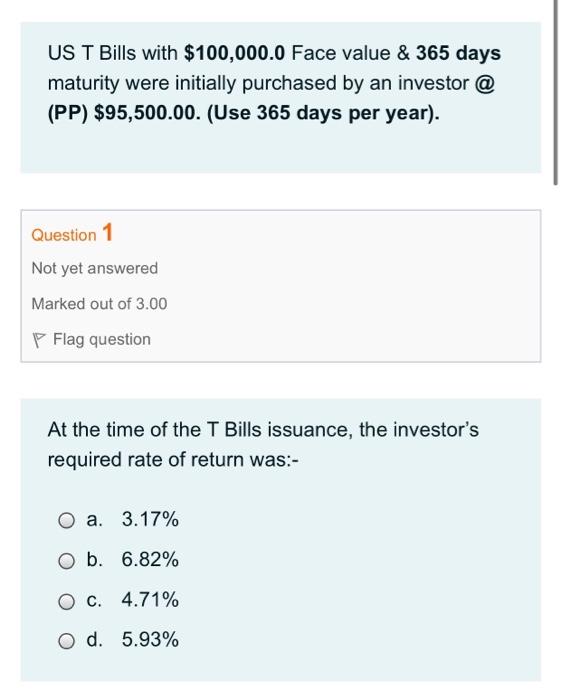

Question: plzzzz answer US T Bills with $100,000.0 Face value & 365 days maturity were initially purchased by an investor @ (PP) $95,500.00. (Use 365 days

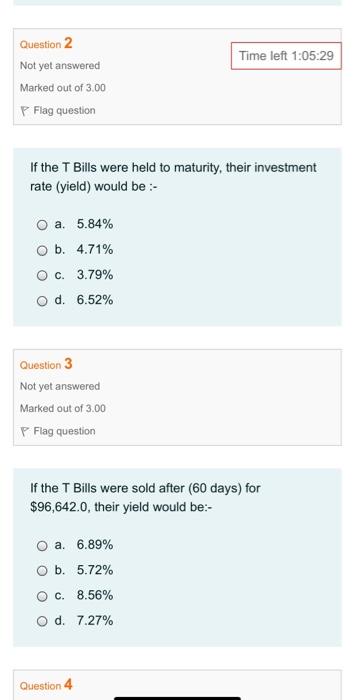

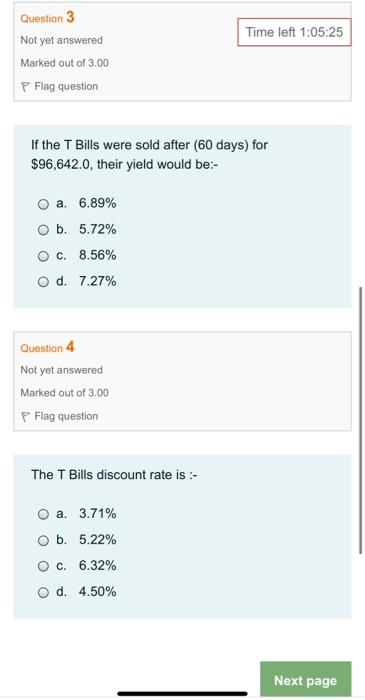

US T Bills with $100,000.0 Face value & 365 days maturity were initially purchased by an investor @ (PP) $95,500.00. (Use 365 days per year). Question 1 Not yet answered Marked out of 3.00 Flag question At the time of the T Bills issuance, the investor's required rate of return was:- O a. 3.17% O b. 6.82% O c. 4.71% O d. 5.93% Time left 1:05:29 Question 2 Not yet answered Marked out of 3.00 P Flag question If the T Bills were held to maturity, their investment rate (yield) would be :- a. 5.84% O b. 4.71% O c. 3.79% O d. 6.52% Question 3 Not yet answered Marked out of 3.00 P Flag question If the T Bills were sold after (60 days) for $96,642.0, their yield would be:- O a. 6.89% O b. 5.72% c. 8.56% d. 7.27% Question 4 Time left 1:05:25 Question 3 Not yet answered Marked out of 3.00 P Flag question If the T Bills were sold after 60 days) for $96,642.0, their yield would be:- O a. 6.89% O b. 5.72% O c.8.56% d. 7.27% Question 4 Not yet answered Marked out of 3.00 Flag question The T Bills discount rate is :- O a. 3.71% b. 5.22% c. 6.32% O d. 4.50% Next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts