at time n = 0. Find the probability that the chain...

-

What are preconditions and post conditions? Give an example of each.

-

Reread the two examples at the beginning of the chapter that involved Target and Netflix. Specify the process that BI improves at each firm and a second process that BI could support. Explain the...

-

Describe the privileging and credentialing process.

-

Arrington Company manufactures T- shirts printed with tourist destination logos. The following table shows sales prices and projected sales volume for the summer months: Prepare a sales budget for...

-

Image transcription text Pipeline Speci?cations Design will need to examine: The tradeoff between the cost of compression [a function of minimum driver power) and the cost of pipeline [a function of...

-

Oleander Corporation, a calendar year entity, begins business on March 1, 2022. The corporation incurs startup expenditures of $64,000. If Oleander elects 195 treatment, determine the total amount...

-

In 2022, Muhammad purchased a new computer for $16,000. The computer is used 100% for business. Muhammad did not make a 179 election with respect to the computer. He does not claim any available...

-

Each drawing shows three points along the path of a projectile, one on its way up, one at the top, and one on its way down. The launch point is on the left in each drawing. Which drawing correctly...

-

Pearl owns 60 percent of Gorman Corp.'s stock. During 2015, Pearl contributed property with an adjusted basis of $20,000 and a fair market value of $15,000 to Gorman Corp. in a transaction qualifying...

-

Sell Corporation has 400 shares of its only class of stock outstanding. Mr. Church owns 60 shares, his wife owns 80 shares, his son owns 200 shares, and his sons daughter owns 60 shares. Under the...

-

During the current year, a corporation distributed property with an adjusted basis of $100,000 and a fair market value of $140,000 to its shareholders. Its earnings and profits for the year were...

-

James owns 100 shares of Price Company which are Section 306 stock. He also owns 300 shares of its common stock. He wants to dispose of these shares in 2019 and is considering several options....

-

Larry owns 90 of the 100 outstanding shares of EDP Corporation. Larry acquired the 90 shares in 2008 for $15,000. He also owns 70 of the 100 outstanding shares of EDT Corporation. Larry acquired the...

-

Briefly describe how to solve for the interest rate or the time period in annuity problems.

-

In a nonmagnetic medium, E = 50 cos (10 9 t 8x) a y + 40 sin (10 9 t 8x) a z V/m find the dielectric constant r and the corresponding H.

-

Juan owns a business that acquires exotic automobiles that are high-tech, state-of-the-art vehicles with unique design features or equipment. The exotic automobiles are not licensed, nor are they set...

-

Juan owns a business that acquires exotic automobiles that are high-tech, state-of-the-art vehicles with unique design features or equipment. The exotic automobiles are not licensed, nor are they set...

-

Juan owns a business that acquires exotic automobiles that are high-tech, state-of-the-art vehicles with unique design features or equipment. The exotic automobiles are not licensed, nor are they set...

-

A car is driving toward you with a speed of 86 km/hr. The roof racks on the car emit a whistling sound, which you hear as a 514 Hz tone. If you are stationary, what will the frequency of this tone be...

-

List the transformations, in words, of f(x) for each of the following functions in the order you would do them in. a) g(x) = -2f(x+2)] b) g(x)=4f(x-3)-2

-

Assume in analyzing alternative proposals that Proposal F has a useful life of six years and Proposal J has a useful life of nine years. What is one widely used method that makes the proposals...

Study smarter with the SolutionInn App